Drowning in liquidity

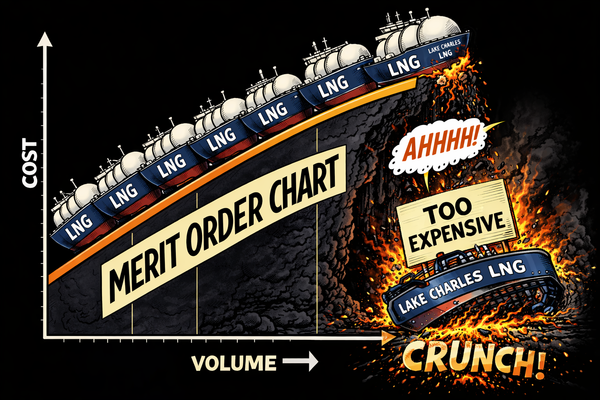

DEEP DIVE: Too much of a good thing can be volatile

Liquidity is vital to the efficient working of commodity markets. An illiquid market is prone to extreme price volatility. But can the opposite also be true? If so, what is an appropriate balance? And when it comes to the European natural gas market, is it possible that the derivatives ‘tail’ is wagging the gas price ‘dog’?

Academic literature on the matter of financialisation of commodities is unequivocal: liquidity enables hedging, which facilitates prudent risk management and accurate price discovery. Speculation is almost always ‘good’, and there is scant empirical evidence to support the view that speculation inflates prices. At least, that’s the perceived wisdom.

Questioning those assumptions is divisive: feedback to recent Energy Flux articles on the topic of speculative capital movements on Dutch TTF, the main EU gas trading hub, has fallen into two broad camps: those that welcome the scrutiny, and those that dismiss the line of questioning altogether.

How to reconcile these opposing views?

The assertion that speculative capital might be manipulating TTF gas prices has proven particularly divisive, so let’s put that controversy to one side. Instead, let’s start from the assumption that it is possible, theoretically, for there to be such a thing as an excessive amount of liquidity. The corollary is that it is also possible to have too much speculation.

If we can agree on that premise, the question therefore becomes: at what point does ‘enough’ become ‘too much’?

This post seeks to answer this question by:

- analysing the physical and derivative traded volumes on the TTF gas hub, and introducing the concept of a ‘market-wide overhedging factor’

- comparing the ‘market-wide overhedging factor’ of TTF gas contracts to other commodities (oil, diesel, coffee, metals and other regional EU gas hubs)

- taking a deeper look at the behaviour of gas producers and utilities — the supposedly ‘genuine’ players on TTF who use financial instruments to hedge their physical positions

- quantifying whether speculation on TTF is indeed excessive, using the T index developed by Working (1960), based on both the type of trader and type of trade (the difference is material)

The findings are illuminating, and nuanced. On the one hand, liquidity and overhedging in EU gas markets does indeed seem to be excessive from a normative perspective. But the quantitative analysis using Working’s equation suggests that speculation is within the bounds of acceptability for the normal functioning of commodity markets.

Let’s dive in.

Article stats: 2,000 words, 10-min reading time, 7 original charts and graphs

Member discussion: Drowning in liquidity

Read what members are saying. Subscribe to join the conversation.