Beware complacency

CHART DECK: Fundamentals are increasingly bearish, but the market remains prone to shocks

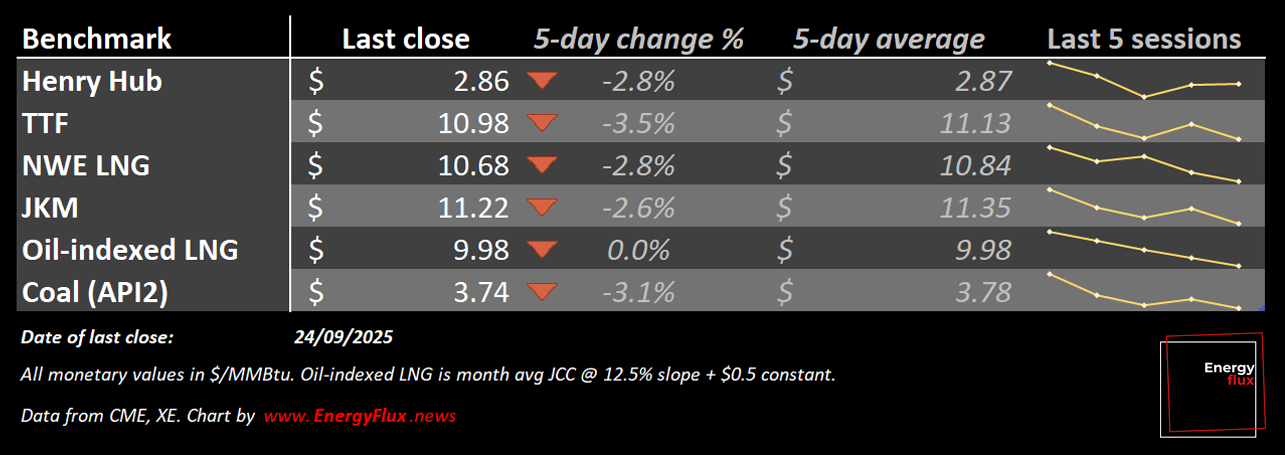

‘Looser fundamentals’, ‘reduced tail risk’, ‘lower volatility’… the dog days of rangebound summer trading have bored many European gas observers into acknowledging bearish market realities.

