The mask slips

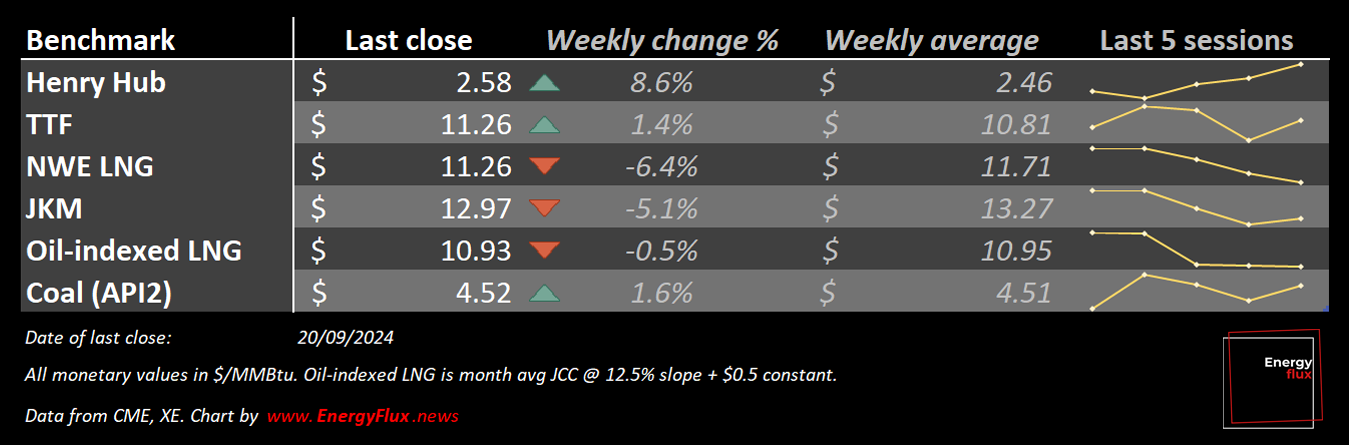

TTF ‘flash crash’ exposes how algorithms & speculation are destabilising Europe’s gas market | EU LNG Chart Deck: 24 September 2024

Anyone labouring under the misconception that the European gas market is a bastion of analytical sophistication, prudent risk management and tech-savvy trading nous was abruptly relieved of that burden last week.

On Thursday, European gas traders swallowed a (pretty obvious) fake news story hook, line and sinker, triggering giddying price movements the likes of which we haven’t seen since the heady days of summer 2022.

If you’re watching EU gas markets, you probably saw the spectacular failure of the gas market to spot the erroneous report (in Reuters, no less) claiming that Ukraine and Azerbaijan had sealed a ‘gas swap’ deal to keep gas flowing into Europe after 1 January, when the Russia-Ukraine transit deal expires.

In a few frenzied minutes, traders dumped an estimated 5 TWh of futures on Dutch TTF, the European benchmark gas trading hub, prompting a ~10% flash crash in the prompt price.

It soon emerged (to the surprise of absolutely nobody) that no such deal had been done and, as is often the case when TTF prices go crazy, nothing had actually changed in the physical supply-demand balances in the European gas market.

How on earth could the market be duped like this? I have thoughts. Lots of thoughts.

Article stats: 2,000 words, 10-min reading time, 8 original charts & graphs

Member discussion: The mask slips

Read what members are saying. Subscribe to join the conversation.