Torching value

DEEP DIVE: The $16 billion global gas flaring scandal — quantified, by country, for the first time

Gas flaring is immune to market signals. No matter the price, the amount of gas routinely burned off at flare stacks around the world only ever seems to creep higher. Last year, gas flaring hit a fresh record despite a sustained price rally that should have focussed minds on curbing the practice.

According to the Energy Institute Statistical Review, global flaring rose 0.8% to hit 158.8 billion cubic metres, equivalent to 3.8% of all gas produced globally in 2024.

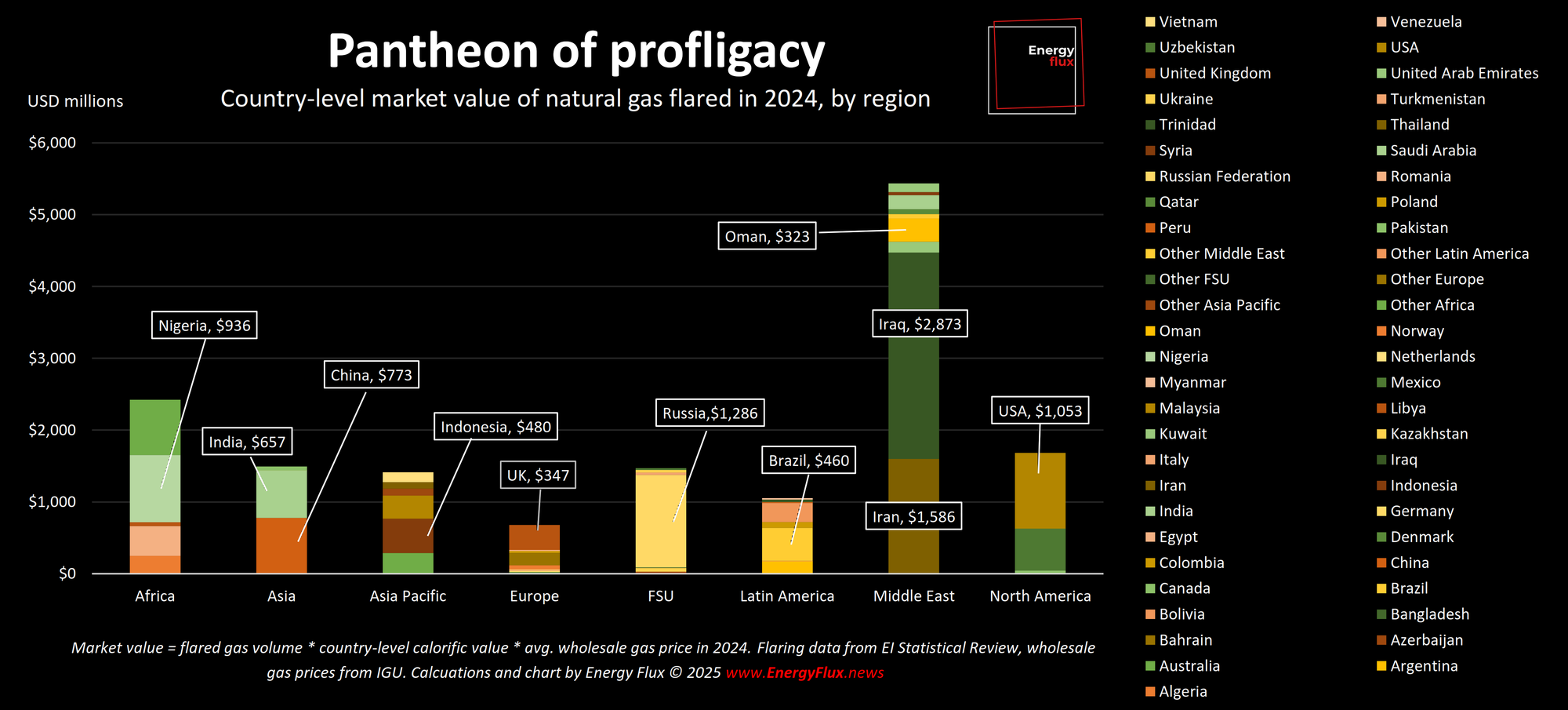

The market value of that gas is rarely scrutinised in detail – until now. Analysis by Energy Flux reveals the world flared off gas with a market value of $15.7 billion last year alone.