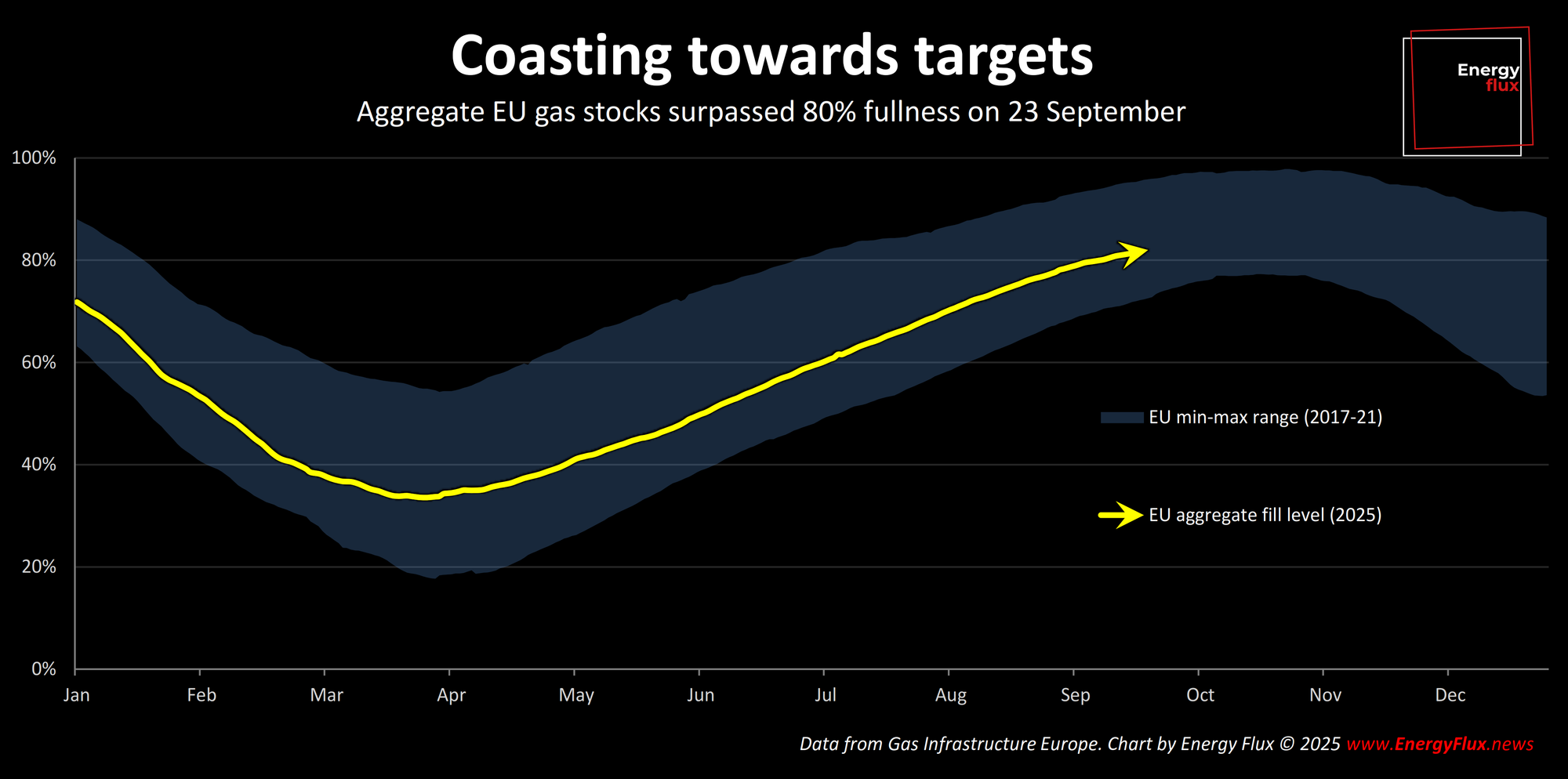

There is a growing awareness that storage levels are healthy (despite all the fuss at the start of the year); that LNG ‘scarcity’ is overstated and diminishing; that demand growth is weaker than expected; and that – crucially – investment funds have significantly scaled back their long bets.

However, just as consensus starts to soften, so the facts seem to change.

As the fourth quarter approaches, what looks like a placid pre-winter setup could be harbouring some nasty surprises for the unprepared.

The latest run of the Energy Flux TTF Risk Model is signalling that bullish risk is now being under-priced.

Not because of a change in the fundamentals, which remain structurally bearish; but because of subtle shifts in the forward curve, and the way that traders and hedge funds are quietly repositioning.

Level up your market insight: subscribe to Energy Flux and support fiercely independent market analysis

This week’s Chart Deck explores how physical and financial players are insuring against near-term weather, geopolitical or supply-side shocks, even as improving physical balances provide a softer grounding.

In this issue...

- Don’t be fooled by deceptively low volatility and rangebound pricing

- Dislocated time spreads tell a chilling winter tale

- Why a record number of investment funds are quietly crowding into strategic positions

- The near-term risks that are stacking the deck against further price declines in Q4

- Asymmetrical incentives will keep the market on its toes until the New Year

- How a reach to crystalise extrinsic storage value could trigger an precipitous Q1 correction

I have talked at length about the looming LNG glut, and how it will transform global energy markets for years.

However, the sober reality is that there is one more winter still to navigate before a new structurally lower pricing regime truly beds in.

This is how the pre-winter market is shaping up.

💥Article stats: 1,750 words, 7-min read, 11 charts & graphs

Member discussion: Beware complacency

Read what members are saying. Subscribe to join the conversation.