Bursting the narrative bubble

Gas markets enter new bullish phase amid Golden Pass LNG debacle & OMV’s mysterious court ruling | EU LNG Chart Deck 13-24 May 2024

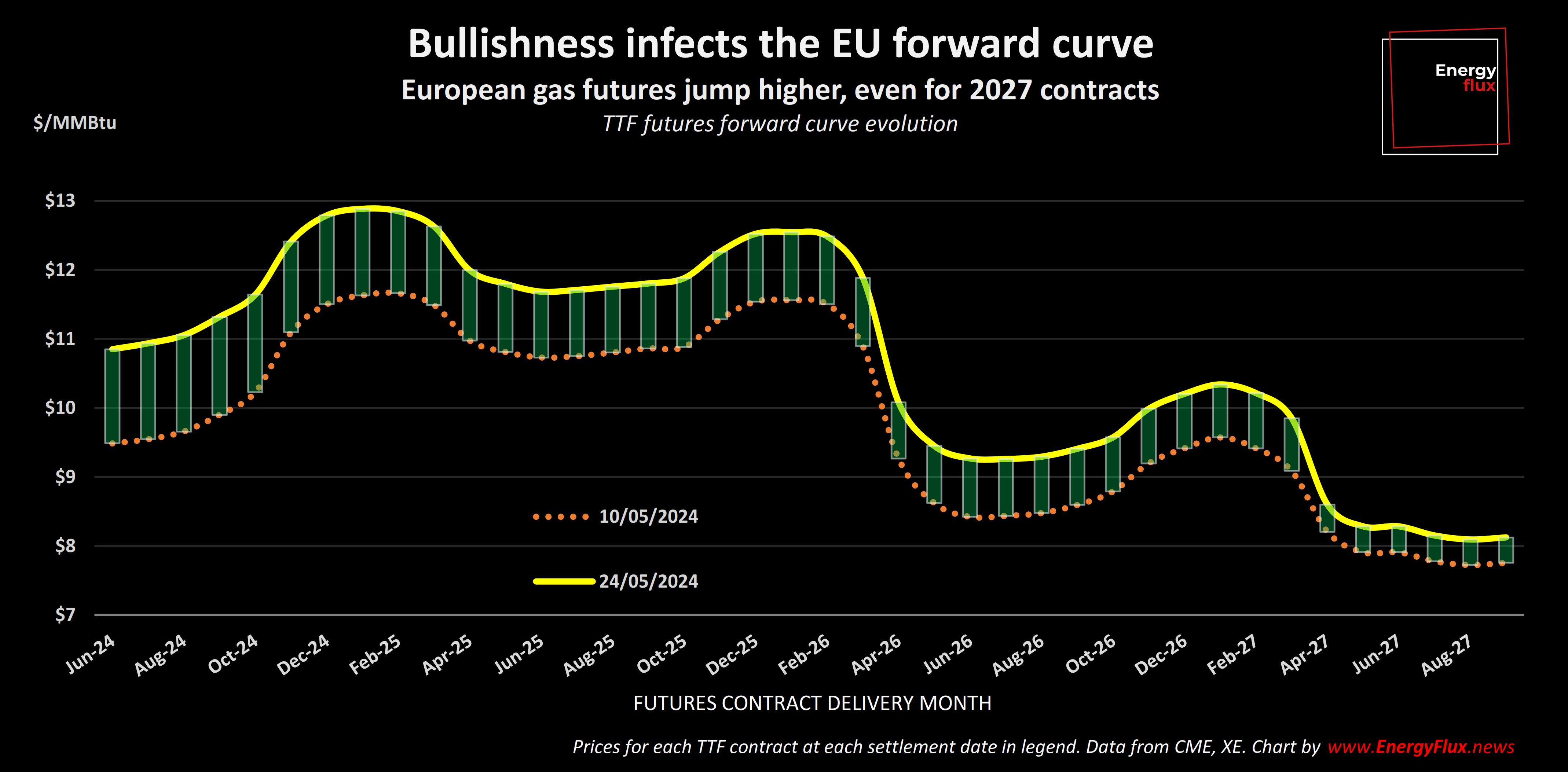

European gas hubs and Asian LNG spot prices are surging on the back of two unfolding stories which, superficially at least, support the bullish narrative that’s now driving market sentiment. One is the costs blowout at Golden Pass LNG, which bankrupted the project’s EPC contractor and signals potentially lengthy delays in bringing the newest Texas export project online. The other is a mysterious court ruling that supposedly threatens what little remains of Russian pipeline gas flows entering Europe.

