Woodside’s high-stakes BHP merger

DEEP-DIVE: Scarborough LNG is go, decommissioning liabilities be damned

Member discussion: Woodside’s high-stakes BHP merger

Read what members are saying. Subscribe to join the conversation.

DEEP-DIVE: Scarborough LNG is go, decommissioning liabilities be damned

Read what members are saying. Subscribe to join the conversation.

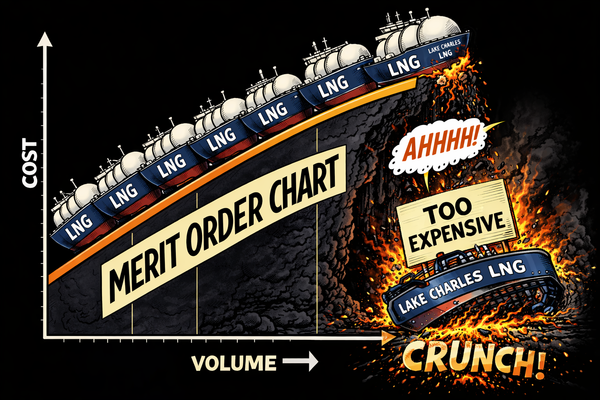

How natural gas prices dictate the pace of energy transition

PLUS: Tracking the glut, cheap gas and the energy transition, 2025 in review, Chart Deck + TTF Risk Model update

New LNG physical balance index monitors glut conditions in real-time | Chart Deck — 19 Dec 2025

Spread compression intensifies, but TTF is primed to snap back | Chart Deck — 12 Dec 2025