Geopolitical theatre (part 2)

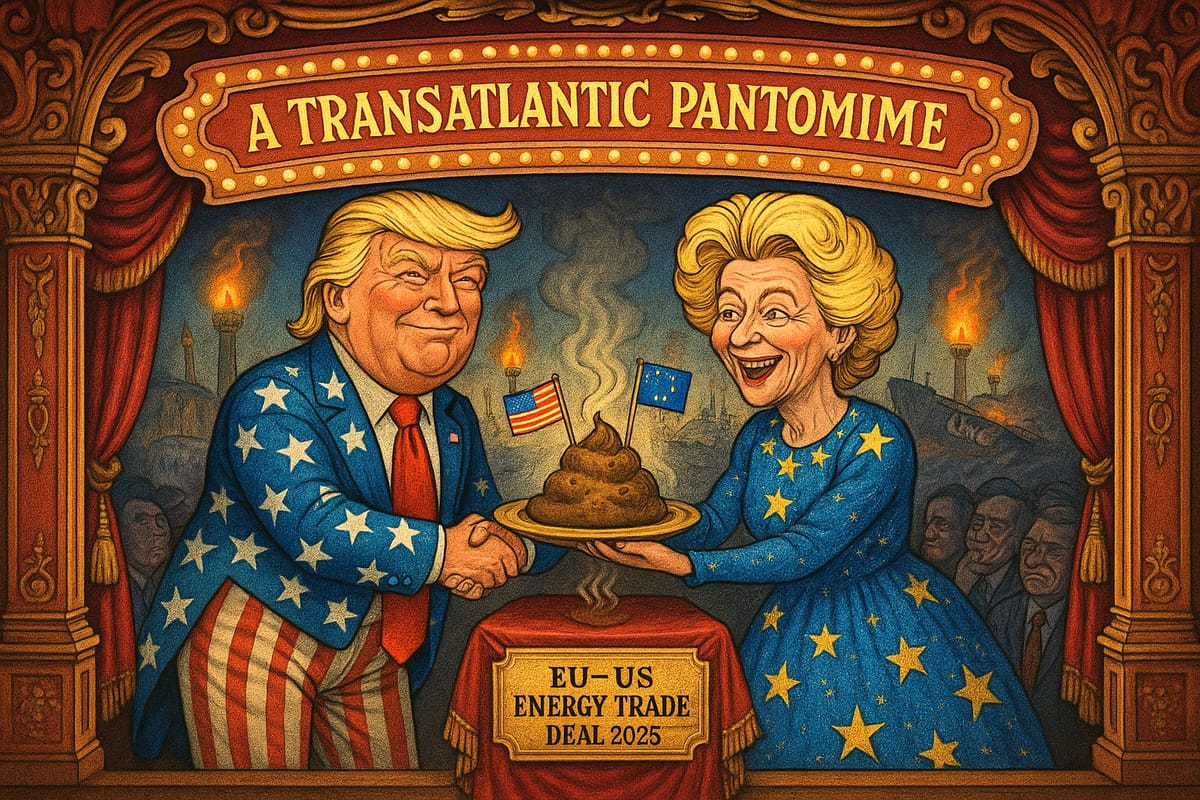

HOT TAKE: The Transatlantic LNG deal is a ridiculous sham, and everyone knows it

The vaunted EU-US trade deal, signed by US President Donald Trump and his EU Commission counterpart Ursula von der Leyen, is not a diplomatic breakthrough. Anchored on fantastical LNG purchase commitments of $750 billion over three years, the deal is a shared delusion: an empty gesture signed by two parties that have no intention or ability to deliver what they’ve promised.

At Trump’s Scottish golf course on Sunday, Von der Leyen committed the EU to buy $250 billion per year of American energy (mostly LNG, plus oil, coal, refined products and possibly nuclear fuel) over three years. No matter how you cut it, this is unattainable and both sides must know it.

I ran the numbers back in April, when Trump declared the EU must buy $350 billion of US energy to bridge the trade gap and avoid sweeping tariffs. Effectively, he was demanding a quintupling of Transatlantic energy trade.

The best I could do at the time was to describe this lunacy as “wilful ignorance towards the real-world constraints of market economics” that is “both mesmerising and terrifying” (glad to see that line picked up by The Telegraph).

The US Gulf Coast export infrastructure constraints alone are insurmountable, not to mention upstream shale depletion rates, financial bottlenecks, and the cannibalistic effect of falling market prices necessitating an even greater surge in output to offset the lower value of EU imports.

Never mind the fact that market forces, not politicians, determine where US LNG flows. Or the inconvenience of classifying what an ‘EU company’ really is, when it operates a globally-traded portfolio that is constantly optimising across basins.

Now that the figure has ballooned to $750 billion and all the same questions remain unanswered, even conservative outlets such as Reuters and price reporting agencies like Argus are calling the deal out as ‘delusional’ and ‘impossible’.

Applying serious analytical rigour to this nonsense feels like dignifying it (although if you need some hard figures, the indefatigable Anne-Sophie Corbeau from CGEP has got you covered).

For me, the real value lies in understanding the motivations behind it. Why set yourself up for failure in this way? Let’s take a closer look.

Get the unvarnished truth. Subscribe to Energy Flux and support fiercely independent market analysis

On the US side, this is just another day of golf for Trump: dream up some big, gaudy numbers to generate headlines, rally the domestic base and US energy stocks, proclaim economic dominance, etc. It’s a re-run of his 2021 China trade farce: inflate the target, declare victory, and then forget all about it before the blame game starts.

The Phase 1 trade deal in December 2019 envisaged China buying more than $50 billion of extra American coal, oil and LNG by the end of 2021. Actual imports fell well short of that, but by then the world had moved on. The same fate awaits the EU-US trade deal.

For the EU, this is strategic capitulation. European officials know they can’t physically import the volumes they’ve pledged, and nor can they force EU companies to do so. But they’re playing along, desperate to mollify a volatile White House and avoid reigniting market-melting tariff threats on Truth Social.

They’ll stretch timelines, pad numbers by redefining trade flows, and issue press releases about ‘record US-EU energy cooperation’ even as volumes fall short. This is how the EU handles unachievable climate targets too: slow failure with good PR.

By holding itself hostage to an impossible pledge, Brussels gets to signal transatlantic unity and energy security without having to actually deliver either. The trouble is, it only kicks the can down the road. Maybe the calculus in Brussels is: ‘Let’s play along, by the time we’re caught short Trump will be too busy thinking about succession and retirement to notice.’

Meanwhile, US LNG exporters are happy to fuel the illusion. The lie pumps their share prices and supports expansion plans. But for European industrials and utilities, stuck with the impossible task of reconciling supply constraints, price risk, and climate goals, this ‘deal’ stinks. If there is ever any attempt at accountability, they will be the scapegoats.

Geopolitics has always been performative, but these days it is pure theatre. Gestures and optics are worth more than facts or results. Reality is at best an afterthought, and much of the mainstream media is too distracted or credulous to call out this pointless game of charades.

Everyone involved knows this deal is structurally unworkable, yet they signed it anyway. There’s a word for that: cynicism, pure and simple. That cynicism distorts price signals, scrambles expectations, and leaves the market groping for substance beneath political spectacle.

Seb Kennedy | Energy Flux | 29 July 2025

Member discussion: Geopolitical theatre (part 2)

Read what members are saying. Subscribe to join the conversation.