Is the EU tipping the scales against green fuel imports?

‘Fit for 55’ package seems to favour EU-based production of ‘green’ hydrogen and ammonia

The EU is planning an unprecedented rollout of renewable power generation capacity this decade, which could exacerbate supply-demand grid imbalances. Mass deployment of electrolysers would flatten the peaks, so prioritising domestic production of ‘green’ hydrogen over imports would make strategic sense for Brussels — and that is exactly what the Commission appears to be doing in its landmark energy and climate policy proposal.

There was a lot to unpack following the unveiling of the European Commission’s sprawling ‘fit for 55’ policy suite on 14th July.

The full ramifications on commodity prices, power markets, trade, investment, geopolitics and domestic EU politics cannot be known at this stage and will take years to play out.

Merely summarising all the proposals would fill an entire newsletter. But one aspect leapt out: the potential for EU regulations to make it that bit harder to import ‘green’ fuels into the bloc.

The ‘fit for 55’ measures could place non-EU producers of green/blue hydrogen and ammonia at a disadvantage to EU-based rivals. If this is indeed the case, it could hurt importers of products that contain these chemicals too.

The package added meat to the bones of the so-called Carbon Border Adjustment Mechanism, under which importers pay at the border the cost of CO2 embedded in their products. It also explained how CBAM would interact with an expanded Emissions Trading System (ETS).

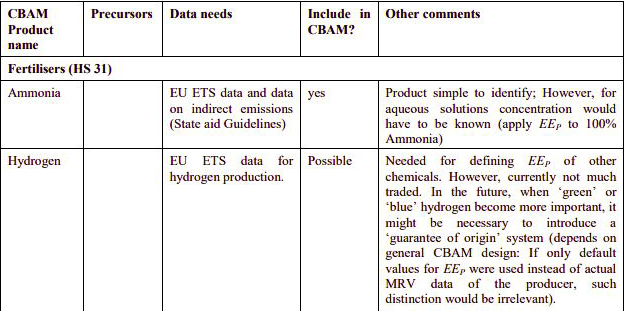

The CBAM will apply initially only to imports of cement, iron and steel, aluminium, fertilisers and electricity. But the regulations suggest that ammonia and possibly hydrogen could be included later (see Table 7-2 on page 79 of this PDF):

Officials need to know the embedded emissions of both H2 and NH3 in order to calculate the carbon content of CBAM-eligible products that contain them. For example, low-carbon fertiliser (where ‘green’ ammonia is a crucial ingredient); and ‘green’ steel or aluminium made using hydrogen derived from renewables.

This would mean that importers of these products would pay the going rate for carbon allowances on the ETS for their CO2 content.

Furthermore, the European Commission is proposing to include the production of hydrogen with electrolysers under the ETS, “making renewable and low-carbon facilities eligible for free allowances”.

Direction of travel

It is not clear the extent to which these measures would impact the economics of imported green fuels and products compared to those manufactured within the EU.

Since the ‘green’ and ‘blue’ varieties by definition have a much lower carbon content than chemical substances and products derived from unabated fossil fuels, the difference might be negligible. It is very hard to tell at this early stage. However, one thing is clear.