Too much politics, not enough gas

Dissecting the European energy crunch

Member discussion: Too much politics, not enough gas

Read what members are saying. Subscribe to join the conversation.

Dissecting the European energy crunch

Read what members are saying. Subscribe to join the conversation.

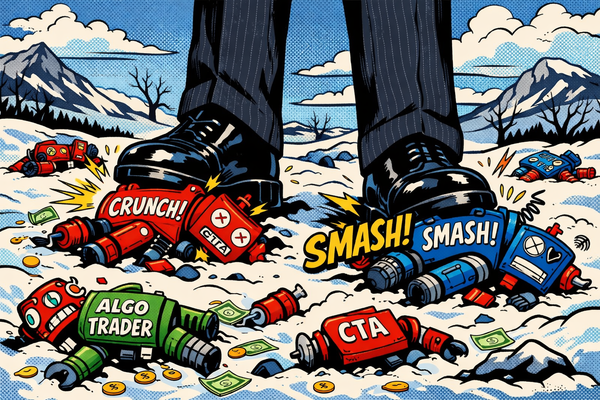

HOT TAKE: Natural gas markets implode in frenzy of automated selling and cascading long-stop orders

Algo traders take a breath after being taken to the cleaners

Self-reinforcing volatility loop sustains sudden winter gas price rally, but for how long?

Hedge funds punish complacency in EU gas market. This is a sign of the times.