Both stories are interesting for reasons I’ll dive into in this post. But it should be stated clearly from the outset that the price response to market events appears, to say the least, overblown. The material adjustments to global supply-demand balances arising from a single project’s commissioning delays or a slight acceleration to the end-date for Russian gas transits through Ukraine are not, in and of themselves, enough to justify the market response.

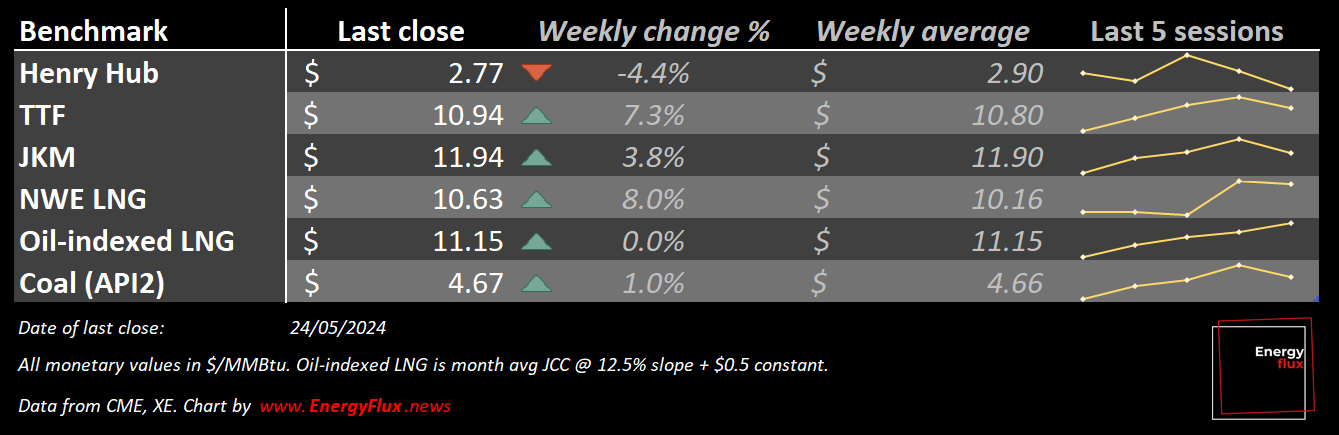

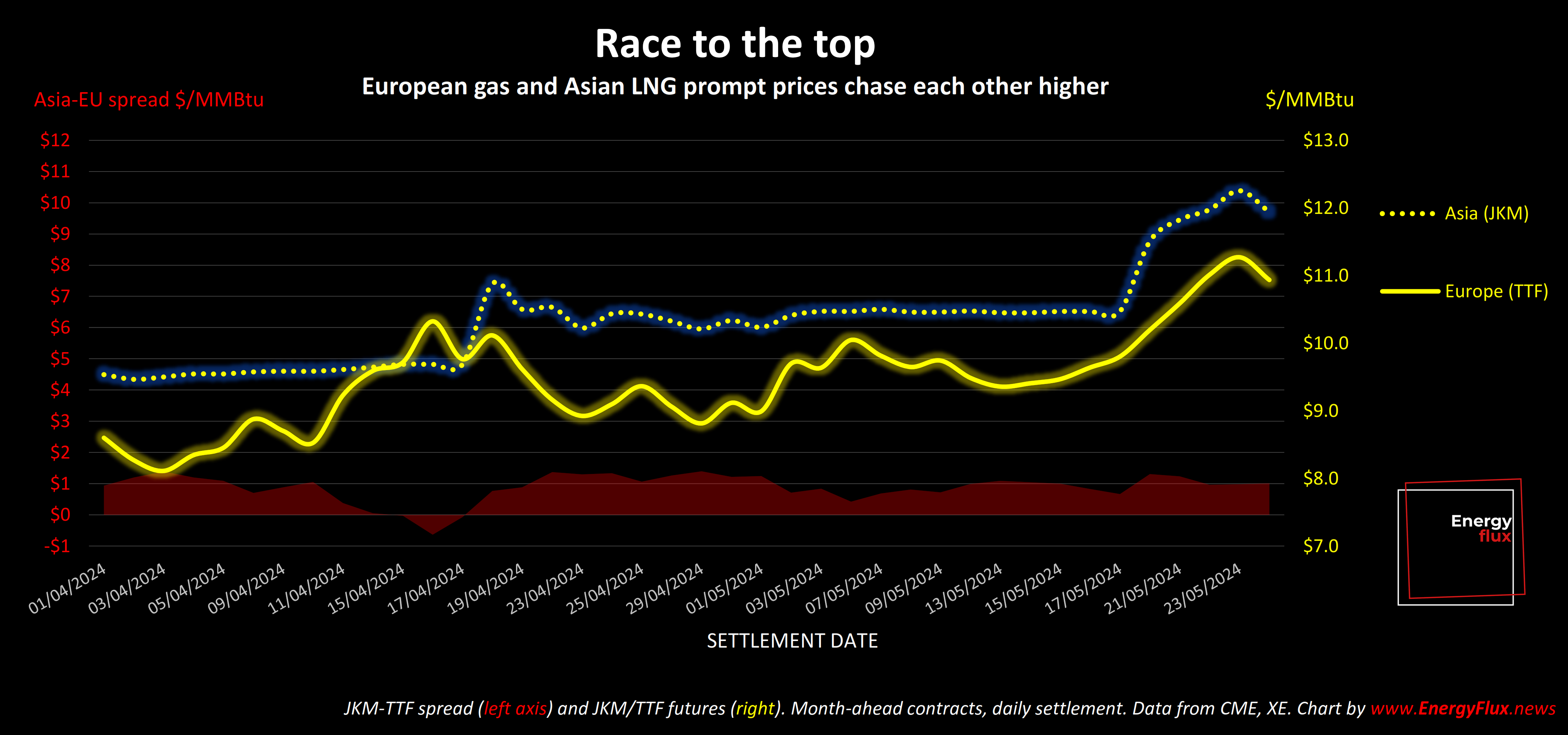

Prices on Dutch TTF, Europe’s main gas trading hub, are up 16% over the fortnight and JKM, the Asian spot LNG benchmark, has registered similar gains. Henry Hub has gained a whopping 43% since the start of the month.

To be clear, these are not the only two events driving gas price inflation at the moment. But they exemplify a wider problem: the predilection of market participants towards upside over-reaction. A lot of people made a lot of money during the market mayhem of 2022, and there’s a reluctance to acknowledge that today’s gas market is fundamentally different to the one roiled by Russia’s full invasion of Ukraine.

This can’t be explained away as ‘market jitters’ forever, and the longer it goes on the more people will start to question the credibility of natural gas price formation. I suspect there’s more to it than ‘nervous traders’, and I’ll be looking into this more in the coming weeks. (If you missed it then I would recommend reading my Nov’23 post, Greed over growth, which details how and why gas markets are failing consumers. That post is free to read.)

