The future growth of LNG

PODCAST: Redefining Energy. AND: Freight rates, tariffs, EU gas storage regs

I had the immense pleasure of appearing on the Redefining Energy podcast recently, with hosts Laurent Segalen and Gerard Reid.

We discussed the future growth of LNG — the inherent volatility of this commodity, the demand outlook in Asia, the future of US shale, untapped gas reserves in geopolitical hotspots, and many other topics.

If you missed it, you can listen to the episode here on Apple:

And on Spotify:

We covered a lot of ground in 30 minutes. The conversation was the spark of inspiration for my two-part miniseries, Sizing Up The LNG Glut.

Part one is available here, and part two is due out next week. (I had hoped to publish the second instalment this week, but it is a complex topic and I want to do it justice.)

Heading for the scrapheap?

Following last week’s news about zero/negative freight rates, I noticed some interesting comments from shipping company Flex LNG.

Speaking on an earnings call, CEO Oystein Kalleklev called for old steam engine vessels to be scrapped:

“Rates for steam tonnage… it’s actually zero. So we have been talking about this for a long time. It's overdue scrapping cycle for steam tonnage. These ships have been surviving because you have had generally quite good markets, especially in '22 and '23 and into at least the … first quarter of '24. So given the slump in the market and making these ships unattractive, we do expect to see a big uptick in scrapping this year, next year and the coming years, driven not only by economics, but also by environmental rules which put a disadvantage on these ships.”

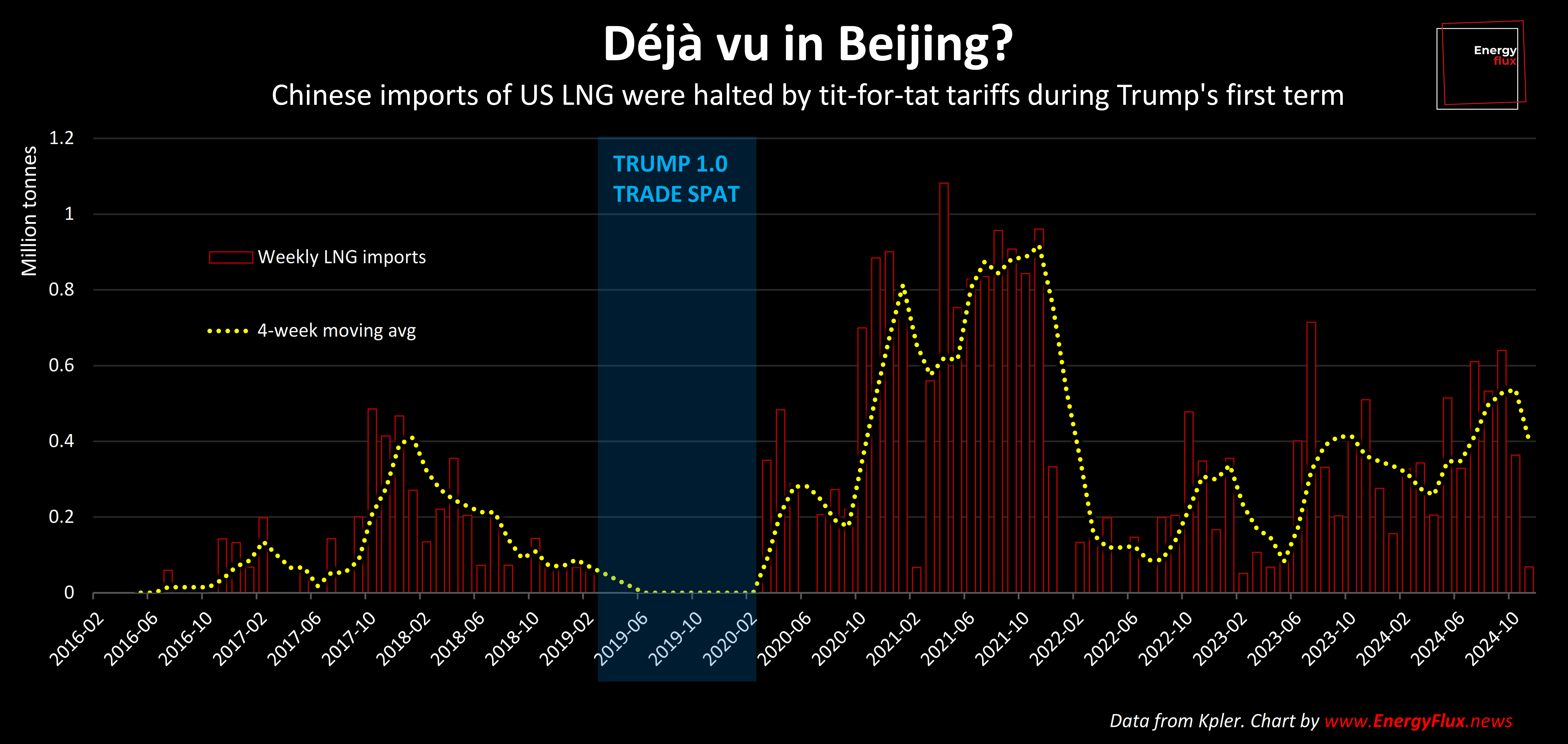

Kalleklev also spoke out against Trump’s trade war with China, which triggered Beijing to impose retaliatory tariffs against US LNG.

“it's not very constructive with the trade rhetoric from Trump, which tend to scare away buyers because if suddenly there are tariffs, that might make it uneconomically to take those LNG cargoes to those import nations, who have acquired them. So we would like to see a toning down of the trade rhetoric that would be very helpful for LNG market for sure.

China is proposing a 15% US LNG tariff if Trump follows through on his threat to slap a 10% levy on all Chinese imported goods. The tariffs are due to come into force on Monday.

Market impact is unclear at this stage; last time Trump did this, Beijing imposed a 25% tariff and Chinese imports of US LNG slumped to zero for several months.

However, Chinese buyers of US LNG are heavily incentivised to deliver these cargoes to Europe in any case due to more favourable economics versus shipping to Asia. US LNG would still be in the money in China compared to current Asian LNG spot prices, even with a 15% tariff.

The biggest losers would be proposed new American LNG export projects at the planning/pre-investment stage. No Chinese buyers would sign sales and purchase agreements (SPAs) in the middle of a US-China trade war, and this might hold up investment in new capacity.

The market can afford a degree of delay and attrition to new supply that might otherwise come online towards the end of decade, when ‘peak glut’ is likely to have passed.

At the same time, the broader macroeconomic impacts of a trade war are bearish for energy and commodities more generally.

Storage rethink

The inverted summer-winter spread on Dutch TTF narrowed this week after reports emerged that a group of EU member states is discussing the possible relaxation of the EU’s misguided gas storage regulations.

The distortions arising from rigid gas refilling targets are by now well documented, so it is good to see this being discussed at the highest level.

What’s perplexing is that any mooted relaxation would apply to the 2026 refilling season, so if anyone can explain why that should be moving the 2025 spread please let me know in the comments.

I’ll be diving deep into some of these topics in next week’s instalment.

— Seb

More from Energy Flux:

Member discussion: The future growth of LNG

Read what members are saying. Subscribe to join the conversation.