Scope 3 hyperopia

The energy industry can barely tame its own emissions, let alone yours and mine

Member discussion: Scope 3 hyperopia

Read what members are saying. Subscribe to join the conversation.

The energy industry can barely tame its own emissions, let alone yours and mine

Read what members are saying. Subscribe to join the conversation.

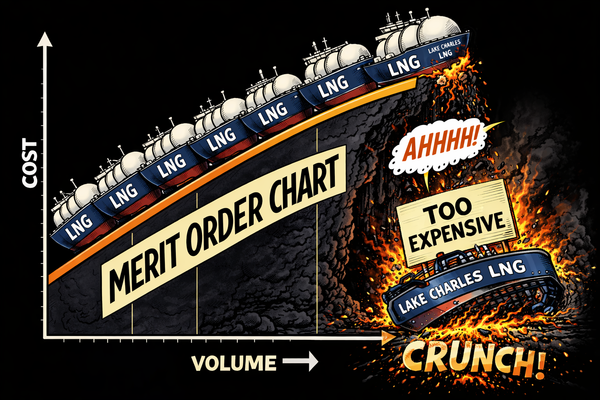

How natural gas prices dictate the pace of energy transition

PLUS: Tracking the glut, cheap gas and the energy transition, 2025 in review, Chart Deck + TTF Risk Model update

New LNG physical balance index monitors glut conditions in real-time | Chart Deck — 19 Dec 2025

Spread compression intensifies, but TTF is primed to snap back | Chart Deck — 12 Dec 2025