LNG glut claims first US scalp

PLUS: Tracking the glut, cheap gas and the energy transition, 2025 in review, Chart Deck + TTF Risk Model update

First off, welcome to the many new readers who signed up after last week’s edition that broke the news of US LNG profits turning negative on an all-in cost basis.

The story seemed to strike a nerve, but as expected the entire episode lasted barely a few days. Warmer weather forecasts and an outage at Freeport LNG prompted a spectacular 25% sell-off on Henry Hub over the following week, as traders priced in a looser domestic gas balance in the Lower 48 states.

At the same time, Dutch TTF, the Title Transfer Facility – Europe’s benchmark gas trading hub – rebounded above €27/MWh (~$9.30/MMBtu) on the brief Freeport outage and forecasts of colder temperatures in parts of Europe.

Henry Hub’s drop below $4/MMBtu combined with firmer TTF widened the transatlantic spread between the two, dragging the all-in cost of US LNG in North-West Europe just below the TTF hub price. Further declines in Atlantic LNG freight charter rates helped edge delivered costs lower (Spark30 spot is again trading below $100k/day).

But as this week’s Chart Deck illustrates, the forces that conspired to crush transatlantic margins are still very much in play. Futures markets are pricing in more negative long-run US LNG profits from October 2026. By summer 2027 this could be a regular occurrence, although much deeper spread compression must occur before LNG netbacks are loss-making on a short-run marginal cost (SRMC) basis.

Why? Because the ~$3/MMBtu liquefaction fee is deemed a sunk cost. When accounted for this way, loss-making LNG is still worth lifting at these prices.