Based on country-level price data and calorific values, this is probably the most accurate publicly-available estimation of the commercial value of flared gas in 2024 (see methodology below).

For context, $15.7 billion is enough to rebuild the Burj Khalifa skyscraper, the world’s tallest building, ten times over.

It is four times greater than the single biggest US government contract terminated by DOGE, the cost-cutting department once headed by Elon Musk (a $4 billion military contract). And it is enough to cover the ~$11 billion cost of hosting the summer Olympics, with change to spare.

Scandalous waste

On a more serious note, the $15.7 billion figure makes gas flaring the biggest scandal that nobody is talking about.

The World Bank set a goal of zero routine flaring by 2030 that but the situation is so bad it is already “decisively out of reach”, according to the Environmental Defense Fund.

But if it were to happen, the direct financial savings alone would be enough to tackle some of the world’s most pressing public health, education, or environmental challenges.

For example, $15.7 billion is enough to fund the entire UN Environment Programme for 18 years.

It could bankroll Universal Basic Income of $1 per day for 43 million of the world’s poorest people. Or it could be used to feed the world’s hungriest 45 million people twice over, with surplus budget for logistics and salaries.

Rediverting the market value of all captured flare gas to an individual project or initiative is of course not possible (it would remain in-country). But the comparison serves to make a point: gas flaring is out of control, and the countries indulging in this level of profligacy tend to be the ones that can least afford it.

Level up your market insight. Subscribe to Energy Flux and support fiercely independent market analysis

Market value of flare gas – methodology

The flared gas value figure was derived by multiplying each country’s flaring volumes (in Bcm) by the gross calorific value of gas in the local gas system, to arrive at an energy content value (in MMBtu) for gas flared.

For example, Qatar has high heating value (HHV) gas of >40 trillion Btu per Bcm, while Russian gas has a lower energy content of approximately 34-36 TBtu per Bcm.

The energy content of each country’s flared gas was then multiplied by the average 2024 wholesale price of gas in that market (in $/MMBtu). Price data was kindly provided by the International Gas Union upon request, from its Wholesale Gas Price Survey 2025.

The use of country-level TBtu/Bcm conversion factors (instead of flat global averages), and actual wholesale prices from the IGU (instead of regional proxies), means this valuation likely has a much tighter error band than any global agency estimate.

This makes it much lower than other estimates. The World Bank gave a rough estimate of $63 billion calculated using European Union import gas prices in 2024, which are much higher than markets in North America or the Middle East, where most flaring occurs. Capterio estimates flare gas value at $31 billion annually based on a flat price of $5 per MMBtu – again, higher than real market prices in many of the global flaring hotspots.

That said, it is a probably conservative estimate: this approach assumes that flared gas, if captured and monetised, would have been sold at the local market rate. However, in gas exporting countries – which account for the vast majority of flaring – those molecules saved from the flare stack might have been shipped to higher-value markets, where they would have attracted a premium.

