Counterweight

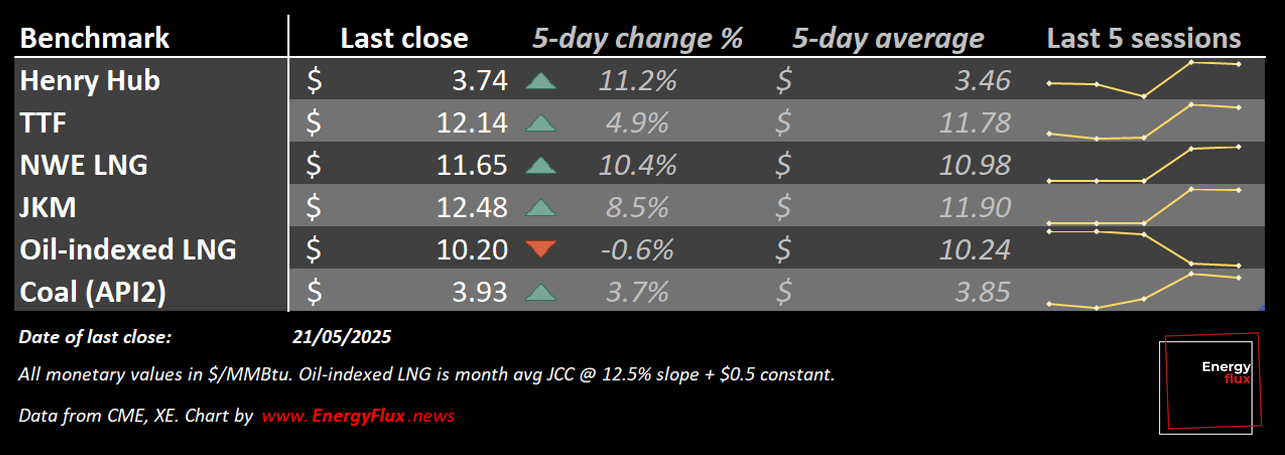

TTF price upsurge must contend with demand flexibility and brimming global LNG supplies | EU LNG Chart Deck: 22 May 2025

Speculative investment funds are out on the prowl in the EU gas market again, buying up TTF gas futures like it’s 2021.

This is no surprise, the pattern is well established: on the tiniest hint of bullish news flow, Commodity Trading Advisors (CTAs) start executing automatic TTF buy trades.

Often these are based on spurious headlines, unsubstantive soundbites, or unconfirmed regulatory interventions with distant time horizons.

