CHART DECK: Bear market spells trouble for LNG exporters

PLUS: Cleaning Up podcast, Mozambique LNG, Australia’s cautionary tale

Welcome back to Energy Flux.

I’ve been on the road all week so this issue is a little thinner than usual. But I did carve out time to update the Chart Deck because the market is moving further into bearish territory.

All data points in this week’s unmissable slide deck confirm the EU gas market is in the throes of a deep LNG glut bear cycle.

The global LNG market is now oversupplied by 2.4 million tonnes, up from 1 mt just a week earlier, as surging supply outstrips demand growth.

The dramatic collapse in China’s LNG imports combined with accelerating supply growth are eclipsing Europe’s increased imports, inflating the physical surplus. Demand simply cannot keep up, and this is barely the thin end of the glut wedge.

Investment funds deepened their net short position in TTF futures last week to -50 TWh. While this is by no means a shock, it does raise further risks of a sudden whipsaw to the upside if a winter shock triggers a bout of short covering.

If you want the full picture of how trader sentiment, market risks, economics and cargo flows are lining up as winter unfolds, it’s all in this jam-packed datavis-heavy Chart Deck (plus free market commentary):

🎧 PODCAST: Demand destruction & oversupply

I was on the Cleaning Up podcast this week, talking with Baroness Bryony Worthington about macro shifts in global gas markets and the outlook for the UK energy sector.

We covered a lot of ground, so make a coffee and grab your headphones:

The episode is also available on Spotify and Apple, or wherever you get your podcasts.

We discussed Bryony’s recent op-ed in Energy Flux about the UK’s relationship with Norway, where she argued for a new long-term deal focussed on energy affordability and demand certainty. If you missed it, that piece is free to read here:

Mozambique LNG soldiers on regardless

The partners in the Mozambique LNG project are digging deep to cover the cash shortfall created by the withdrawal of UK and Dutch export finance.

TotalEnergies has agreed with project partners to stump up more cash after British and Dutch export credit agencies UK Export Finance and Atradius pulled $2.2 billion in preferential loans for the project, representing 10% of external financing.

As documented in Energy Flux earlier this year, Mozambique LNG is of critical importance to the country due to the sovereign debt arrangements that backstop the state’s involvement in the development.

Read more about why Maputo and the US EXIM Bank are persevering with this deeply troubled project in this Deep Dive from April:

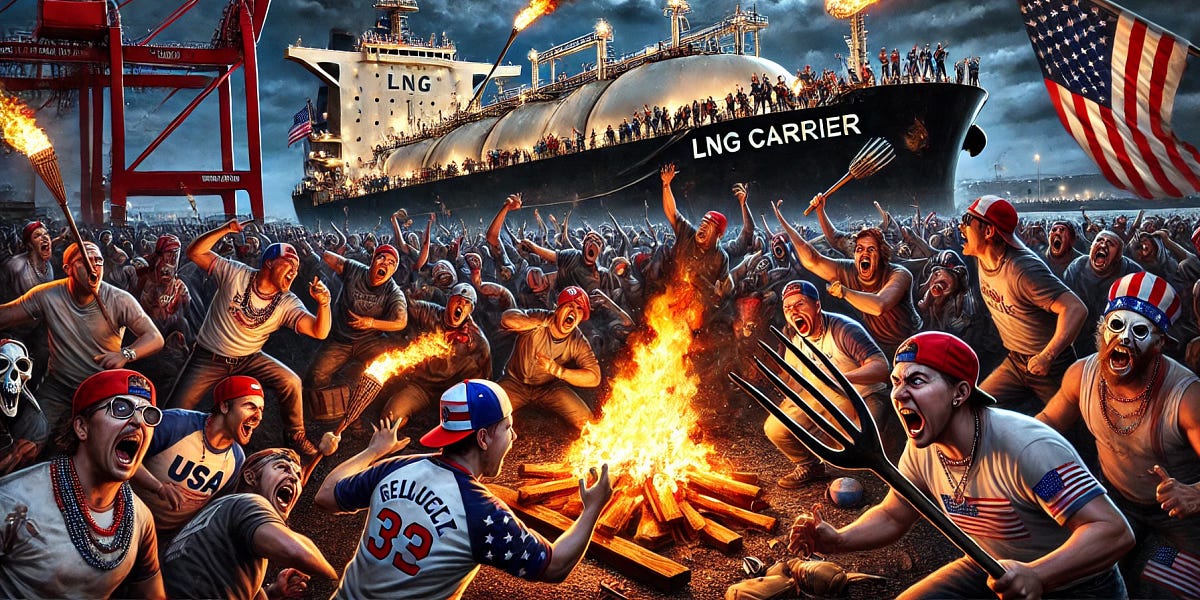

Oz LNG: a cautionary tale

A decade after Australia’s LNG export boom, the country is still dealing with the fallout from soaring prices and industrial bankruptcies.

Now, the Labour government is reportedly poised to unveil a new east coast gas reservation scheme that would cap or limit LNG exports to overseas markets such as Japan, a major buyer of Australian LNG.

I’ve written extensively about the risk of political backlash from uncontrolled expansion of LNG exports. The Australian experience is probably worth keeping in mind as the United States gears up for its own rapid increase in Gulf Coast LNG export capacity between now and 2030...

That’s all for this week. Thanks for reading.

—Seb

Are you receiving Flux Briefing, the daily blast of gas, LNG and geopolitical news? If not, you are missing out!

Head on over to Flux Exchange to sign up (click the alarm 🔔 icon in the Flux Briefing category and choose ‘watching first post’)

Member discussion: CHART DECK: Bear market spells trouble for LNG exporters

Read what members are saying. Subscribe to join the conversation.