Don’t forget the macro!

HOT TAKE: Oil and gas prices will surge on Monday’s market open. But this won’t mark a structural shift.

Oil prices leapt 6% when news broke that US was evacuating non-essential personnel from Middle East deployments due to rising Israel-Iran tensions. Nobody knew what would come next, but markets were already pricing in the worst-case scenario.

While analysts are traders were still debating whether this was the usual sabre-rattling, the next day, on Friday 13th June, Israel launched Operation Rising Lion against Iran. Oil prices jumped another 8%. In Europe, TTF natural gas prices gained 5% to close Friday’s session at €37.89/MWh, and are up 9% since Tuesday.

As I write this article, Brent is nearing $75 and WTI is at $73. It is a weekend. The billion-dollar question is, what comes next? $100 oil? €50+ TTF?

Everybody is asking, will Iran shut down the Strait of Hormuz? Will tit-for-tat air strikes on energy installations significantly disrupt regional oil and gas flows?

The coming days will clarify those questions. In the meantime, the bottom-line is this: without a geopolitical conflict, higher energy prices remain a function of higher demand and a strong macro-economic environment. The following analysis shows that we don’t have either of these.

💥 Article stats: 1,600 words, 12-min reading time, 6 charts & graphs

Level up your market insight. Subscribe to Energy Flux and support fiercely independent market analysis

The fundamental view

Let’s start with oil, the commodity most closely correlated to geopolitical conflicts. Here are where the fundamentals stand right now.

The International Energy Agency (IEA) reports a 1.2 billion barrels of emergency stock available which, at current oil demand, would be enough to cover 15 days of global demand.

OPEC+, even after the increased production levels, still have a 3 million barrels per day (mbpd) of spare capacity amongst them. This is almost the same as Iran’s current oil production of 3.3 mbpd.

In terms of product buildups, we have a 1.5 mbpd increase in gasoline stocks. Middle distillates saw an increase of 4.2 mbpd while total product supplied rose by 19 mbpd week ending 6 June.

Another important metric to look at is oil supply, and there is no shortage of it.

Non-OPEC supply is still holding up strong. Brazil is expected to add 460,000 bpd. The IEA’s May oil market report shows that global supply will increase by 1.6 mbpd in 2025 and 970,000 bpd in 2026. Non-OPEC producers will provide 1.3 mbpd of additional barrels in 2025 and 820,000 bpd next year.

By contrast, oil demand outlook looks shaky. The agency sees a 650,000 of growth for rest of the year. The US Energy Information Administration (EIA) also echoes this sentiment.

Macro miasma

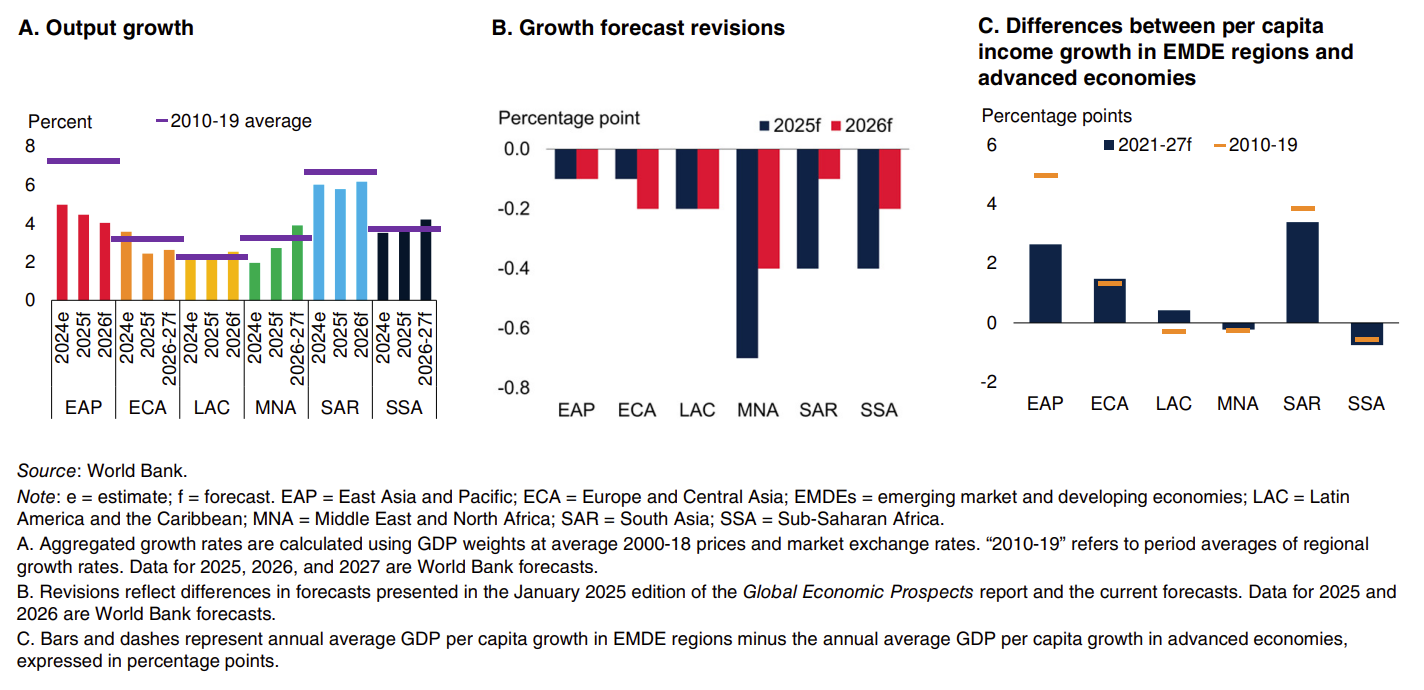

Now let’s look at the global economy and macro-indicators. For this we can turn towards the recently released Global Economic Prospects report by World Bank that shows that growth will reduce in 70% of all economies. This is driving structural weakness across all commodity and energy segments.

