Revenge of the machines

Natural gas markets implode in frenzy of automated selling and cascading long-stop orders

Energy markets have seen plenty of crazy days in recent years, but few quite as unhinged as yesterday.

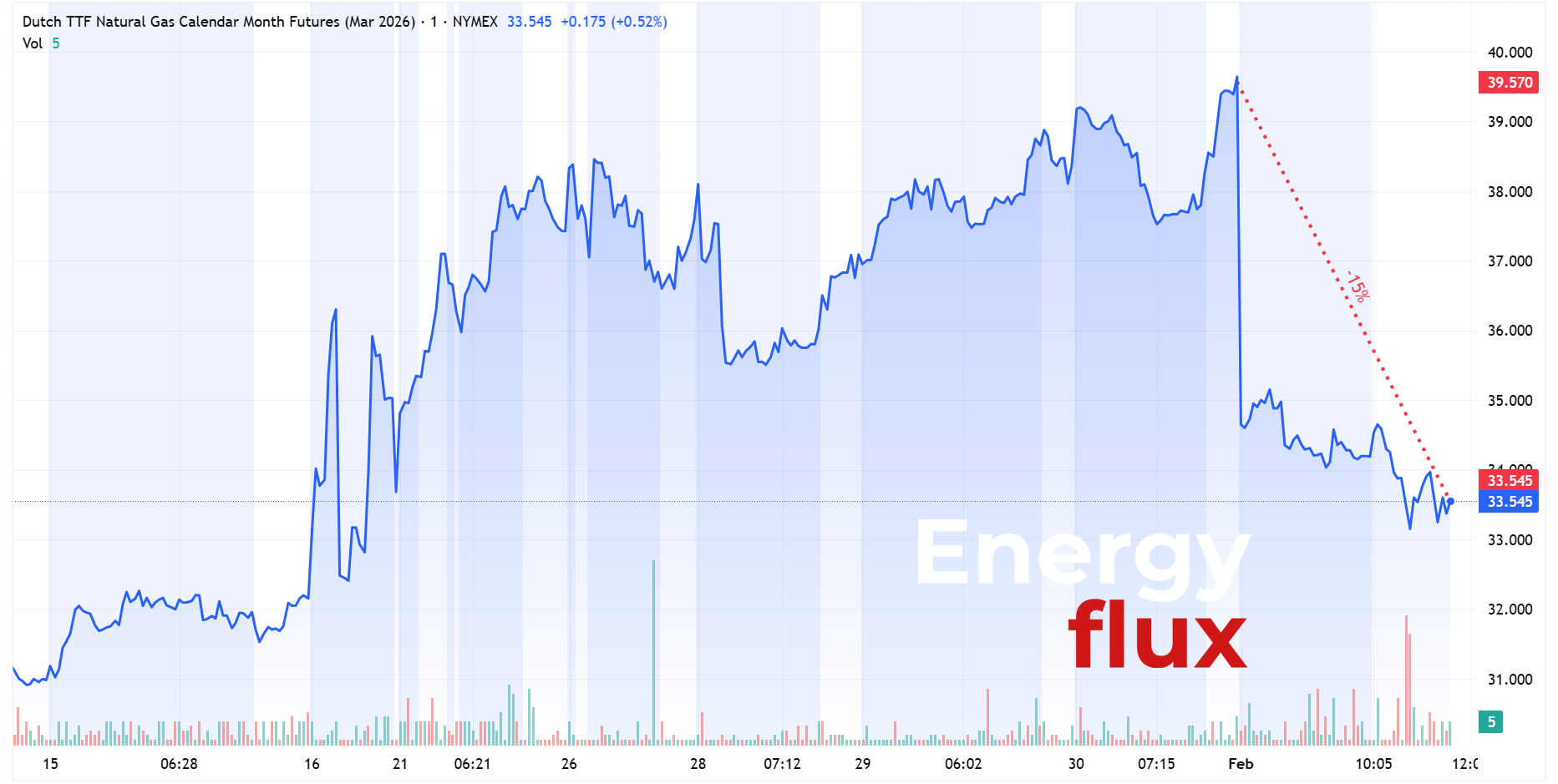

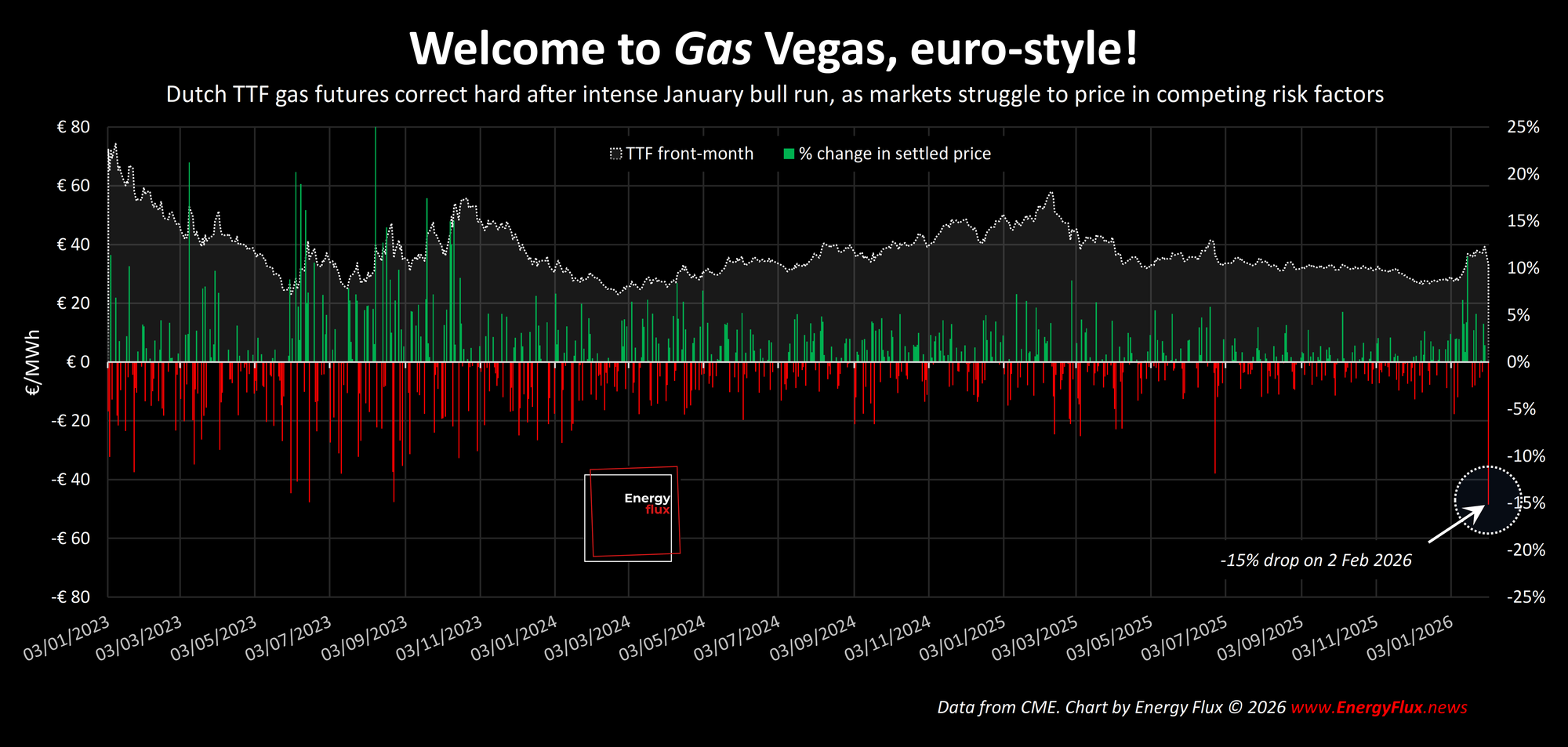

Dutch TTF, the European benchmark, crashed by a staggering 15% on Monday to remind everyone that vital commodities such as natural gas are now priced by hysterical algorithms making vast financial bets with precious little human oversight.

The March 2026 contract, currently the front month, opened the session below €36 per MWh – down more than €3/MWh on Friday’s close – before selling off hard throughout the day to settle at €33/MWh.

This marked the sharpest daily selloff since the post-invasion demand destruction and market recalibration of late 2023.

