💥Energy Flux💥 Tuesday, 30th March 2021

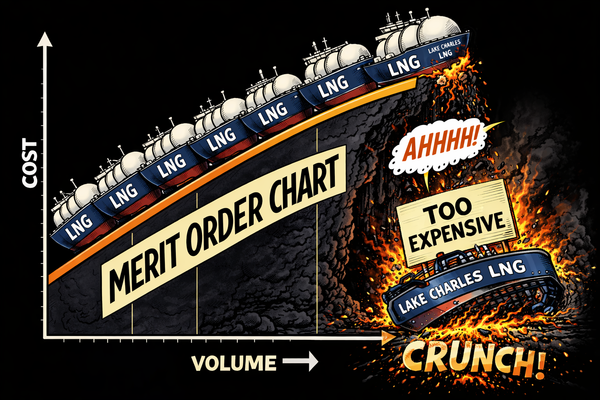

Big asset managers inflate ‘net zero’ expectations 🎈Heavy emitters buy absolution via LNG ‘carbon offsetting’ 🏭 + LOTS more 🚀

Member discussion: 💥Energy Flux💥 Tuesday, 30th March 2021

Read what members are saying. Subscribe to join the conversation.