UK capacity subsidy balloons amid supply jitters

Government accused of ‘excluding’ mothballed CCGTs

UK electricity consumers will pay more than ever to keep the lights on next winter, after the latest capacity market auction cleared at a record price of £75 per kilowatt per year. The result stems from an unusual UK government decision to subsidise all participating generators, citing market uncertainty. The British power market has experienced extreme volatility in recent months and faces the prospect of enduring tight winter supply margins — and yet two modern gas-fired power stations appear to have been excluded. Energy Flux investigates.

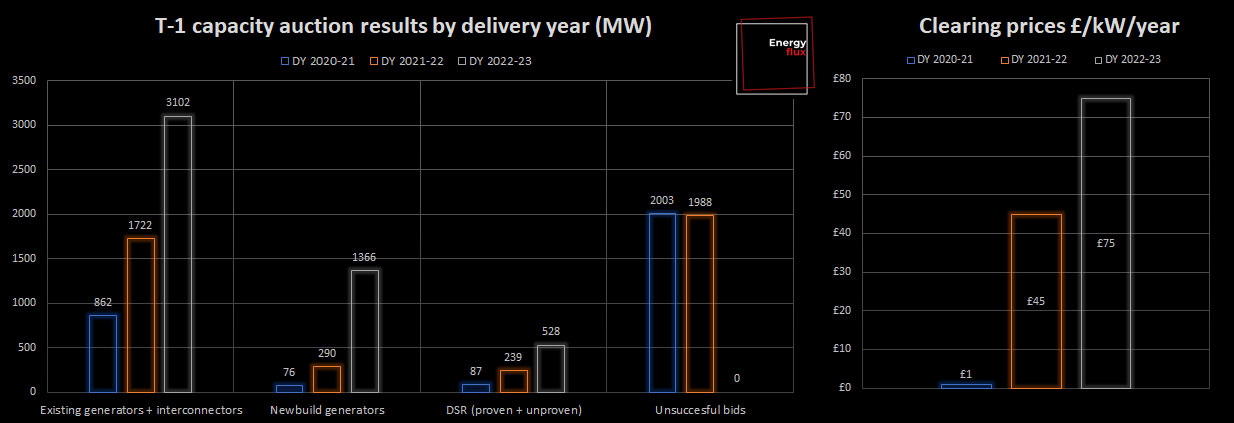

The T-1 auction procured almost 5 GW of capacity for availability during the 2022-23 winter. The vast majority of these are gas-fired turbines (3.4 GW), plus some coal (41 MW), batteries (385 MW) and demand-side response (515 MW). There was also a small amount of energy-from-waste, oil, diesel, pumped storage and even an 11 MW onshore wind farm in the mix.

The T-1 auction is an annual affair that contracts small amounts of capacity for the following winter. Much larger volumes are procured four years in advance in the T-4 auction.