“Growth in all EMDE regions is facing considerable headwinds amid a notable deterioration in the external environment, resulting in weaker growth projections this year relative to pre-pandemic trends and previous forecasts.” – World Bank

When we look at the World Bank’s revisions to its global projections of regional growth the chart below reinforces the slowing outlook.

Hormuz: Red Herring?

Every analyst under the sun is speculating over Iran’s threats to close the Strait of Hormuz. Some shipping companies are avoiding this critical artery for Persian Gulf oil exports and the Red Sea due to the unravelling security situation, but many are not.

Alternative routes offer a degree of flexibility. Saudi Arabia can utilise the East-West pipeline (Petroline), which can carry 5 mbpd from the east to the western port of Yanbu on the Red Sea. The UAE can access the Habshan-Fujairah pipeline, which can transport 1.8 mbpd.

But it is important to note that these capacities account for less than half of the traffic via Hormuz.

The complete closure of Strait of Hormuz seems to work best for Tehran as an empty threat. It would not be feasible for Iran to halt its own oil exports because it needs the funds, and Tehran is loathe to upset China – its largest buyer – at a moment when it desperately needs allies.

In the unlikely event of a Strait closure, the US and its allies can deploy an armed convoying system to safeguard tanker passage, as suggested by independent analyst John Kemp.

Gas stock build, demand doldrums

In natural gas, markets were quick to price in a Hormuz premium as Israeli missiles began raining down on Iran, as more than one-fifth of global LNG trade flows through this pinch-point.

Let’s look at the fundamentals. European gas inventories stand at 52% compared to 62% this time last year, and refilling puts a floor under prices. But US stocks are building fast too, suggesting no lack of feed gas for liquefaction and export from US Gulf Coast LNG plants.

EU industrial gas demand – which is most exposed to macroeconomics – shows no signs of recovering back to the 2019-21 trend. According to Bruegel, the structural decrease in EU industrial gas usage that started in 2022 has persisted to this day.

EU industrial decline

It is important to look at what is happening in Germany – the EU’s once-mighty industrial powerhouse. German gas demand remains sharply lower than the 2019-21 average with sharpest declines in early 2023 and 2024. Rising costs, declining automotive industry and weak global demand have all contributed to this decline.

Wider economic indicators strike a similar trend. Energy intensive manufacturing has been under pressure in Europe for the last 2-3 years, and German output has remained below the Euro area average since those crisis years.

Germany’s industrial production is down by 1.4% on a month-on-month basis. Eurozone PPI was down 2.2% as well. In the automotive industry, car registrations in Italy, Germany and France are down 19.2%, 4.2% and 9.8% in the first week of June, respectively.

The Eurozone’s consumer inflation expectation in May fell from 29.4 to 23.6. As per the GEP report by World Bank, Euro area GDP growth has been revised down to 0.7% in 2025 and 0.8% in 2026 – a halving in the economic outlook since January.

Energy Flux is 100% supported by paid subscriptions. If you value ad-free energy journalism and independent analysis, please consider upgrading. Often this can be expensed to your employer.

The shock of war

Markets will understandably fixate on fast-moving Middle East events that have disrupted or damaged energy infrastructure in both Israel and Iran. But the impacts are – so far – not as dramatic as headlines might suggest.

Israel’s closure of its Leviathan and Karish gas fields disrupted exports to Egypt, which relies on these flows for about one-fifth of demand.

- While this could see Egypt import more LNG to compensate, the most likely scenario is demand destruction. Egypt’s Petroleum Ministry has implemented an emergency plan to cut supplies to non-critical industries such as fertiliser producers, which were forced to halt operations on Friday.

Israel pounded Iran’s oil and gas infrastructure on Sunday 15 June. Shahran oil depot, a storage facility outside Tehran with 11 tanks, is ablaze. Officials in Iran said the situation is “under control”.

An onshore processing plant at one of the world’s largest gas fields, South Pars, has also been hit. An Israeli strike caused a fire at Phase 14 of South Pars, reportedly halting production of 12 million cubic metres of gas. The blaze has since been extinguished.

- South Pars provides around two third of Iran’s gas needs. Iran exports only small volumes to Turkey and Iraq, so the impact on regional balances remains very limited at this stage. Similarly, the volume of oil that may be impacted is insignificant given the supply overhang we have discussed above.

Suspended animation

Energy prices are rising, buoyed mostly by deteriorating sentiment. In the absence of a diplomatic breakthrough, this is likely to continue for most of next week and possibly beyond.

But prices always surge on conflict. If price action isn’t backed by fundamentals the surge will be fleeting.

As long as critical energy infrastructure supplying global markets remains unharmed, don’t expect the overarching direction of oil and gas markets to shift.

If there is a global pivot to a war economy this might sustain some artificial economic growth, but it will be inflationary and prone to collapse. The long-term trend is downward and a drawn-out conflict will only reinforce this trend.

Osama Rizvi | Energy Flux | 15 June 2025

Get more timely, original market insights like this delivered straight to your inbox 👇

More from Energy Flux:

Member discussion: Don’t forget the macro!

Read what members are saying. Subscribe to join the conversation.