From risk premium to risk-off

Why WW3 would not be ‘bullish for gas’ | EU LNG Chart Deck 29 July-2 August 2024

If there are reasons to be ‘bullish’ on European gas prices, a global stock market meltdown on the eve of a Middle East regional conflict is not one of them.

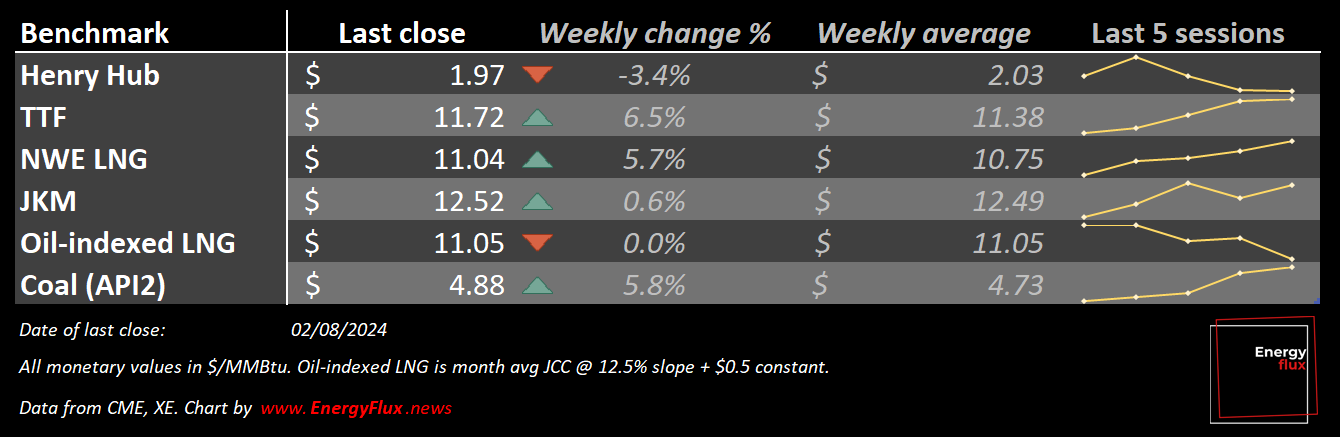

European natural gas prices leapt to 2024 highs last week, as the US and Israel laid bare their appetite for military escalation against Iran and its proxies.

The White House described the deployment of more US Navy aircraft carriers to the region as “de-escalatory”, in what must be a candidate for the 2024 Double Speak award (if such a thing does not exist, it should).

Natural gas traders saw right through it, and pressed the only button that seems to matter when two de-facto nuclear powers square off: buy.

European natural gas futures on the Dutch Title Transfer Facility duly rallied to prices not seen since December.

That knee-jerk response might prove premature. While US warships were amassing in the Red Sea and Gulf of Oman, the bottom fell out of the Japanese stock market — triggering a deep selloff in US and European equities and cryptocurrencies.

European gas futures fell more than 4% as febrile markets opened on Monday. Is the bullish thesis for gas prices finally unravelling?

There are plenty of outlets happy to carry credulous commentary parroting the ‘gas scarcity’ narrative. Energy Flux is not one of them.

Yes, the Middle East looks like it is about to boil over. And yes, a widening conflict could even disrupt oil and gas flows out of the Persian Gulf.

But as this week’s EU LNG Chart Deck explains, temporary supply shocks are not the same as structural changes to underlying demand. The signal is in the latter, not the former.

Article stats: 2,100 words, 12-min reading time, 10 charts and graphs

Member discussion: From risk premium to risk-off

Read what members are saying. Subscribe to join the conversation.