The great Transatlantic gas crunch

Negative US LNG profits & record-low Henry Hub-TTF correlation signal extreme market dislocation — and looming rebalancing

Global gas pricing is supposedly becoming more integrated as LNG trade accelerates, yet the two benchmarks at the heart of the Atlantic Basin — Henry Hub in Louisiana, and the Dutch Title Transfer Facility (TTF) — remain fundamentally regional creatures.

Henry Hub expresses a fast-moving North American supply-demand system, now complicated by LNG exports that graft an international outlet onto a mature domestic hub. TTF performs the same function for import-dependent Northwest Europe, where storage swings, weather patterns, pipeline flows and policy signals all leave deep marks on price formation. Each hub responds acutely to its own regional pressures. Sometimes those pressures align; often they don’t.

LNG is the connective tissue between the two hubs, but it’s still only a partial link. Growth in US export capacity has widened the channel through which shocks can travel, yet infrastructure limits and regional fundamentals keep Henry Hub and TTF only semi-interconnected. The result is a spread that swings between opportunity and warning.

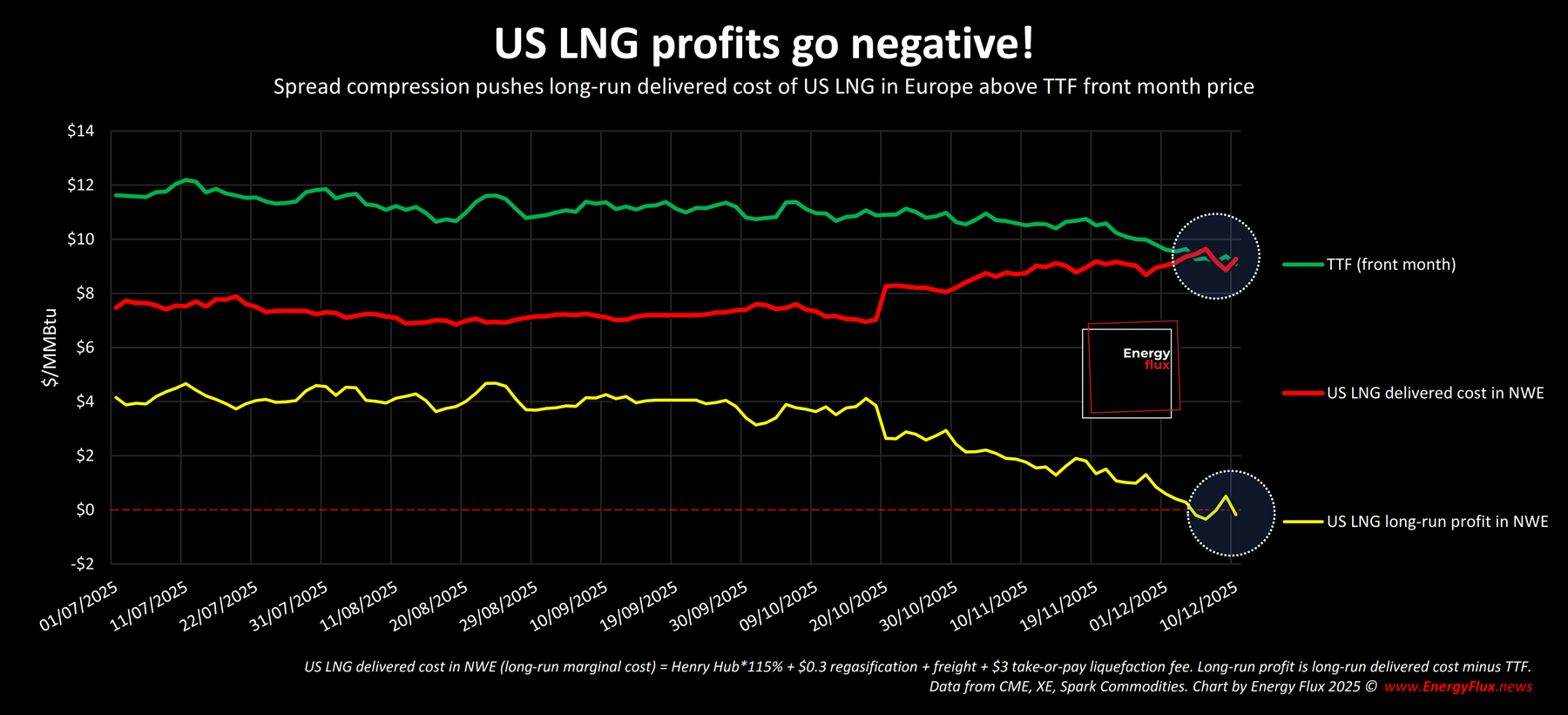

When the spread widens, it signals room for arbitrage and clear direction for Atlantic flows. When it collapses, it warns that the system is hitting its limits — either because Europe can no longer absorb incremental LNG, or because the US domestic market is tightening faster than exports can respond. And right now, the alarms are flashing bright red.

The onset of negative US LNG profits in Europe came as something of a shock to casual observers. Of course, regular readers of Energy Flux saw this coming; the pernicious combination of higher costs and lower sales prices has been eroding US LNG margins for many months now (see also these two gems from the archive).

Will long-run profits remain negative? Only for as long as the Henry Hub-TTF spread collapses towards the short-run marginal cost of liquefaction plus freight and regasification. Myriad factors could pull it back from the brink at any moment.

The HH-TTF spread alone tells only part of the transatlantic gas price story. A lead indicator is the correlation between Henry Hub and TTF — and this critical relationship is at an extraordinary inflection point.

This Deep Dive analyses the HH-TTF correlation: what drives it, how it behaves during different regimes, and what it tells us about the fast-shifting dynamics of US LNG trade in Europe.

IN THIS ISSUE (click to expand)

- How HH-TTF correlation is signalling unprecedented transatlantic dislocation

- Why freight, storage, and inventory drive correlation — and why the pattern breaks down when the market hits extremes

- How the TTF-JKM link explains periods of transatlantic alignment — and why it fails in a glut

- Why the Henry Hub-TTF decorrelation shock is likely only the first of many in the LNG cycle

💥Article stats: 2,200 words, 10-min reading time, 9 charts and graphs

Member discussion: The great Transatlantic gas crunch

Read what members are saying. Subscribe to join the conversation.