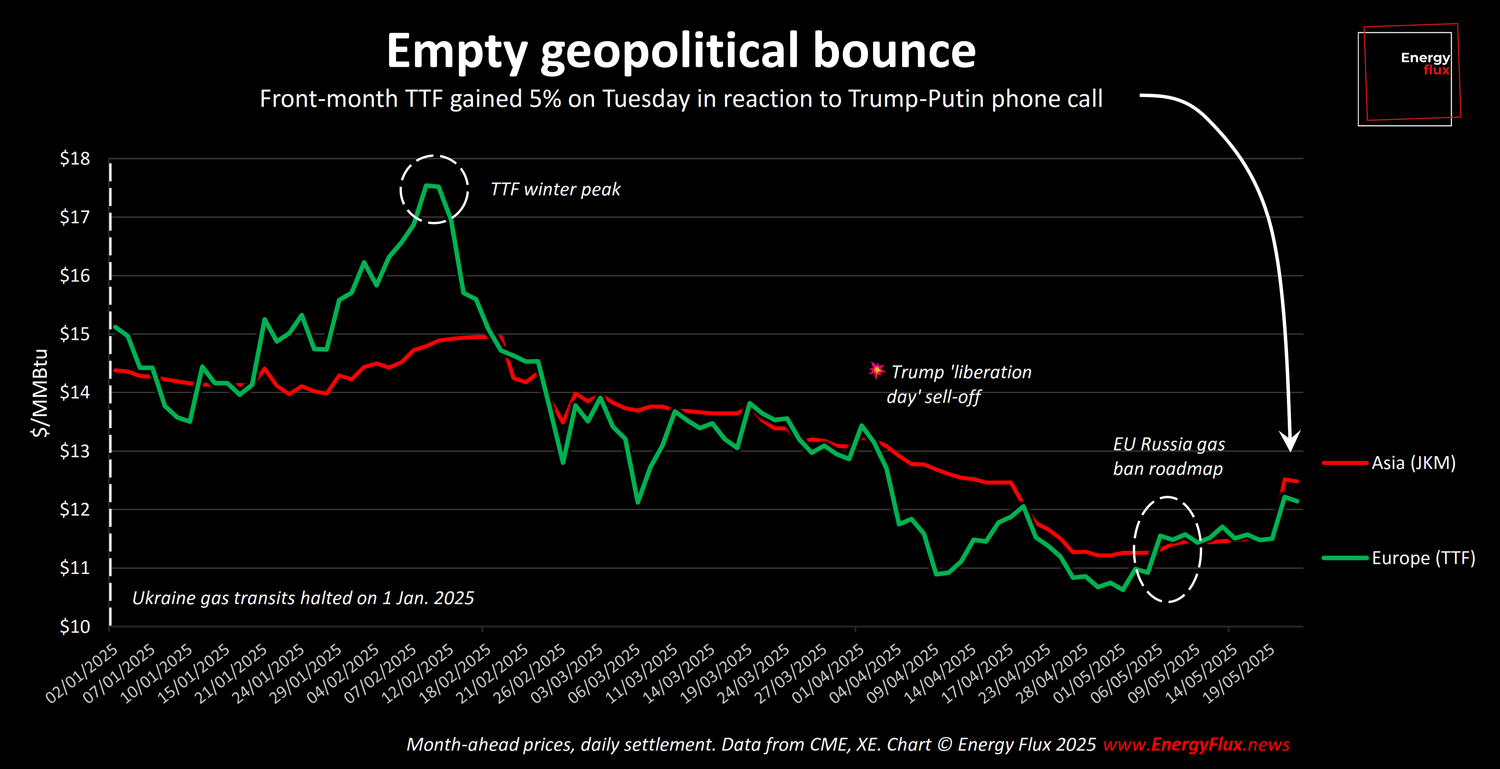

Donald Trump’s damp squib phone call with Vladimir Putin on Monday appears to have triggered the bullish algorithms.

Their trading logic is as follows: Trump’s credulous rapprochement with Putin has, predictably, yielded zero results towards a ceasefire in Ukraine (let alone a lasting peace accord). Therefore, the prospects are dimming for the lifting of sanctions against Moscow and the return of Russian pipeline gas to Europe.

Never mind the fact that a lasting peace settlement was always going to be months away, at best. Or the reality that cautious European energy companies, not the White House, would have to be willing counterparties to Gazprom.

Monday’s phone call – in which one septuagenarian kleptocrat played the other like a fiddle – apparently means that EU natural gas futures for delivery next month are suddenly worth 5% more than they were before one of them reluctantly hung up.

I’m being facetious, of course. The EU adopted its 17th round of sanctions against Russia on Monday, seeking to stymie Moscow’s energy export revenues. This came shortly after the EU Commission published its roadmap for a Russian gas ban.

On the supply side, there was an unplanned outage at the Kollsnes processing plant that could coincide with seasonal maintenance scheduled this week at some Norwegian fields and facilities. And those cavernous EU gas storages aren’t going to fill themselves.

For investment funds, events over the last fortnight sent a signal to hit that big red ‘buy’ button.

So far, so predictable. But perma-bullish hedge funds are not the primary actors in the EU gas market right now.

That role currently rests with the Commercial Undertakings – the physical players with large production, supply and storage portfolios. Think: gas producers, distributors, utilities, storage operators, and capacity holders.

These participants are the counterweight to the oversized speculative capital component that’s been driving TTF price action all over the place since the 2021-22 energy crisis.

This week’s bumper EU LNG Chart Deck dives into the shifting procurement and hedging strategies of Commercial Undertakings to shed light on the way the summer gas market is likely to unfold.

It also runs the rule over global LNG trade economics and how recent price action is reshaping inter-basin arbitrage from global LNG supply locations.

TL:DR; While the CTAs are striving to relive past speculative glories, the physical gas market is sending a crystal-clear signal: this is not a buying opportunity.

Let’s dive in.

Article stats: 1,800 words, 8-min reading time, 16 charts and graphs

Member discussion: Counterweight

Read what members are saying. Subscribe to join the conversation.