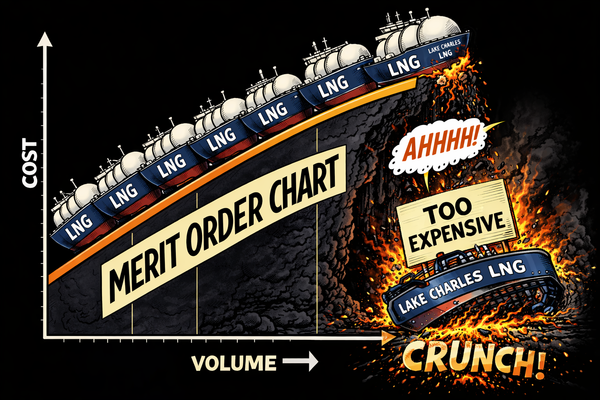

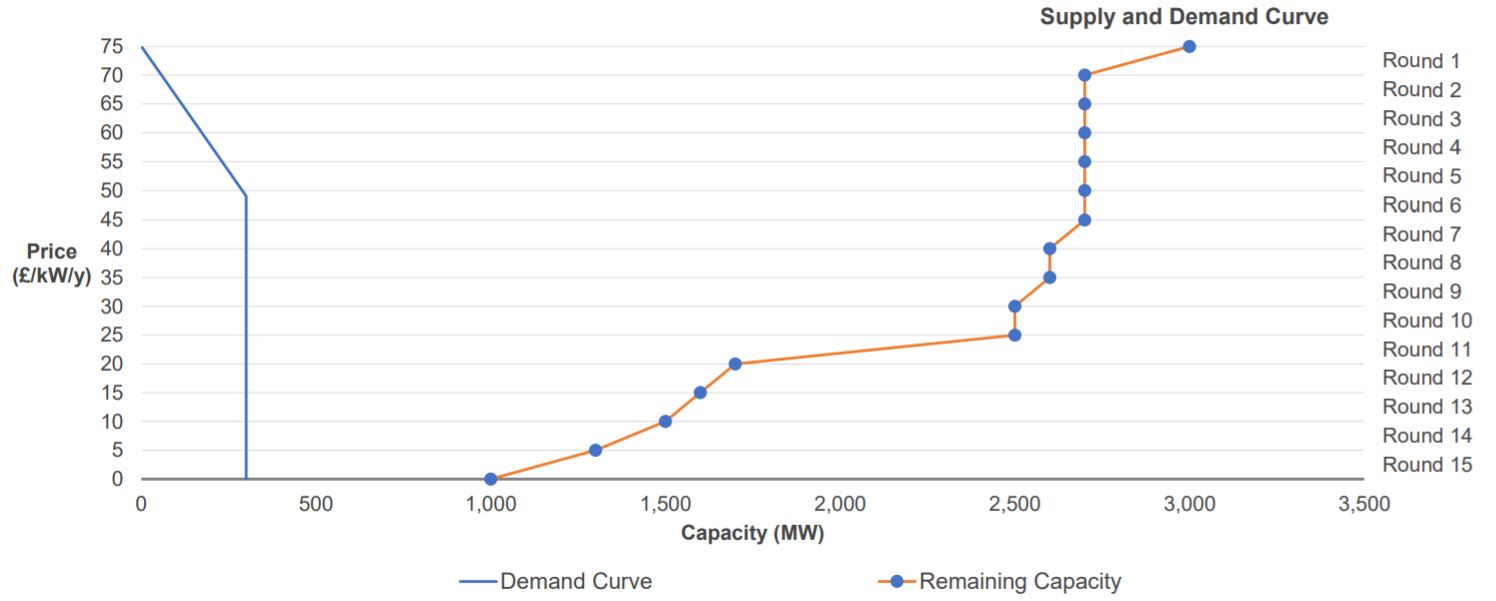

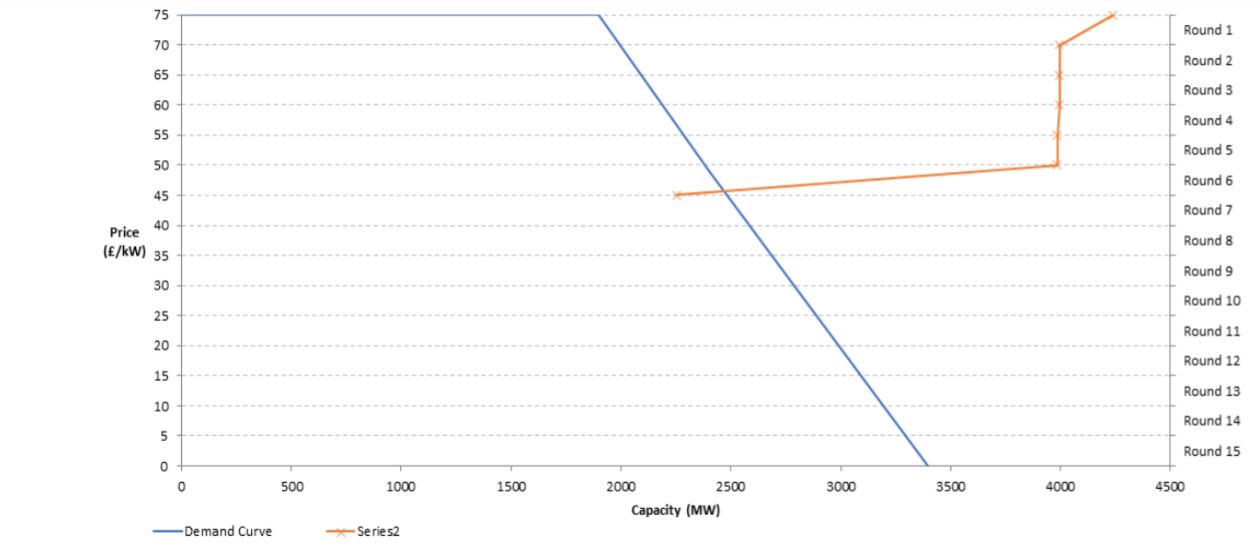

T-1 usually awards the vast majority of capacity to existing generators, but in this case it will rely on 1,365 MW of newbuild units. This is much more than the newbuild capacity contracted in the previous two T-1 tenders combined. The clearing prices for the two previous T-1 auctions were also much lower, at £45/kW/year for winter 2021-22 and just £1/kW/year for winter 2020-21:

The reason for this week’s expensive result is energy secretary Kwasi Kwarteng’s surprise decision in January to set a target volume of 5,361 MW for the 2022-23 auction – a figure in excess of the 5,166 MW of plant capacity registered to participate.

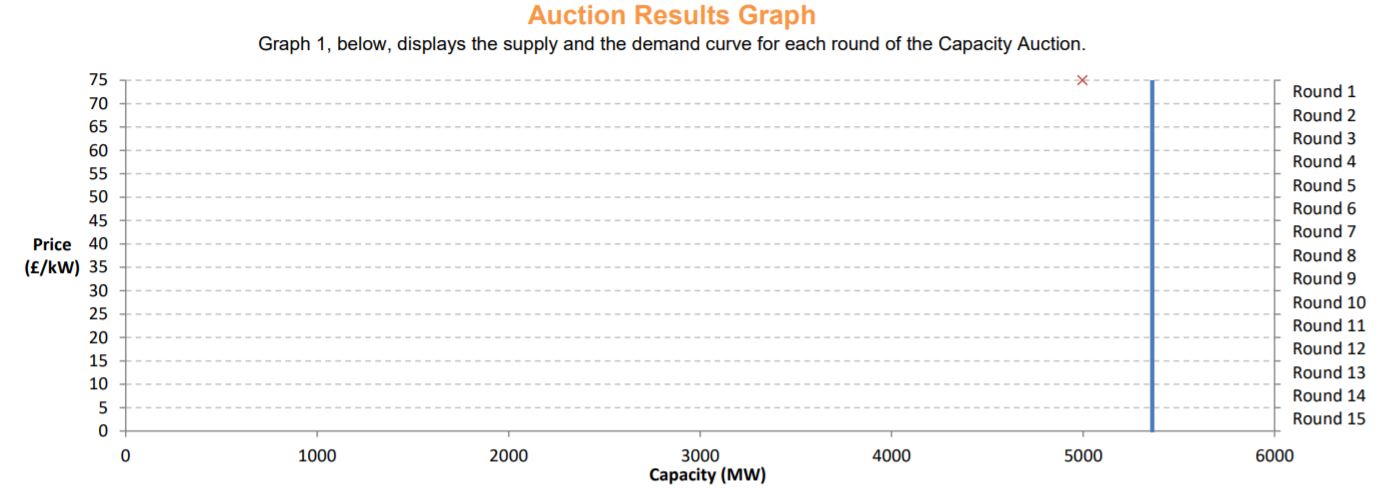

Bidding cleared instantly in the first round and every participating bidder was awarded a capacity market agreement at the maximum price, i.e. the cap of £75 – meaning this ‘auction’ was really nothing of the sort.

The chart above shows a vertical line instead of the more typical ‘demand curve’ of a competitive auction. In the previous two T-1 auctions, only 53% and 38% of bidders emerged successful after several rounds of competitive bidding to establish the clearing price. Those auction demand curves turned out like this:

Ministerial edict

The Secretary of State sets the target capacity in each auction after taking advice from UK power system operator National Grid ESO. The system operator had advised he set a target volume of 4,700 MW. Kwarteng’s response, which one analyst described as a “shock”, stated the following (emphasis added):

“I have decided to set a target volume of 5.361GW for the T-1 auction for delivery in 2022/23, an increase on your recommended target of 4.7GW. While I agree with the analysis you provided… this target reflects the broader uncertainties within the power sector.”

Kwarteng did not elaborate on what those uncertainties might be. A spokesperson for his department, BEIS, told Energy Flux:

Member discussion: UK capacity subsidy balloons amid supply jitters

Read what members are saying. Subscribe to join the conversation.