In search of signal

TTF Risk Model sheds light on opaque summer EU gas market | Chart Deck: 24 July 2025

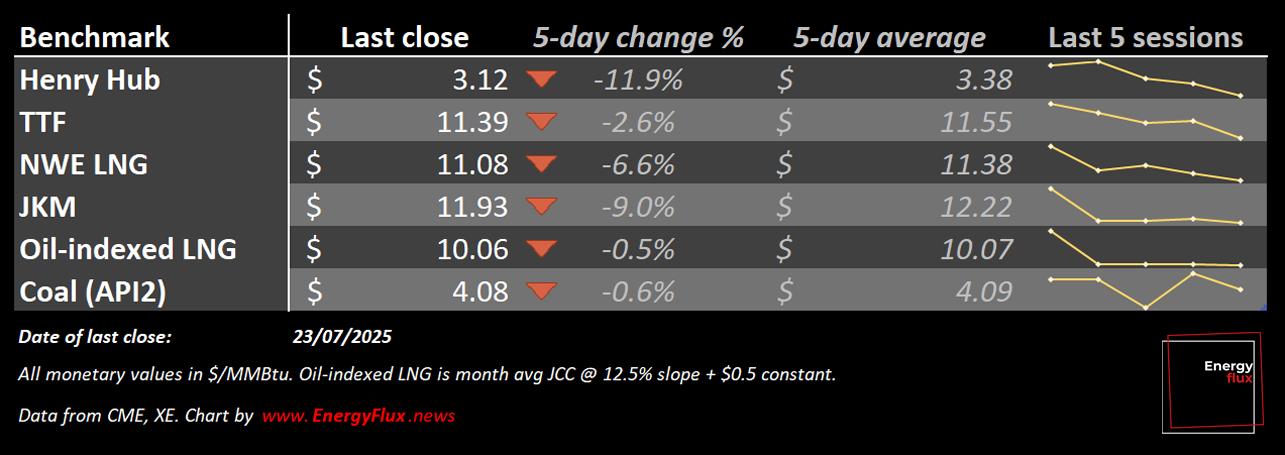

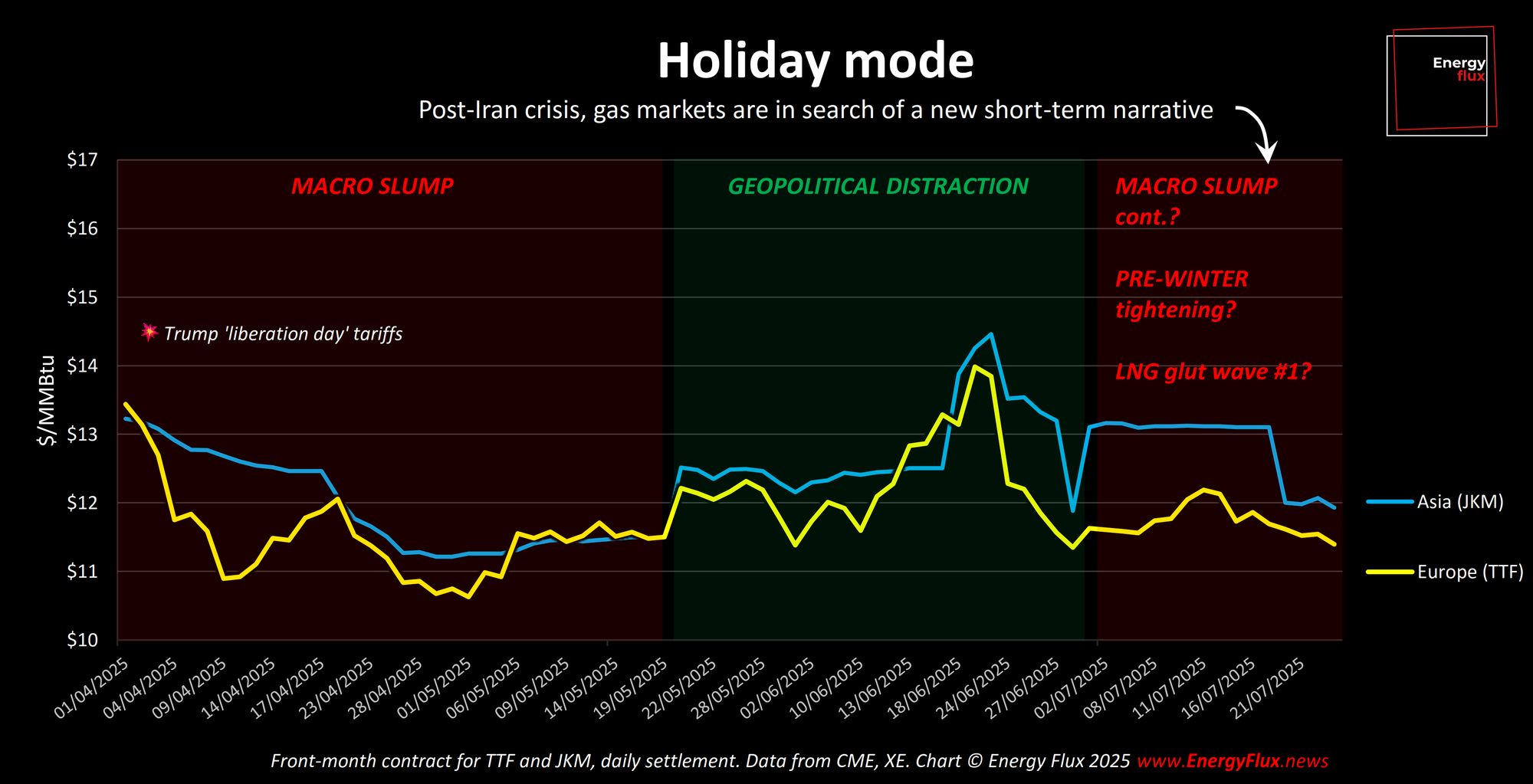

With the Israel-Iran geopolitical drama fading into a summer haze, the European natural gas market is stuck in suspended animation. Talking heads are casting around for a fresh narrative to define near-term price direction.

As if to illustrate the point, Equinor CEO Anders Opedal popped up this week to warn of “a more tight market” this autumn and winter, citing (of course) low EU gas storage levels.

Yes, stocks are lower than they were this time last year (66% full versus 84% in July 2024). But storage is not the only protagonist in the unfolding Q3-Q4 gas market story. There are other fresher, more dynamic characters lurking in the wings.

Fortunately, the Energy Flux TTF Risk Model is here to shed some light on an otherwise opaque late summer setup.

This week’s Chart Deck leans into the recently revamped model’s output to extract signal from the currently dominant sideways momentum.

If you’ve read all your holiday literature and fancy diving into a technical assessment of TTF futures positioning by the swimming pool, this post is for you. Warning: it’s pretty engrossing — don’t let your ice cream melt🍦

ARTICLE STATS: 1,500 words, 9-min reading time, 9 charts & graphs

Member discussion: In search of signal

Read what members are saying. Subscribe to join the conversation.