The rain in Spain makes gains by playing games

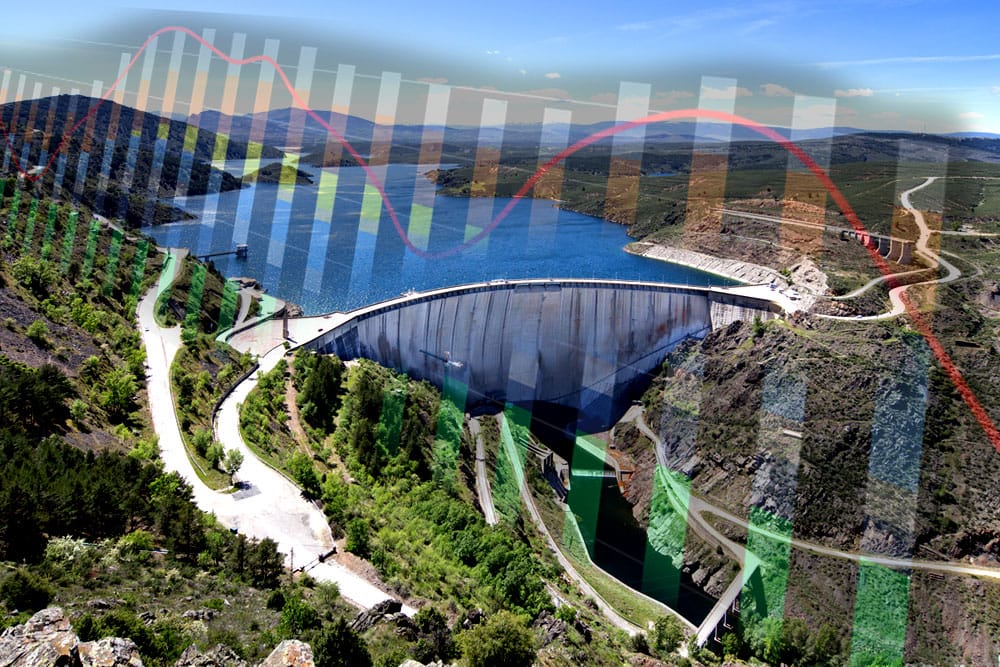

Are Iberian hydroelectric plants gaming the power market?

Last week’s newsletter on marginal pricing in EU electricity markets struck a chord. Quite a few readers got in touch, and one suggested I follow up with a piece about the Spanish and Portuguese plan to cap the wholesale price of electricity across the Iberian Peninsula. I’ve dug into it, and the story is much more interesting than is being reported in mainstream media.

The high-level proposal from Madrid and Lisbon to cap thermal power generation at €40/€50 per MWh won political approval from European leaders in March and from the European Commission in April. A formal plan was submitted to Brussels last weekend. The Spanish and Portuguese governments are expected to issue formal decrees this Friday.

Spain and Portugal buy very little gas from Russia but are exposed to global gas pricing via LNG imports and, to some degree, via pipeline imports from North Africa. There is limited interconnection with the rest of Europe, so the Iberian Peninsula is something of an ‘energy island’. This is why the EC and other member states made the exception and acquiesced to a temporary Iberian cap.

The information available suggests the one-year cap will apply only to electricity generated from coal and gas-fired power plants. In Spain, these are predominantly combined-cycle gas turbines (CCGTs). Since CCGTs have currently very high fuel prices, they tend to get priced out of ‘pay-as-clear’ power markets when supply of renewables exceeds power demand. And when they do run, they set the clearing price as the highest bidder in any given hourly segment in the Spanish power pool’s day-ahead market.

The idea is that by capping gas-fired power at €40 per MWh initially, rising to €50 per MWh later, the clearing price in the Spanish power pool will be correspondingly lower whenever gas is the marginal price-setter. In order to prevent the CCGT operators from going bankrupt, the government will top up the difference between the cap and their actual running costs and charge this back to consumers via a levy on their bills.

Consumers will still pay less on aggregate because every generator ahead of gas in the merit order will be paid only up to the €50 per MWh cap rather than the much higher prices in the pool these days (frequently >€200 per MWh). Academics estimate the cap will immediately cut wholesale prices by 30% because gas is always the most expensive generator when it runs.

Well, that’s how things should work. But data from Spanish power market operator OMIE tells a rather different story. This article digs into some bizarre goings-on in the Spanish power pool with the aid of numerous charts and graphs. The upshot is that the incoming price cap decree might not be as effective as billed by its proponents because some generators seem to be gaming the system.

And if it does work, the Iberian cap will confirm that pay-as-clear auctions are far from ideal for setting wholesale power prices in markets with a diverse mix of technologies.