Today’s post explores the Golden Pass and OMV court ruling stories before diving into their impact on gas and electricity markets in Europe (with the usual selection of Energy Flux charts and graphs). There’s a lot of ground to cover, so be sure to open this post in your browser for a better reading experience.

Article stats: 2,450 words, 12-min reading time, 12 charts and graphs

Costs blowout déjà vu

Every few years, a major engineering or construction contractor gets chewed up and spat out by the American liquefied natural gas industry. Last week it was the turn of Zachry Group, which filed for Chapter 11 bankruptcy protection after being pushed into insolvency by spiralling costs at the Golden Pass LNG project in Texas.

The filing came days after Zachry filed a $1 billion-plus court claim against the 15.6 million tonne per annum (mtpa) LNG export conversion project, which is owned by ExxonMobil (30%) and QatarEnergy (70%).

Zachry claims Golden Pass was “plagued with unexpected challenges that put it behind schedule and over budget” from the get-go, and that the owners “refused to foot the bill” for accelerating work to get the project back on track.

Zachry was on the hook for cost overruns because it agreed to build the project under a $10 billion-plus lump sum engineering, procurement and construction (EPC) turnkey contract. As the name suggests, such contracts pay out a fixed price to undertake the work – placing the lion’s share of construction risk onto the EPC contractor.

The risks inherent in building a multi-billion-dollar infrastructure project are too great for any EPC contractor to stomach alone. So, as is standard practice in the LNG world, Zachry partnered with compatriot CB&I (McDermott) and Japan’s Chiyoda Corporation in a dedicated joint venture called CCZJV – which Golden Pass hired to do the job in 2019.