LNG glut claims first US scalp

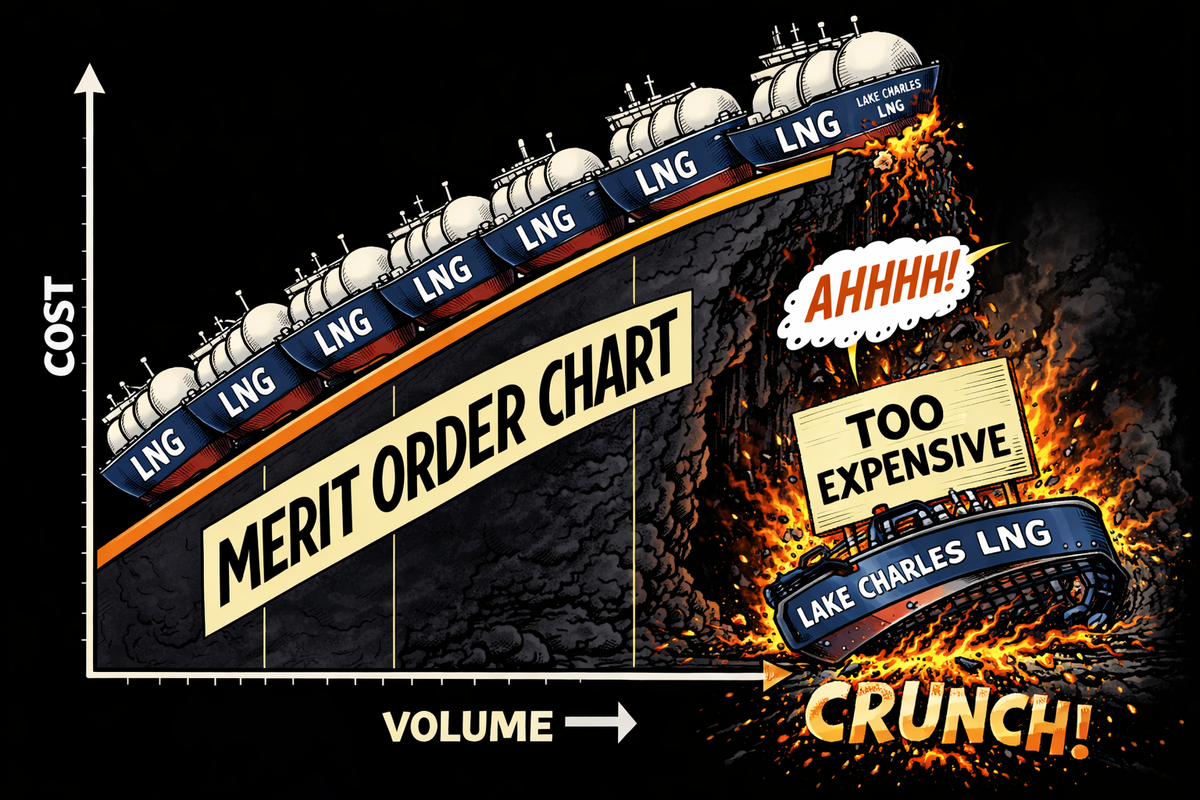

As the global LNG glut bites, weak hands will fold first. Energy Transfer yesterday suspended development of its Lake Charles LNG project in Louisiana, after deciding that the project offered an inferior risk-return profile compared to other capital investments.

The US developer said building the liquefaction project is “not warranted”. It will instead “focus on allocating capital to its significant backlog of natural gas pipeline infrastructure projects that Energy Transfer believes provides superior risk/return profiles.”

This last line is telling. Since when was a simple pipeline, with boring utility-style returns and point-to-point delivery, a more attractive investment than an LNG export megaproject that exploits double-digit ROI global arbitrage opportunities?

Materials and labour inflation is a real pain-point for construction projects in all segments, and liquefaction megaprojects are particularly exposed. Rising build costs combined with a rapidly softening market make big-ticket capital investments a hard sell at board level.

Energy Transfer evidently sees the writing on the wall. Either the company baulked at the likelihood of materially diminished returns, or it knew it couldn’t pre-sell enough of the project’s nameplate 16 mtpa capacity to leverage debt finance. In a buyer’s market, locking down ~80% under binding sales and purchase agreements is extremely challenging.

Either way, Lake Charles was effectively sunk by the LNG glut – before the supply wave even breaks.

This is one way for the market to self-correct: through US LNG construction delays and project cancellations. While it won’t avoid a glut happening, capacity attrition could trim the length and depth of oversupply. Keep an eye out for more headlines like this in 2026.

Tracking the LNG glut

How can we tell if the global LNG market is actually in a glut? The spread compression observed last week offers some clues, as does the Lake Charles cancellation. But neither speak directly to physical balances today, on the water.

To fix this, I developed a new indicator to track how efficiently the global LNG market is absorbing supply. This indicator quantifies whether LNG is flowing smoothly through the system, or encountering friction.

📈 When LNG is taking longer than normal to clear despite falling prices, the indicator moves positive, signalling latent oversupply that could lead to glut-like conditions if sustained.

📉 When cargoes clear quicker than usual even though rising prices might warrant holding them in floating storage, the indicator moves negative, consistent with tighter conditions and stronger pull from buyers.

Why does this matter? Market stress often builds before it becomes obvious in prices or headlines. Changes in clearing efficiency can signal shifting leverage between buyers and sellers, emerging pressure on infrastructure, or the early stages of oversupply or tightening. By tracking how LNG moves through the system week by week, this indicator provides a complementary lens on market conditions — one that might help explain why prices are behaving as they are.

The LNG Flow Index is available to subscribers while in beta testing, before being incorporated into the Energy Flux TTF Risk Model. Both are published in the Chart Deck.

