Easter energy reading 🐣

And some non-energy bits too

Member discussion: Easter energy reading 🐣

Read what members are saying. Subscribe to join the conversation.

And some non-energy bits too

Read what members are saying. Subscribe to join the conversation.

Who pays when risk management itself becomes riskier and more expensive?

Gunboat diplomacy, commodity shocks, and the price of escalation

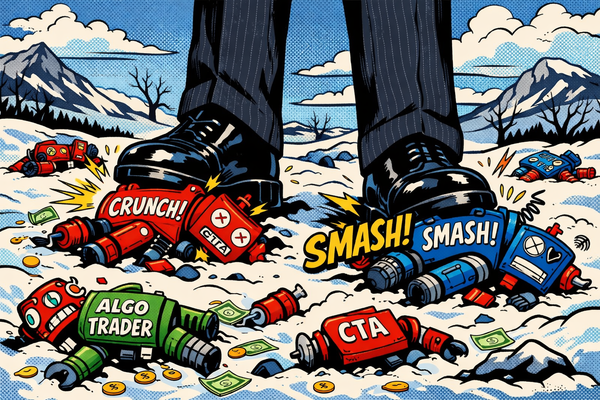

Natural gas markets implode in frenzy of automated selling and cascading long-stop orders

Algo traders take a breath after being taken to the cleaners