Zachry is the lead partner in CCZJV with responsibility for 52% of the scope of work, valuing its share at $4.8 billion. The Texas-based company says it absorbed ~$2 billion in cost impacts arising from project delays and cost increases, which it sought to claw back from Exxon and QatarEnergy. But the big boys “leverage[ed] their superior wealth and bargaining power” to string out the negotiations and ultimately refuse to pay, leaving Zachry broke.

Déjà vu all over again

The story is all too familiar for Zachry’s JV partners. Chiyoda and McDermott were both plunged into financial crisis while working on the Cameron and Freeport LNG projects in 2018. Chiyoda sought a bailout from major shareholder Mitsubishi and its CEO even took a 50% pay cut as part of emergency cost-savings measures. McDermott sought Chapter 11 protection and emerged from bankruptcy after restructuring in 2020.

The experience probably explains why they decided to take smaller shares in the CCZJV joint venture at Golden Pass: once bitten, twice shy. It seems that Zachry did not heed the warnings, despite working on Freeport and Cameron alongside Chiyoda and McDermott.

Golden Pass LNG says construction is 75% complete and the owners are “committed to completing the project”, but it is not clear how they can when Zachry is seeking “structured exit” from the contract. Replacing the EPC contractor at this late stage is a complex task that will only result in more costs and delays, since Exxon and QatarEnergy will need to negotiate new prices and deadlines for every outstanding work package.

Why does this matter?

The fact that the American LNG industry has yet again bankrupted a major established EPC company with a 100-year track record is a big red warning sign to the current US LNG buildout. Zachry is the lead EPC contractor at the Plaquemines LNG export project in Louisiana. Venture Global says it doesn’t foresee any issues building the 10 mtpa first phase on time, but how can they be so sure?

Exxon and QatarEnergy were racing to get Golden Pass online this year, presumably to lock in higher profits before a flood of new LNG supply tanks prices in 2026/27. But post-Covid supply chain and logistics problems, combined with post-Ukraine cost increases and trade disruptions, caused costs to “explode”. Furthermore, Golden Pass “erroneously described soil conditions at the plant site, forcing a redesign of numerous plant structures”, Zachry says.

The Freeport and Cameron cost overruns were triggered in part by an acute labour shortage on the US Gulf Coast following the destruction wreaked by Hurricane Harvey in 2017 and subsequent rebuilding effort. History might be about to repeat itself here too.

US government forecasters are predicting an “extraordinary” 2024 Atlantic hurricane season that could see as many as seven named hurricanes potentially making landfall, fuelled by “record” ocean temperatures and La Niña atmospheric conditions. Now, forecasts are always speculative and their track record is by no means perfect. But if Mother Nature drops a bomb on the epicentre of America’s LNG buildout just as an unprecedented wave of construction is getting underway, there’s every chance that Zachry won’t be the last EPC contractor filing for Chapter 11.

