Arb to nowhere

CHART DECK: Moribund European gas market resurrects narrow Asian LNG premium

Are you receiving Flux Briefing, the *free* daily blast of AI-powered gas, LNG and geopolitical headlines? If not, you are missing out!

Head on over to Flux Exchange to sign up (click the alarm 🔔 icon in the Flux Briefing category and choose ‘watching first post’)

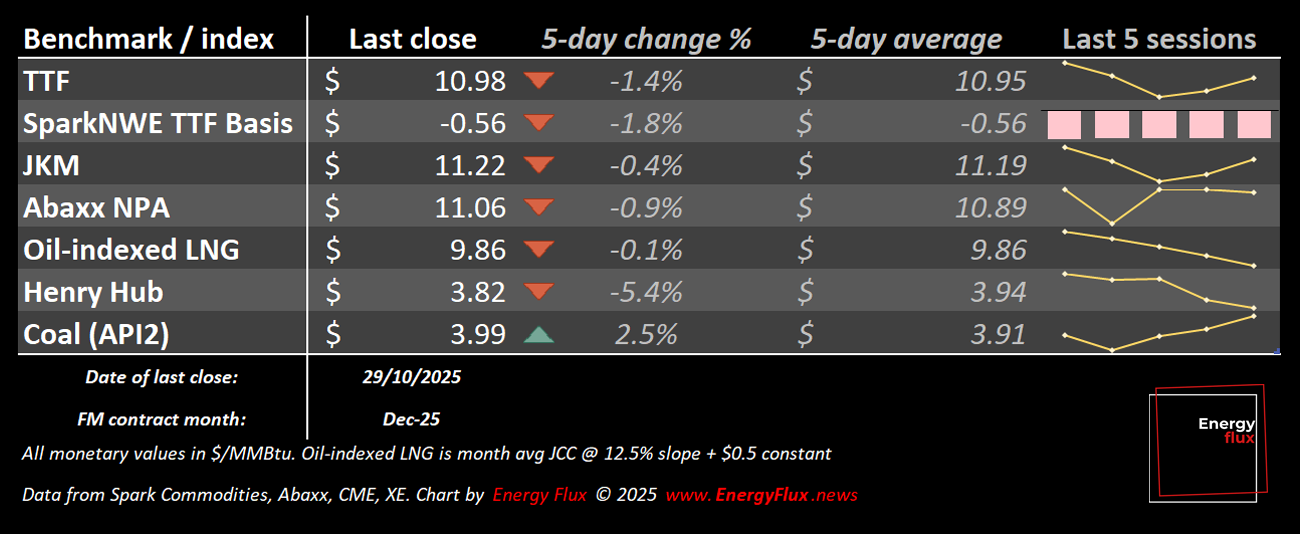

The European gas market is stagnant. Prices are locked in a narrow range, suppressed by ample LNG supply and adequate storage.

But beneath the calm, two signals warrant attention: a marginal profit for sending US LNG to Asia has re-appeared, and a growing number of vessels are being used for floating storage.

These developments are by no means concrete trading opportunities. Instead, they reveal the underlying tensions in a market caught between a clear fundamental surplus and the persistent risk of a winter price spike.

This contradictory dynamic is captured in the Energy Flux TTF Risk Model, which is emitting a knife-edge signal that the forward curve is under-pricing winter risk.

In today’s Chart Deck:

- Why the returning Asian premium signals European weakness, not strength

- What the rise in floating storage says about trader expectations

- How untimely fund short positions clash with physical market bets

- Why soft oil prices are suppressing Asian LNG procurement

- The key factors that will determine if, when and how the stalemate breaks

- How the TTF Risk Model and Sentiment Tracker reconcile market tensions

- PLUS: Full datavis gallery of global LNG supply-demand balances, with regional breakdowns

💥 Article stats: 1,900 words, 12-min reading time, 30 charts & graphs

Level up your LNG market insight. Subscribe to Energy Flux for instant access, and support fiercely independent market analysis 🔥

Member discussion: Arb to nowhere

Read what members are saying. Subscribe to join the conversation.