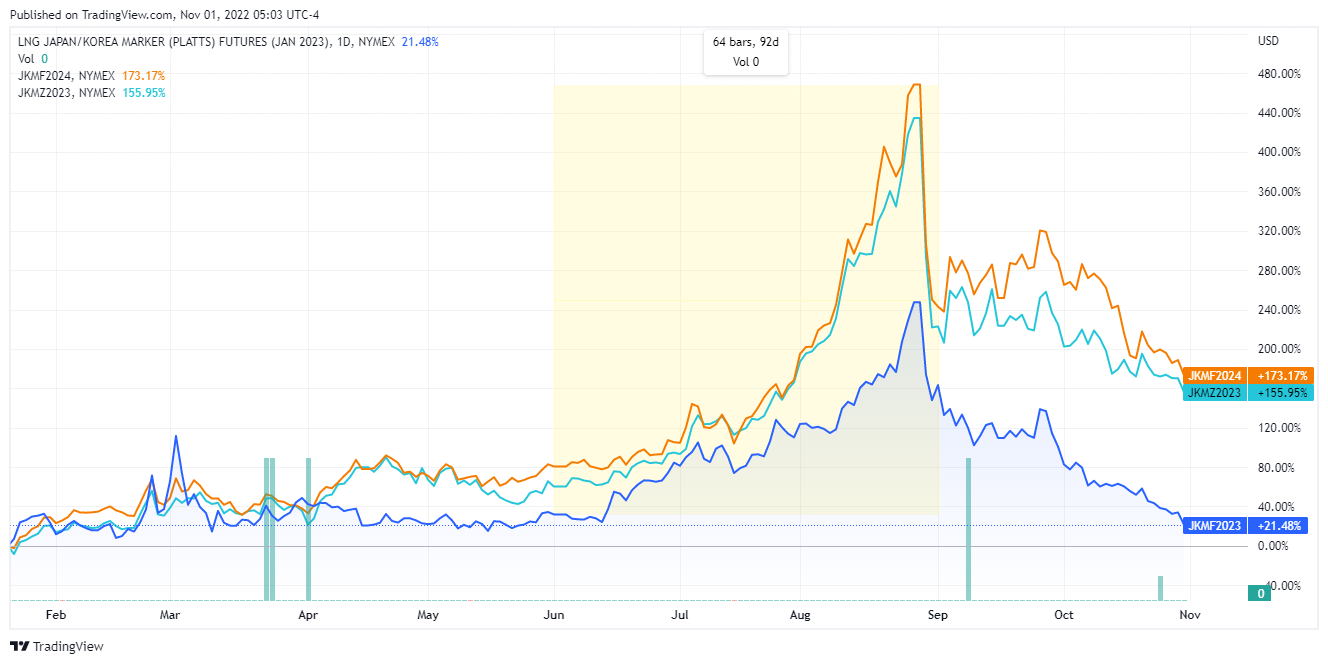

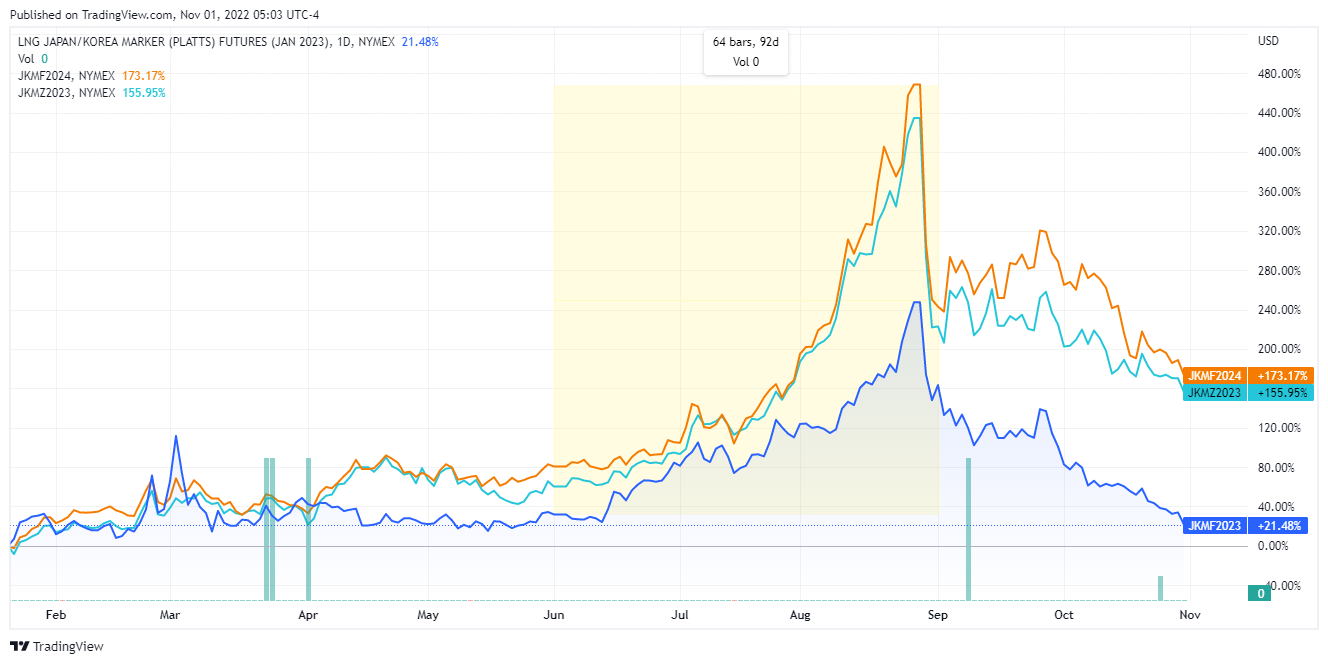

HOT TAKE: BP’s LNG hedge turns sour

But ‘exceptional’ gas trading propels earnings

Member discussion: HOT TAKE: BP’s LNG hedge turns sour

Read what members are saying. Subscribe to join the conversation.

But ‘exceptional’ gas trading propels earnings

Read what members are saying. Subscribe to join the conversation.

Hedge funds punish complacency in EU gas market. This is a sign of the times.

As the world fixates on oil, Venezuela burns $1.4bn of gas — while sitting on an untouched methane empire that could redraw regional power

2026 OUTLOOK: The Old Continent’s LNG habit could soon be funding two illegal military interventions on its immediate peripheries

Chaos looms after audacious decapitation of Maduro regime