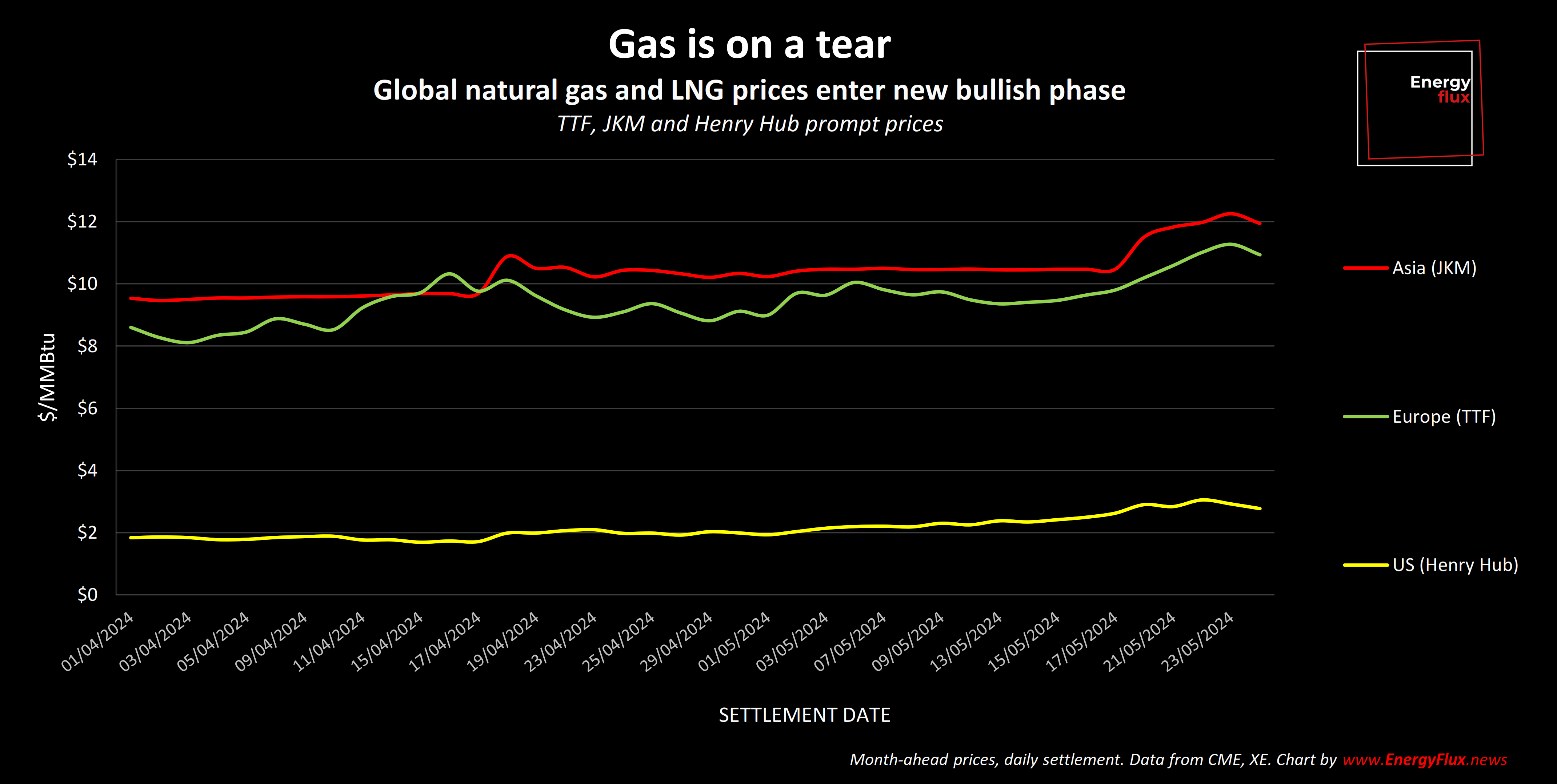

The price is wrong

Delays to commissioning Golden Pass ought to dampen domestic US gas prices. Markets had already priced in the up-to 2 billion cubic feet per day (Bcf/d) of additional feed gas demand from the project, so deferring that demand should alleviate market tightness in the near-term and strengthen prices further out on the curve.

But instead, the opposite happened.

Now, there are other factors influencing US gas prices, not least potentially explosive new power sector demand driven by data centres, cloud computing and AI. But that doesn’t entirely explain the counter-intuitive price moves in the US, or indeed those happening in other major gas markets too.

