There’s not enough gas to go around

Will war-rattled Europe deprive emerging Asia of winter fuel and food?

Member discussion: There’s not enough gas to go around

Read what members are saying. Subscribe to join the conversation.

Will war-rattled Europe deprive emerging Asia of winter fuel and food?

Read what members are saying. Subscribe to join the conversation.

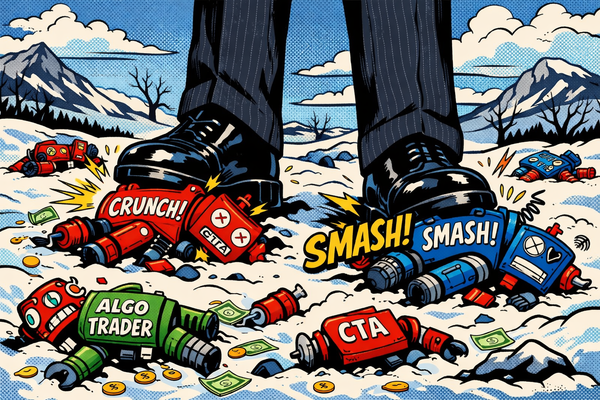

Algo traders take a breath after being taken to the cleaners

Self-reinforcing volatility loop sustains sudden winter gas price rally, but for how long?

Hedge funds punish complacency in EU gas market. This is a sign of the times.

As the world fixates on oil, Venezuela burns $1.4bn of gas — while sitting on an untouched methane empire that could redraw regional power