Decorrelation!

TTF breaks from the script. Does this alter the winter outlook?

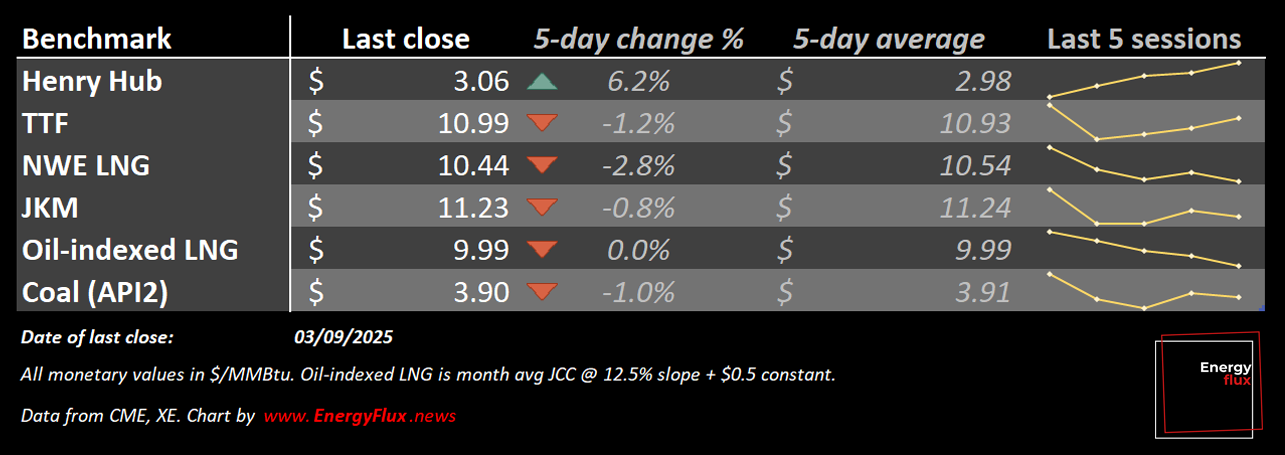

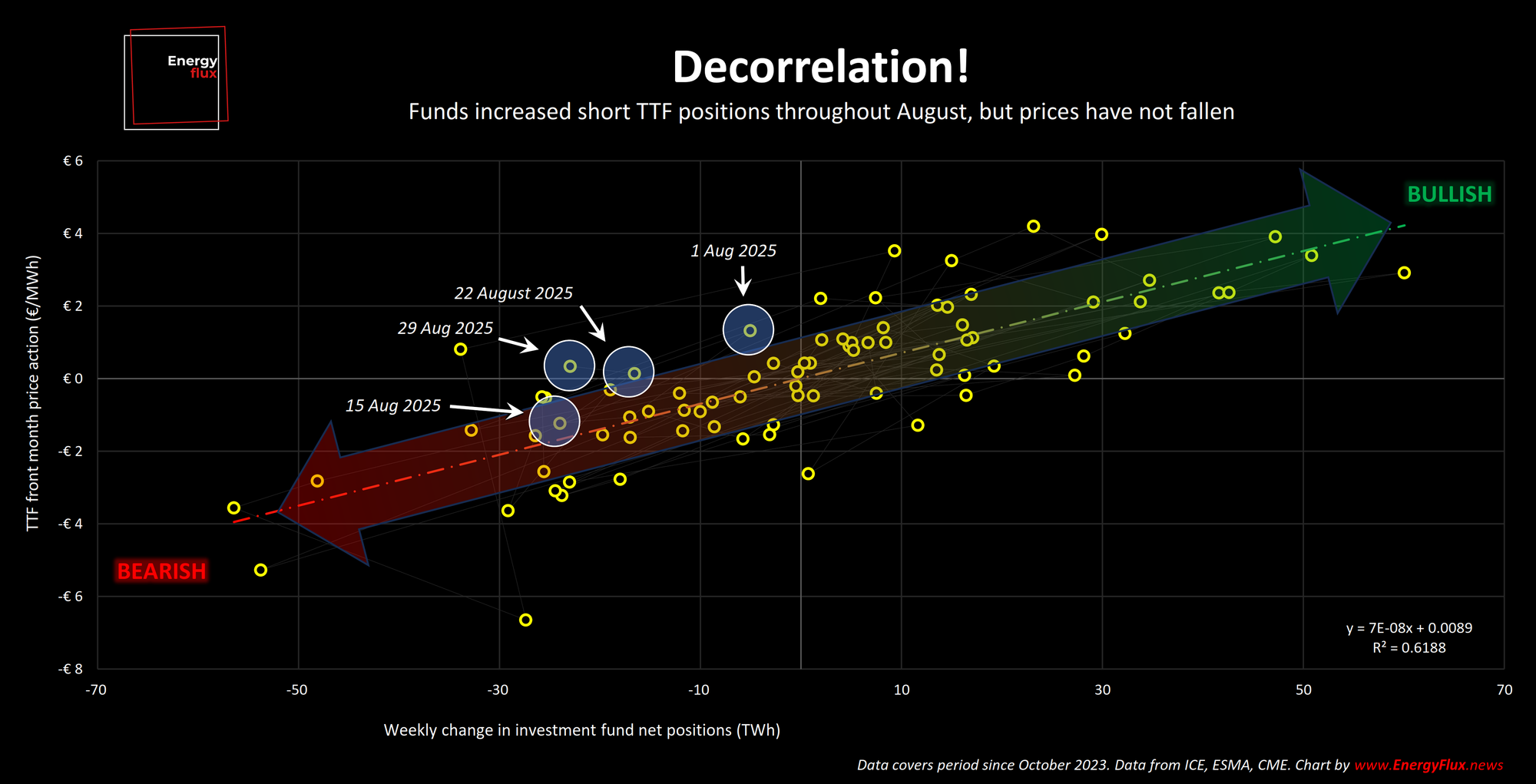

Gas prices usually buckle when hedge funds pile into shorts, but not this August. Investment funds have driven total short positions on Dutch TTF to a 16-month high, yet prompt prices remain rangebound around €32-33 per MWh. In other words, the usual correlation between fund positioning and price action has broken down.

The TTF Sentiment Tracker illustrates this dynamic well:

How should we interpret this anomaly? Either (a) there’s offsetting buying elsewhere (e.g. short ICE Endex TTF, long EEX TTF), or (b) funds are following rather than anticipating price action. The latter seems unlikely because it is not what they get paid to do!

Alternatively, (c) liquidity is thinner than usual in August, so fund flows aren’t transmitting cleanly to price. The decorrelation is a signal, but one that may resolve once September liquidity returns in the data.

Until then, it is worth looking closer at positioning of both Investment Funds and Commercial Undertakings. The datapoints paint a compelling picture of where winter market outlook aligns across market participants, and how they are pricing up outlier risks.

Most notably, speculative capital is steaming towards a highly significant inflection point. Hedge funds are still net long, but their bullish conviction is rapidly collapsing. Bearish momentum is undiminished and could break through a threshold within weeks, as the following charts reveal.

💥 Article stats: 1,000 words, 6-min reading time, 9 charts & graphs

👇 Need access? Offer ends soon! 👇

Member discussion: Decorrelation!

Read what members are saying. Subscribe to join the conversation.