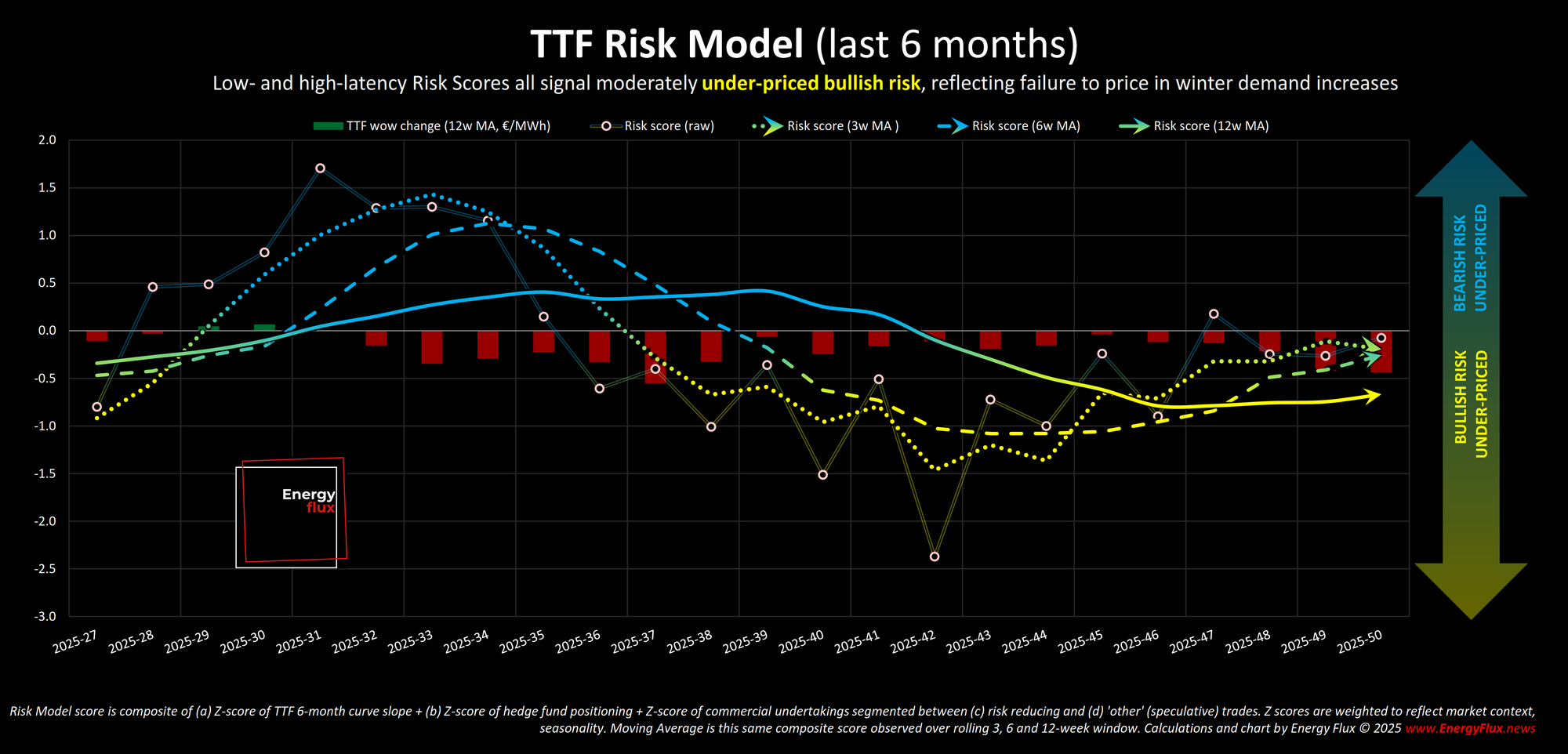

The risk model is a composite risk score, comprised of Z-scores of EU gas storage tightness, TTF curve slope, investment fund positioning, and commercial operator hedging.

The latest run of the TTF Risk Model is again pointing to moderate underpricing of bullish risk, indicating persistent complacency in the way that market participants are pricing winter risk. But with winter nearing the halfway mark, that risk should gradually diminish in Q1 absent a weather or supply shock.

Check out this week’s downloadable Chart Deck to see the results in full, alongside the physical balances metric and 70+ slides covering a slew of other vital metrics that take the pulse of global LNG market 👇

Cheap gas and the energy transition

I was invited to speak at the Global Renewables Alliance (GRA) Energy Dialogue 2025 in central London this week. The private event was an interactive workshop and debate among thought leaders designed to deepen shared understanding of where the opportunities and pinch-points lie in the ever-changing energy transition.