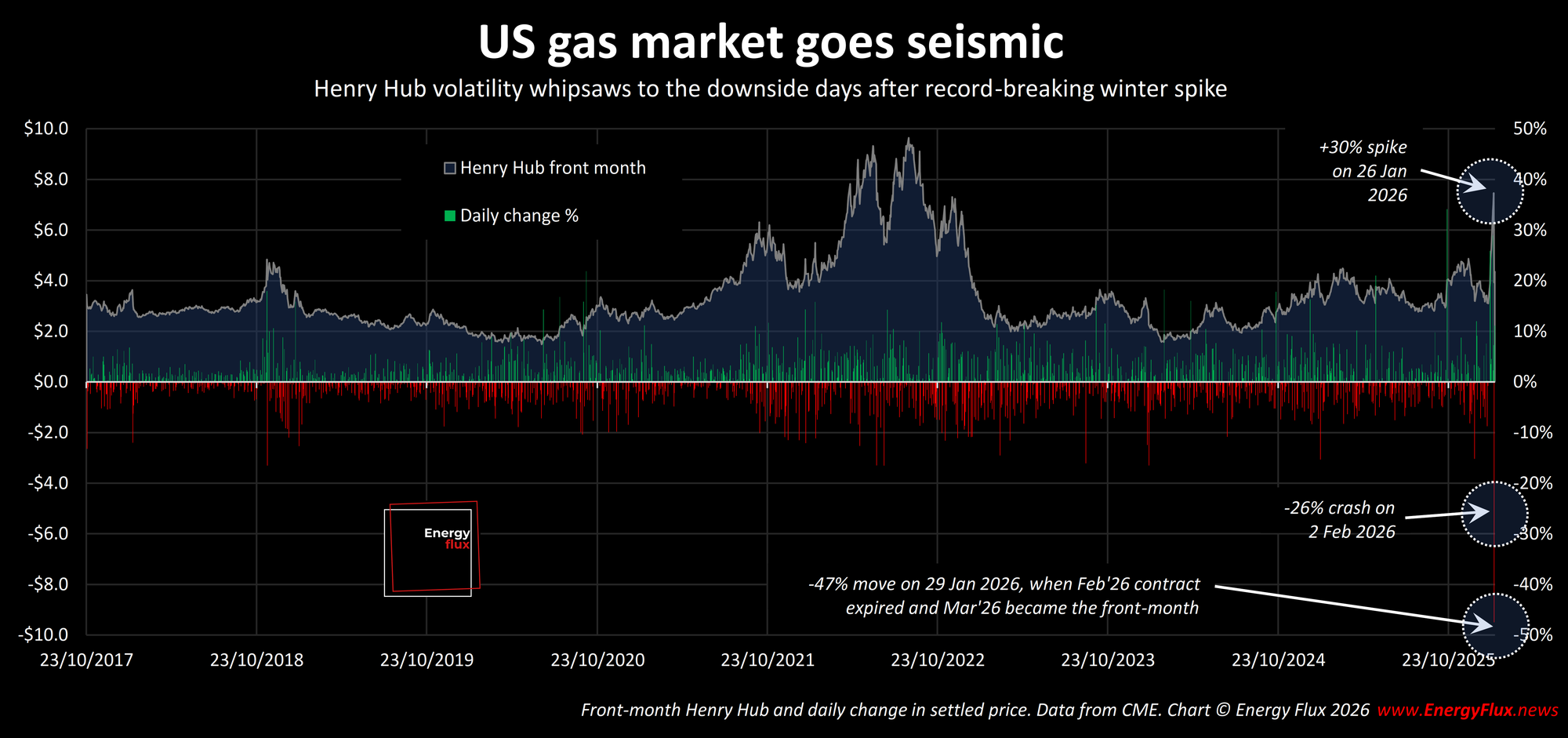

Across the Atlantic, the price moves were even more dramatic.

Henry Hub, the US benchmark, lost a quarter of its value in what Bloomberg described as “the largest daily loss for the front-month contract on a percentage basis since 1995, excluding contract rollover days.”

Analysts were quick to rationalise the histrionics as a function of milder weather forecasts, and a swift recovery in shale gas production after the recent winter storm Fern freeze-off. But there’s a better explanation.

Get timely, no-nonsense debriefs on major market moves. Differentiate your understanding with fiercely independent analysis from Energy Flux

Member discussion: Revenge of the machines

Read what members are saying. Subscribe to join the conversation.