Zombie bulls twitch back to life

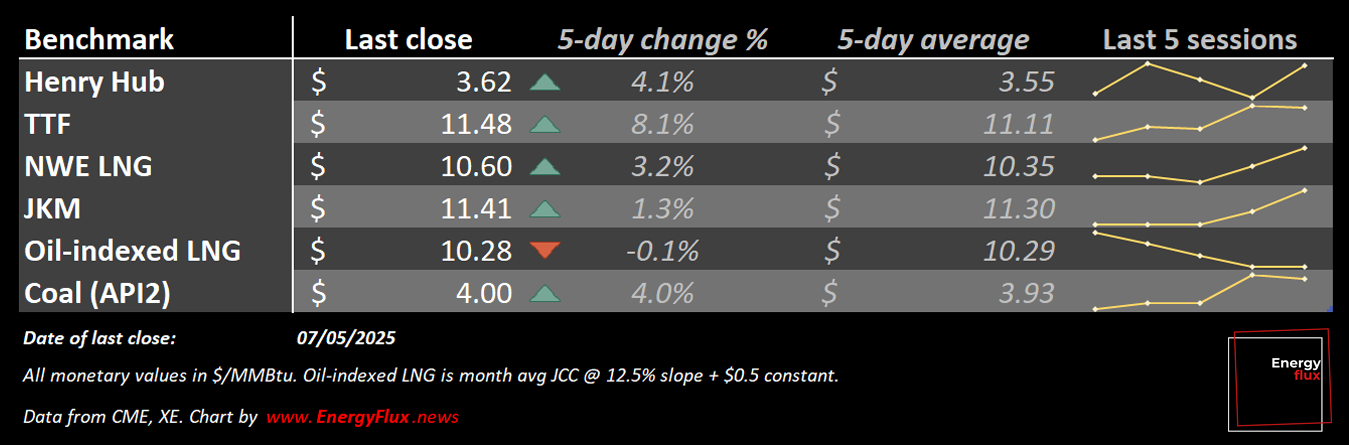

Prompt EU gas price rebounds on Russian gas ban, but this ain’t no recovery | EU LNG Chart Deck: 10 May 2025

Are investment funds rising from the ashes of the 2024 bull run? After months of relentless selling, Dutch TTF futures twitched to life this week as Brussels unveiled plans to sever ties with Russian energy imports by 2027 — a move greeted as a bullish spark.

The European Commission’s roadmap to halt Russian energy imports is more ambitious than anticipated. Gas and LNG spot deals and new long-term contracts could all be halted by the end of this year, and existing ones phased out by end-2027.

The narrative reversal is palpable. Not so long ago, the return of Russian gas to Europe was being widely discussed as part of putative Ukraine peace talks that have since stalled. Now, Moscow’s methane might never return to the troubled Old Continent.