Traders pounce on court mystery

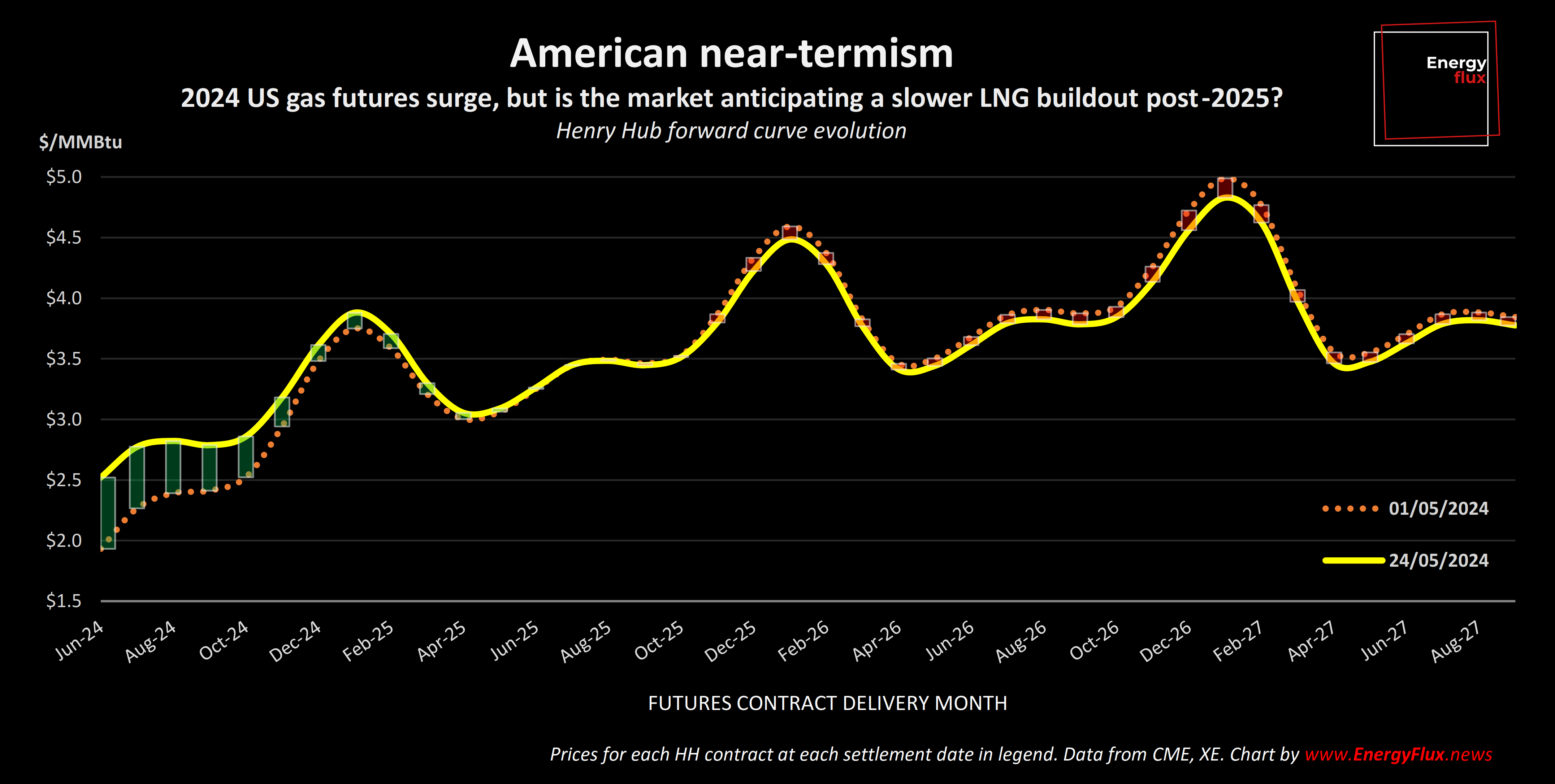

European gas prices went berserk last week after Austria’s main gas company OMV warned of a potential cut-off in Russian gas supply from Gazprom, in the wake of an undisclosed “foreign court decision”.

The mysterious ruling, obtained by an unnamed “major European energy company”, would require OMV (rather than Gazprom) to reimburse said company for gas supply disruptions that arose following Russia’s 2022 invasion of Ukraine. If the ruling is enforced, OMV “considers it likely” that Gazprom would halt gas supplies to Austria, based on the Russian company’s conduct in similar situations.

Nobody knows when or if the ruling will be enforced, or any further detail about its legal basis. OMV has alternative non-Russian supplies and doesn’t expect any impact on its ability to supply customers. But the announcement was enough to send TTF futures spiralling – and not just for prompt delivery.

The whole forward curve was electrified by the news. But what are we really talking about here? The possibility that Gazprom might halt gas supplies into Austria at most a few months earlier than expected. The Russia-Ukraine gas transit deal is due to expire at the end of the year, signalling an end to pipeline flows through that route in Austria and other westward markets.