I offered a leftfield perspective for the renewables crowd, focussing on the role of natural gas prices in shaping energy transition pace and trajectory. I shared some thoughts in a LinkedIn video reel beforehand, and have been mulling the discussion in the days since.

In essence, one way of looking at the energy transition is as one enormous exercise in managing gas price risks. Gas is so fundamental to power, heat and industrial competitiveness that gas market prices are the economic benchmarks against which transition tech investments are measured.

There are major implications for the energy transition as gas markets pivot away from the 2022 energy crisis into an era of unprecedented LNG oversupply. The energy security and affordability arguments that drove three years of rapid electrification will start to fall away. Mindsets will shift from scarcity to abundance, and with that the sense of urgency will start to ebb.

The challenge for renewables and storage is to remain relevant in an era of energy abundance, and find a fresh argument that cuts through. Decision-makers will be less absorbed by energy cost inflation and afforded precious time to spend on other pressing issues – not least Ukraine, Russia, trade, and tortuous transatlantic relations.

The GRA session was conducted behind closed doors under the Chatham House rule, so I can’t report exactly what was said. But the experience got me thinking about just how important – and overlooked – gas prices are in the way people think about the economics of decarbonisation and cleantech.

I launched Energy Flux in part to shed light on this exact topic, so it was gratifying to be able to share knowledge in person with some highly esteemed leaders and friends in this space. If I have time over Christmas, I’ll write up a longer piece that distils my thinking on this topic, and share some thoughts about the market outlook for 2026.

Are you receiving Flux Briefing, the daily blast of gas, LNG and geopolitical news? If not, you are missing out!

Head on over to Flux Exchange to sign up (click the alarm 🔔 icon in the Flux Briefing category and choose ‘watching first post’)

2025 in Energy Flux

If I had to summarise 2025 for Energy Flux in a single word, it would be infrastructure. Or more specifically, a year of building the digital foundations to turn a newsletter into a multimedia platform.

This time last year, Energy Flux was little more than a simple blog hosted on Substack. Since then, the platform has grown in myriad ways:

- Switched hosting providers, migrating seamlessly to Ghost to expand feature offering.

- Relaunched the Energy Flux podcast and Youtube channel with listener Q&A (got a question? Hit reply!)

- Launched tiered subscriptions, giving readers greater flexibility and choice.

- Launched Flux Exchange, the community forum for Energy Flux readers.

- Launched Flux Briefing, the daily AI-powered news summary that’s now read by thousands of people.

- Relaunched the Chart Deck as a downloadable 70-slide deck in .pdf format, for easy offline viewing.

I’ll admit, rolling out that many product/feature launches in such a short period was extremely time-consuming. For every article or podcast episode I published, there were many more I wanted to produce but simply didn’t have time to tackle. My mission for 2026 is to refocus on creating the high-quality, original content readers want, now that the various channels are established through which to deliver it all.

Apart from keeping me busy, all of this expansion work costs money. The various hosting fees, tech stack subscriptions, bridging solutions and technical support don’t come cheap. As a fiercely independent publisher, these costs are 100% covered by subscription revenue. Without paying readers, none of this would be possible.

So, two things:

1️⃣ First, an enormous heart-felt thank you to the hundreds of readers who pay for a monthly or yearly subscription. You really are keeping this project alive.

2️⃣ Second, please consider upgrading your subscription if you enjoy reading Energy Flux. The subscription business is tough, especially for independent publishers. There are numerous subscription tiers and payment plans (browse them all here). I also offer corporate billing via invoice and personal account management for group subscriptions. Get in touch to find out more.

Level up your market insight. Subscribe to Energy Flux and support fiercely independent market analysis

Above all, many thanks for reading Energy Flux in 2025. I haven’t quite finished for the year, so keep an eye out for one or two final pieces before we enter the second half of the decade.

—Seb

Member discussion: LNG glut claims first US scalp

Read what members are saying. Subscribe to join the conversation.