Hormuz on the brink?

Gunboat diplomacy, commodity shocks, and the price of escalation

Middle East tensions are on a yo-yo string, as the US once again dials up the pressure on Iran amid a brutal crackdown on protestors opposed to the Islamic regime in Tehran.

Tensions appeared to ease last weekend when officials from both sides agreed to hold talks in Istanbul this Friday, 6 February. But yesterday, a US F-35 fighter jet shot down an Iranian drone that approached its aircraft carrier in the Arabian Sea.

The stakes at Friday’s talks could not be higher. The build-up of US Navy warships in the region adds gravitas to President Donald Trump’s warning that “probably bad things would happen” if no deal is reached.

Energy markets have grown numb to Middle East geopolitics in recent months, with natural gas traders focussing instead on weather runs, storage levels, and LNG flows as critical triggers of major price moves. But in today’s febrile markets, geopolitics is never far away.

Qatar’s perennial headache

As geostrategic signalling intensifies ahead of crunch talks, high-level LNG executives are currently gathered in Qatar for a major industry conference.

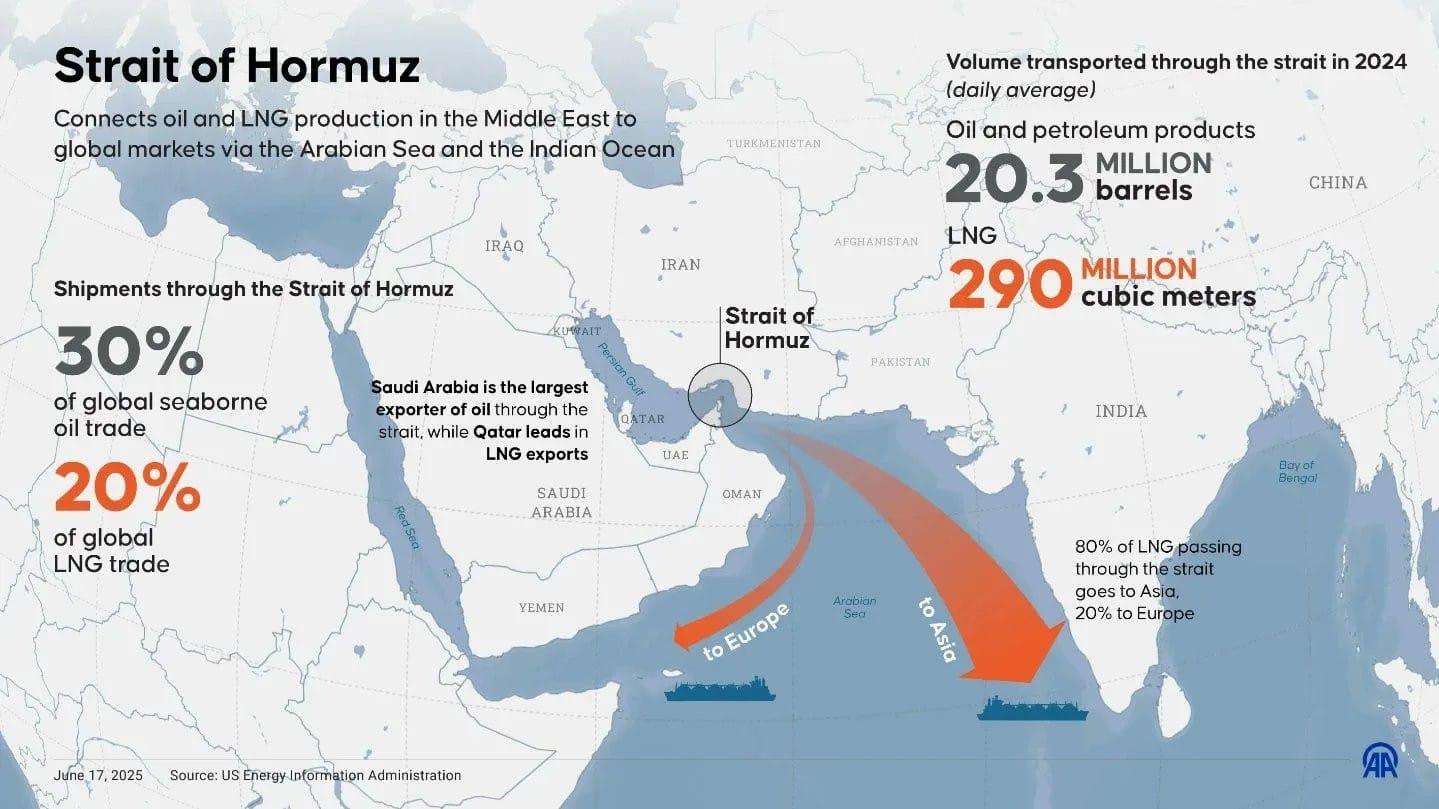

The implications of a potential military flare-up in the Strait of Hormuz, the maritime bottleneck for Persian Gulf oil and gas exports, will be weighing on minds in Doha.

Every week, Qatar exports more than 1.5 million tonnes of LNG, or 20% of worldwide supply, along this narrow sea passage to global markets, primarily in Asia.

Understanding the nuances of Hormuz gunboat diplomacy and the many unexpected ways this febrile situation could unfold is vital to evaluating geopolitical risk premia being priced into gas trading hubs in Europe and North America.

Today’s Deep Dive explores spiralling US-Iran brinksmanship, the burgeoning risk of unintended escalation, and asks whether markets are today under-pricing risk even though a full-blown conflict remains improbable.

The article is a guest post co-written by three esteemed authors with extensive knowledge and expertise in Gulf regional security, diplomacy, and energy issues:

- Naeem Yahya Mir is a veteran oil and gas industry professional who served as Managing Director and CEO of Pakistan State Oil (PSO) from January 2012 to July 2013

- Imran Nasir Sheikh is a seasoned naval aviator with extensive operational experience in maritime surveillance and anti-submarine warfare

- Asim Riaz holds an M.Phil in Strategic Studies from the National Defence University, Islamabad, with degrees in Energy Management and Mechanical Engineering

IN THIS ISSUE:

- Hormuz as a financial pressure valve: why fear reprices energy faster than missiles ever could

- How military “signalling” could accidentally morph from careful deterrence into an escalation machine with no one fully in control

- The structural reason chokepoints favour the weaker actor, and how weaponising congestion would unleash a loose cannon

- Why markets don’t need lost barrels to panic, only credible disruption probabilities based on incomplete information

- The under-discussed endgame risk that’s far more dangerous than conflict: fragmentation, and prolonged disorder

💥 Article stats: 3,000 words, 12-min reading time

The US-Iran standoff is often framed as whether war starts or is averted. This article looks beyond that black-and-white framing to face the substantive question for energy professionals: the many ways markets can misprice fast-moving events long before the first shot.

The Middle East crisis is all about how risk quietly metastasises, through shipping rates, spot LNG, inflation, and global growth. The potential for an outsized correction in risk pricing is considerable, even if the worst-case scenario fails to materialise.

Subscribe now to read the full analysis of the brinkmanship transforming this narrow waterway into a global energy market pressure cooker. Upgrade to Premium unlock this article & the entire Energy Flux archive

Member discussion: Hormuz on the brink?

Read what members are saying. Subscribe to join the conversation.