Golden hour for gas-fired power

DEEP DIVE: Falling costs put gas ahead of coal in the merit order. Could electrification sustain this trend?

Conventional wisdom holds that thermal power generation is under sustained attack in Europe from the energy transition: as zero marginal cost renewables saturate the grid, gas and coal plants face a double-whammy of structurally lower wholesale power prices and reduced running hours. But falling gas and carbon costs have opened a window of opportunity for coal-to-gas switching — and a fundamental change in Europe’s electricity demand profile could extend gas burn well into the 2030s.

Steep declines on European gas hubs have recalibrated the economics of gas-fired electricity. It is now profitable for utilities that operate a portfolio of thermal power plants to wind down coal generation and crank up output from gas.

The coal-to-gas switching market of reference is Germany, Europe’s largest economy, which operates a fleet of almost 40 GW of coal and lignite plants and 32 GW of gas — most of which are equipped with combined-cycle gas turbines (CCGTs).

Forward prices on the Dutch Title Transfer Facility (TTF), the main gas price-setting hub for north-western Europe, range from €27 to €33 per megawatt-hour ($9-10 per million British thermal units) between now and the end of winter 2025-26. Analysis by Energy Flux shows that CCGTs will remain ahead of coal and lignite power stations in the German merit order for the next two winters if TTF stays below €33.50/MWh ($10.62/MMBtu), all else being equal.

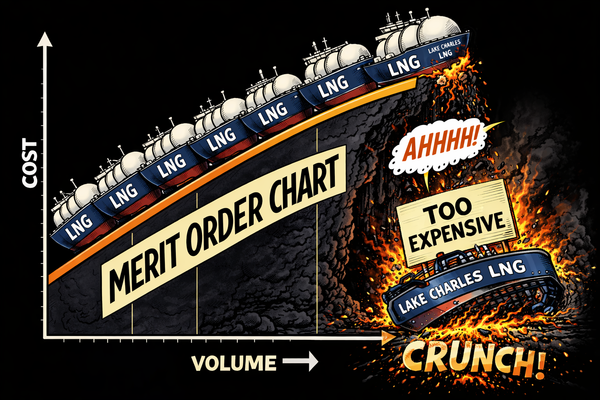

With a wave of new liquefied natural gas (LNG) supply about to break onto global gas markets, there is every chance of that happening. And to help matters further, the recent slump in the European carbon price below €60 per tonne means that gas power can edge out coal and still remain profitable.

If European gas and power futures continue to trade at current levels, the price of CO2 allowances on the European emissions trading system (EU ETS) would need to fall below €58 per tonne to prevent high-efficiency coal plants from edging back into merit. Again, markets do not anticipate this happening, meaning gas could undercut coal for the foreseeable future.

Energy Flux is funded entirely by its readers. If you value independent market analysis, please consider subscribing.

Looking further ahead, electrification offers new opportunities for unabated gas burn. Europe’s drive to electrify vast swathes of the economy, in combination with a sharp increase in power demand from generative artificial intelligence and data centres, will dramatically alter seasonal load profiles in major markets such as Germany — leaving lucrative pockets of unmet peak demand.

With the aid of a brand-new slate of spark spread charts, today’s Energy Flux dives deep into the shifting economics of European power and carbon markets between now and the end of 2025. It then takes a longer-term view of power system trajectory, to assess the scope and implications of gas playing a role balancing the renewables-heavy European grids of the post-2030 period.

Article stats: 3,000 words, 14-min reading time, 12 original graphs and charts

Member discussion: Golden hour for gas-fired power

Read what members are saying. Subscribe to join the conversation.