Valuing energy waste

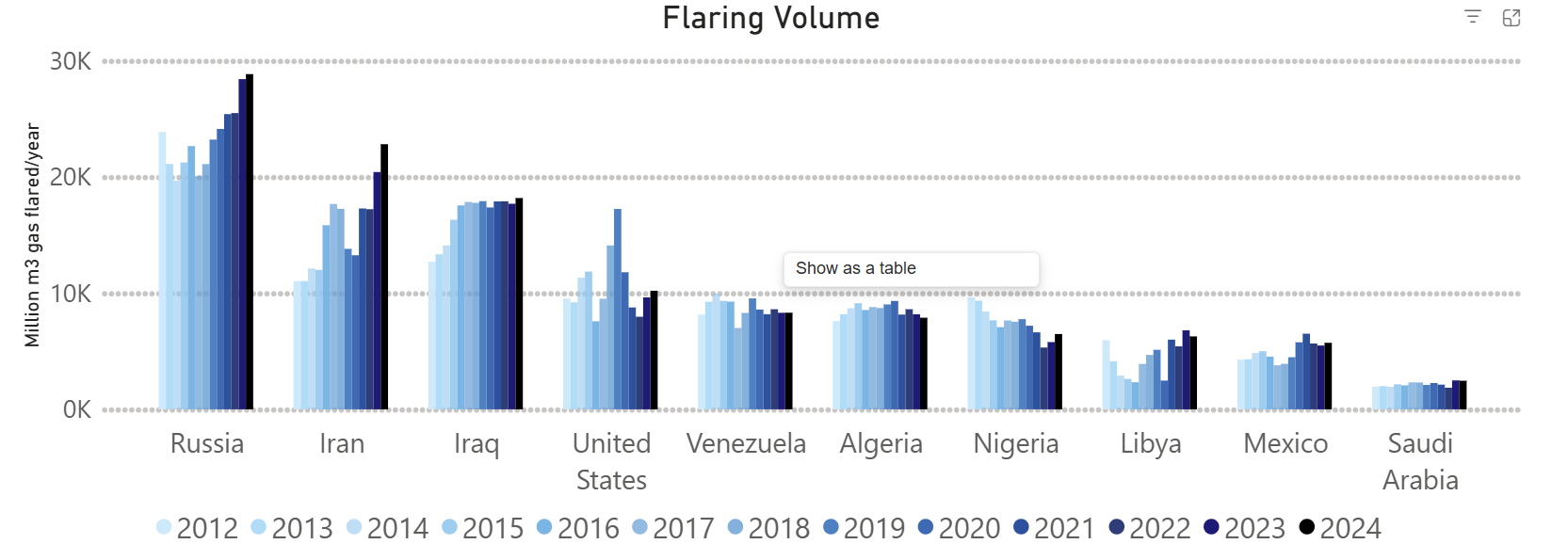

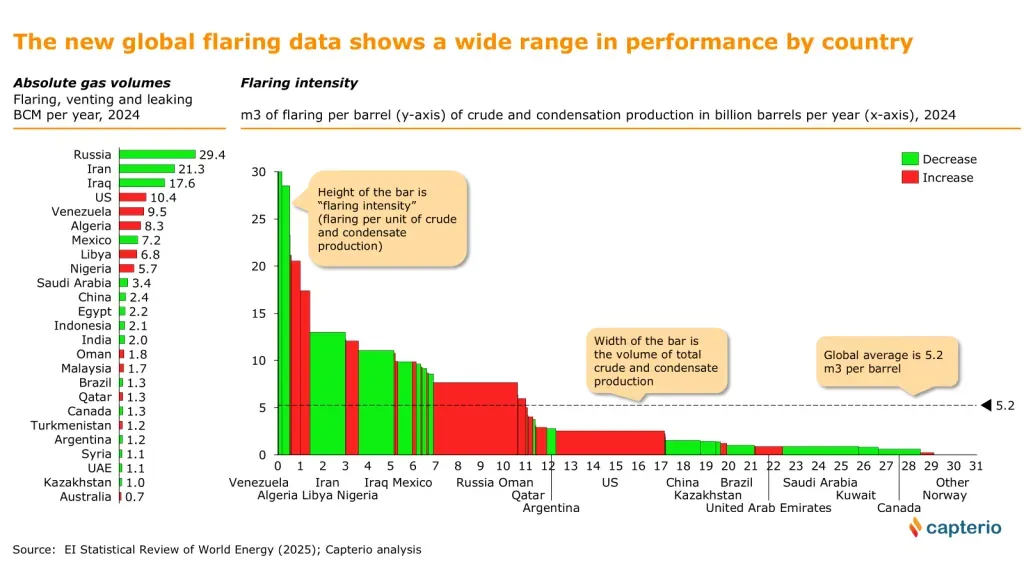

The worst culprits for gas flaring are well documented. The World Bank’s Global Gas Flaring Data consistently ranks Russia, Iran, Iraq, the United States and Venezuela as the top five biggest gas flaring countries by volume.

Capterio’s analysis of flaring intensity – flaring per unit of oil production – puts Venezuela, Algeria, Libya and Iran squarely in the naughty corner.

However, focussing on market value brings a new lens to the issue of wasted gas. Most flaring is done by national oil companies in countries that, shall we say, do not tend to prioritise ESG matters. But every government in the world cares about money, finance, resource efficiency, and fiscal deficits.

This Deep Dive reveals which countries are flaring off the most value in their domestic energy systems, and – in another first – how much money they are wasting via flaring on a per-capita basis.

The findings bring home the sheer egregiousness of the oil and gas industry’s collective inability to tame its own recklessness, and the potentially huge financial benefits of tackling this long-running problem.

💥Article stats: 1,900 words, 11-minute read, 5 interactive charts, graphs and maps

Member discussion: Torching value

Read what members are saying. Subscribe to join the conversation.