‘We didn’t pay a premium’ – BP

CEO Bernard Looney denies overpaying for Irish Sea offshore wind leases

Member discussion: ‘We didn’t pay a premium’ – BP

Read what members are saying. Subscribe to join the conversation.

CEO Bernard Looney denies overpaying for Irish Sea offshore wind leases

Read what members are saying. Subscribe to join the conversation.

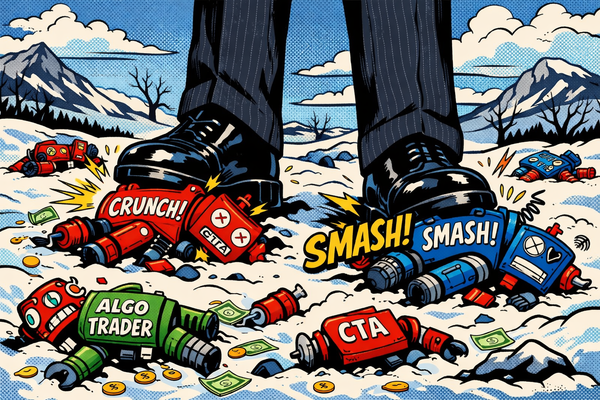

Algo traders take a breath after being taken to the cleaners

Self-reinforcing volatility loop sustains sudden winter gas price rally, but for how long?

Hedge funds punish complacency in EU gas market. This is a sign of the times.

As the world fixates on oil, Venezuela burns $1.4bn of gas — while sitting on an untouched methane empire that could redraw regional power