The trouble with dirt-cheap shale gas

DEEP DIVE: Is America facing an LNG feed gas crunch?

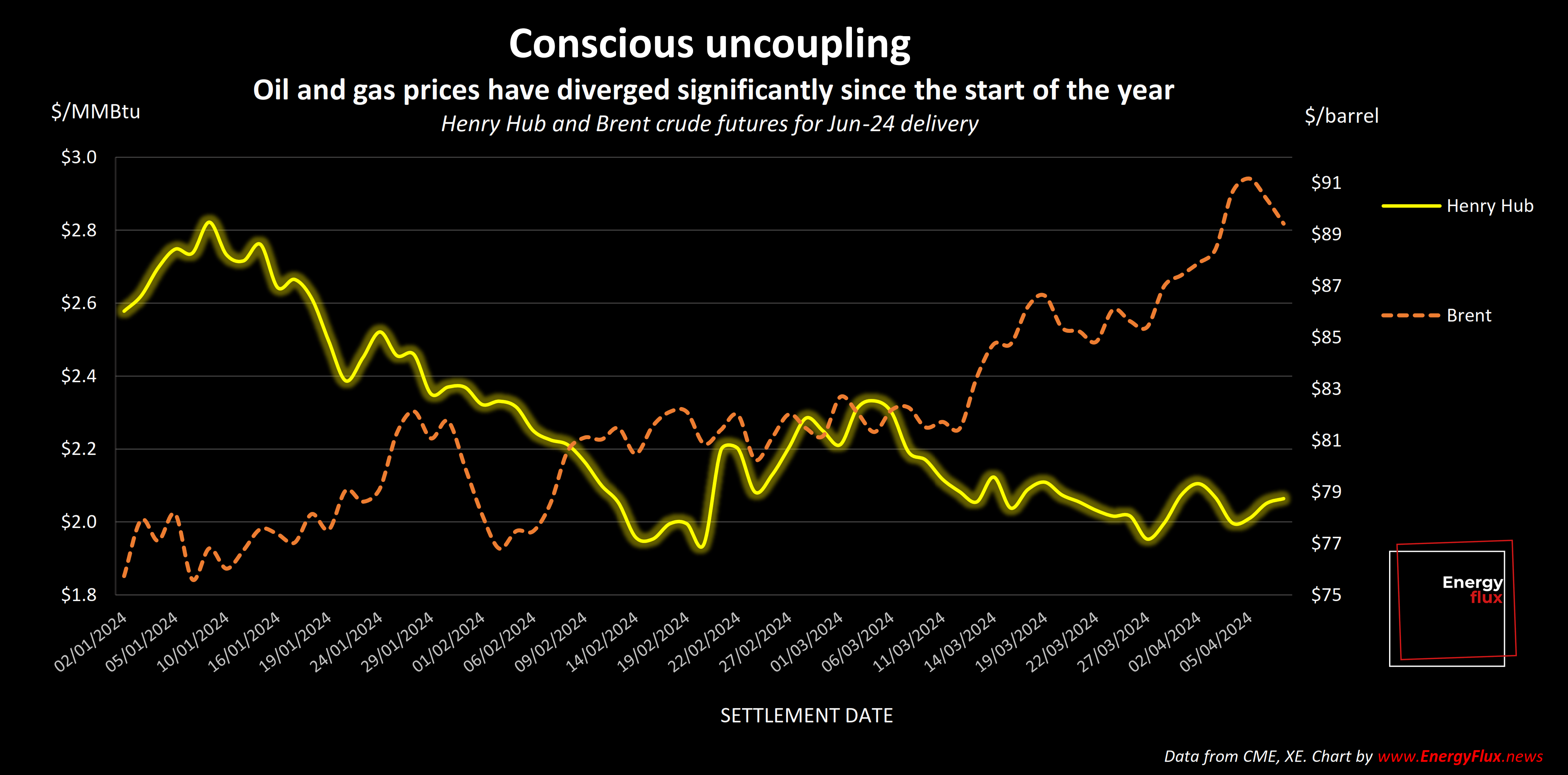

Oil and gas prices are diverging, which poses a problem for American shale producers — and, by extension, exporters of US liquefied natural gas (LNG).

Brent crude is flirting with $90/barrel and West Texas Intermediate (WTI), the US crude benchmark, is above $85/barrel. Both are up by almost 20% since the start of the year on production cuts by the Organization of the Petroleum Exporting Countries (OPEC) cartel, as well as Houthi attacks on ships in the Red Sea and from Ukrainian drone strikes on Russian oil infrastructure.

But prices on Henry Hub, the US natural gas benchmark in Louisiana, have fallen by more than a quarter so far in 2024, primarily due to an overhang of storage on the back of weak winter demand. “US gas balances remain oversupplied, with Lower 48 storage levels 23% higher than in 2023 and 38% higher than the five-year average as the market enters the non-peak season for gas,” Rystad said in a note on 10 April.

Until recently, this divergence would not be an issue as upstream operators focussed primarily on oil production. Oil is a more lucrative commodity and tends to have higher value per unit compared to natural gas, so a rising oil price would stimulate more drilling.

But changes in the gas-to-oil ratio (GOR), as well as new environmental regulations, are making the economic calculus more complicated for US shale producers. The upshot is a looming market failure that is depressing natural gas production growth on the eve of an unprecedented increase in US LNG export capacity.

Article stats: 2,500 words, 12-min reading time, 6 charts/graphics

Member discussion: The trouble with dirt-cheap shale gas

Read what members are saying. Subscribe to join the conversation.