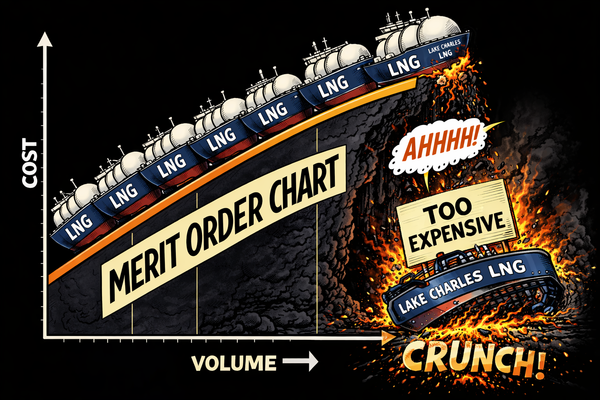

Terminal decline

Softening demand raises questions around Europe's LNG terminal expansion drive | EU LNG chart deck: 27 Oct - 10 Nov 2023

Member discussion: Terminal decline

Read what members are saying. Subscribe to join the conversation.