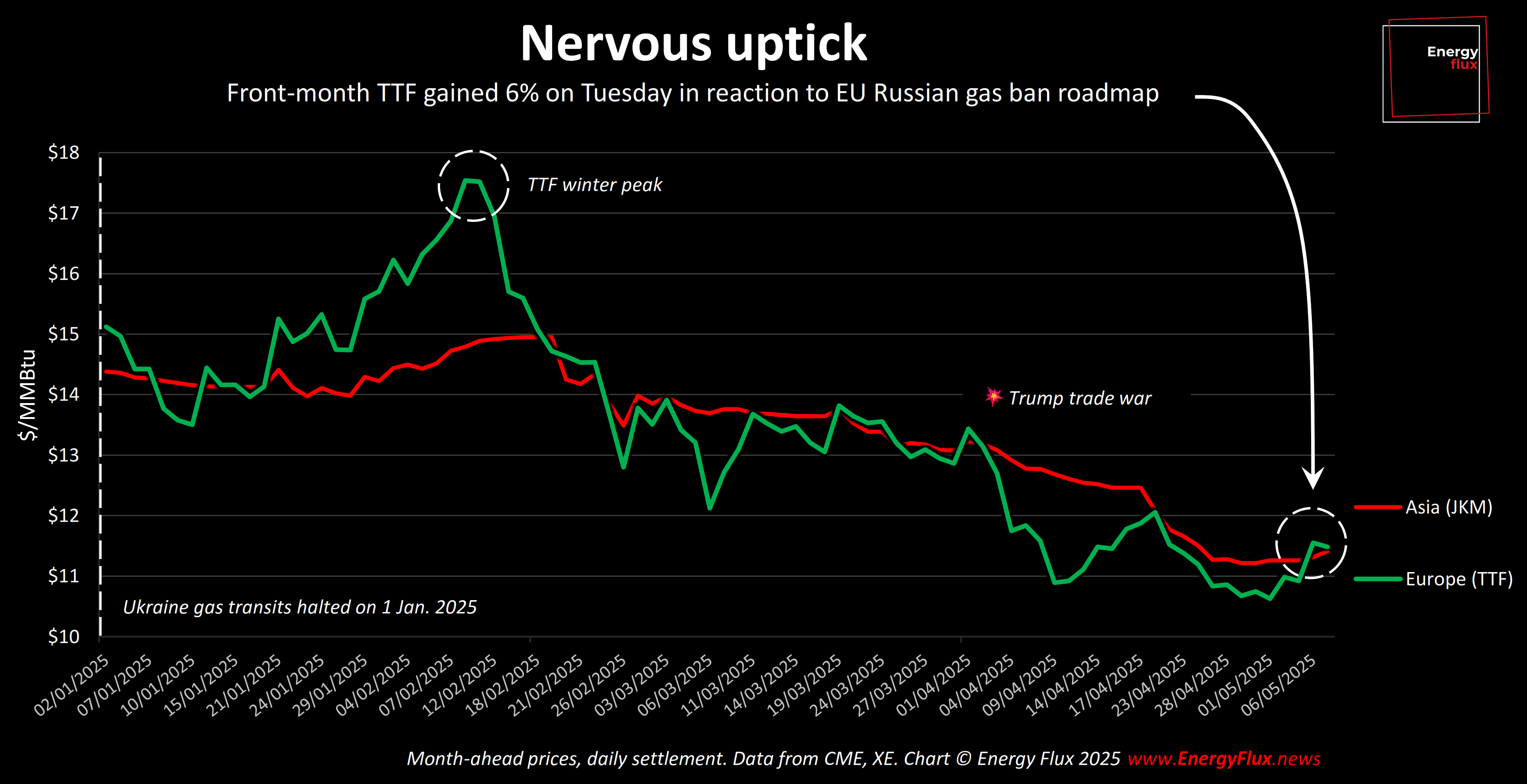

Spooked by this U-turn, front-month TTF duly leapt 6% on Tuesday to settle at a two-week high of €34.74/MWh before racing above €35 in intraday trading on Thursday.

For some, mid-€30s TTF is oversold territory. For others, it is merely a dip into a price range that (just about) incentivises the refilling of EU storage caverns.

The ‘oversold’ crew might be feeling vindicated. But this nervous uptick reeks less of revival and more of a dead cat bounce.

Bullish hedge funds, ever the opportunists, are almost certainly diving back into long positions, lured by the siren song of fresh geopolitical drama.

Their enthusiasm will collide with an inconvenient truth: frothy narratives based on improbable scarcity fears don’t have the same cut-through in the shoulder season, when demand sags and panic over dwindling gas stocks dissipates.

I’ve said this before, but the facts of the recent selloff bear repeating: hedge funds torched a staggering 227 TWh of speculative net length since February, dragging prompt TTF prices down 40% from their winter peak.

Acting as if none of that really happened, the market wasted no time pricing in the total loss of all Russian molecules as if it were a fait accompli — while apparently ignoring the imminent relaxation of storage refilling targets.

The EU Parliament voted yesterday in favour of the Commission’s new gas storage regulation, which — pending final negotiation — is highly likely to take the heat out of the summer 2025 procurement season.

This week’s EU LNG Chart Deck dissects the latest TTF histrionics by weighing up the push-pull price effect from (bearish) new storage targets and a (bullish) mooted Russian energy ban.

Looking beyond the exaggerated prompt price action, the regulatory interplay between these two uncertainties could recast the winter risk calculus and reshape the TTF forward curve in subtle ways. Let’s dive in.

💡 Elevate your understanding of gas markets with fiercely independent market analysis. Sign up now for full access to original, actionable insights backed up by hard data.

💥 Article stats: 2,200 words, 10-min read, 10 charts and graphs

Member discussion: Zombie bulls twitch back to life

Read what members are saying. Subscribe to join the conversation.