Expensive gas = expensive electricity

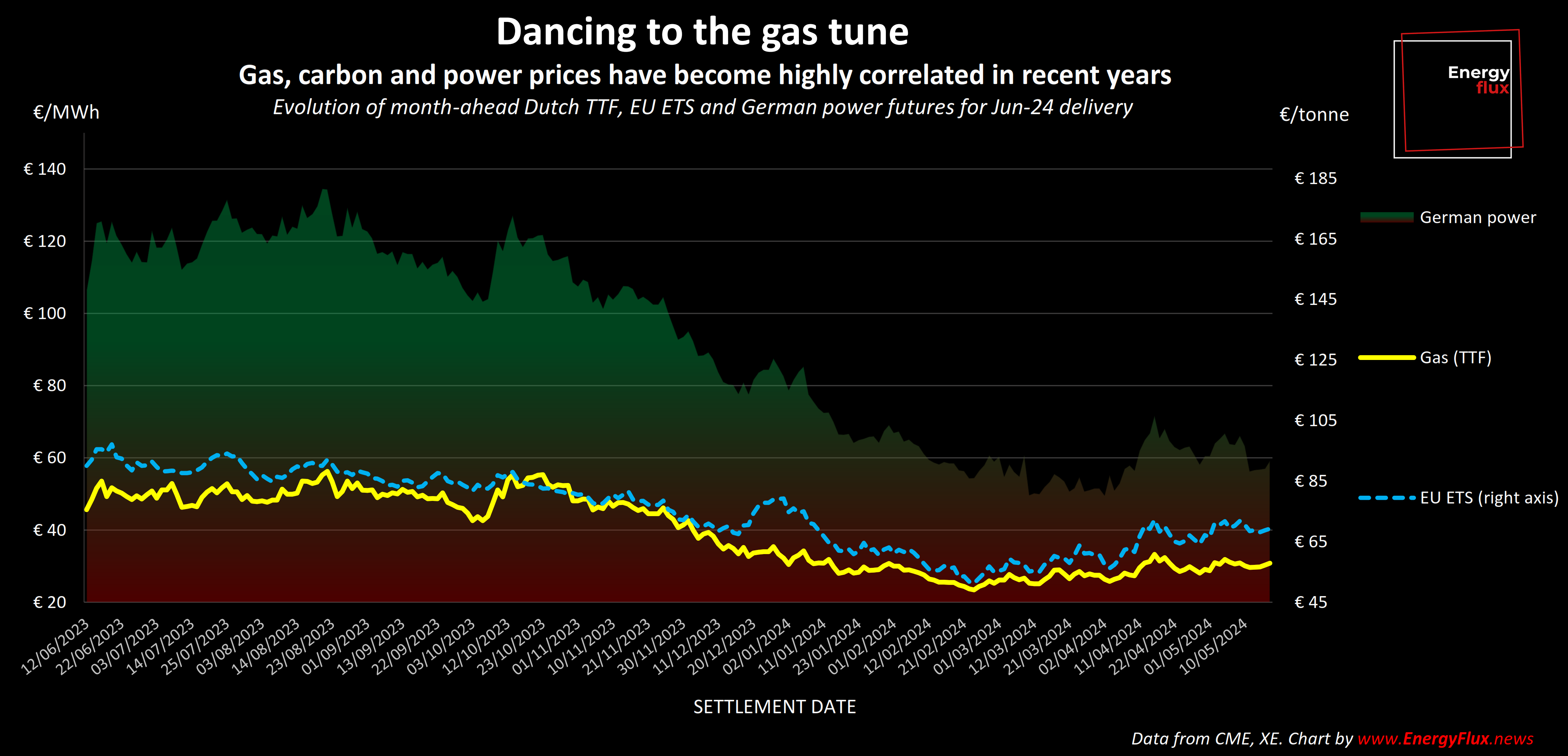

Again, facts are an afterthought in the realm of gas price formation. That’s too bad for gas and electricity consumers (i.e. everyone), who will face higher bills as a result. German power futures have risen by a quarter in less than two weeks on the back of TTF gains, because gas is increasingly the marginal price-setter (as coal is pushed out of the merit order).

This speaks to the importance of flexibility in power markets, and the reliance on gas to provide this flexibility. Until batteries or demand response play a greater role in flexibility, power prices simply must rise to accommodate higher gas prices.

Gas is also driving carbon prices higher. As long as there is price-sensitive coal available at the margins, a higher gas price incentivises more coal generation to come back into merit. This results in more power sector emissions, which creates greater demand for emissions allowances. This, in turn, pushes up the carbon price.

The correlation between TTF and carbon allowances (EUAs) on the emissions trading system (ETS) has become pronounced in recent months. So much so, in fact, that traders can now hedge their positions by going long on TTF and shorting EUAs, according to market sources.

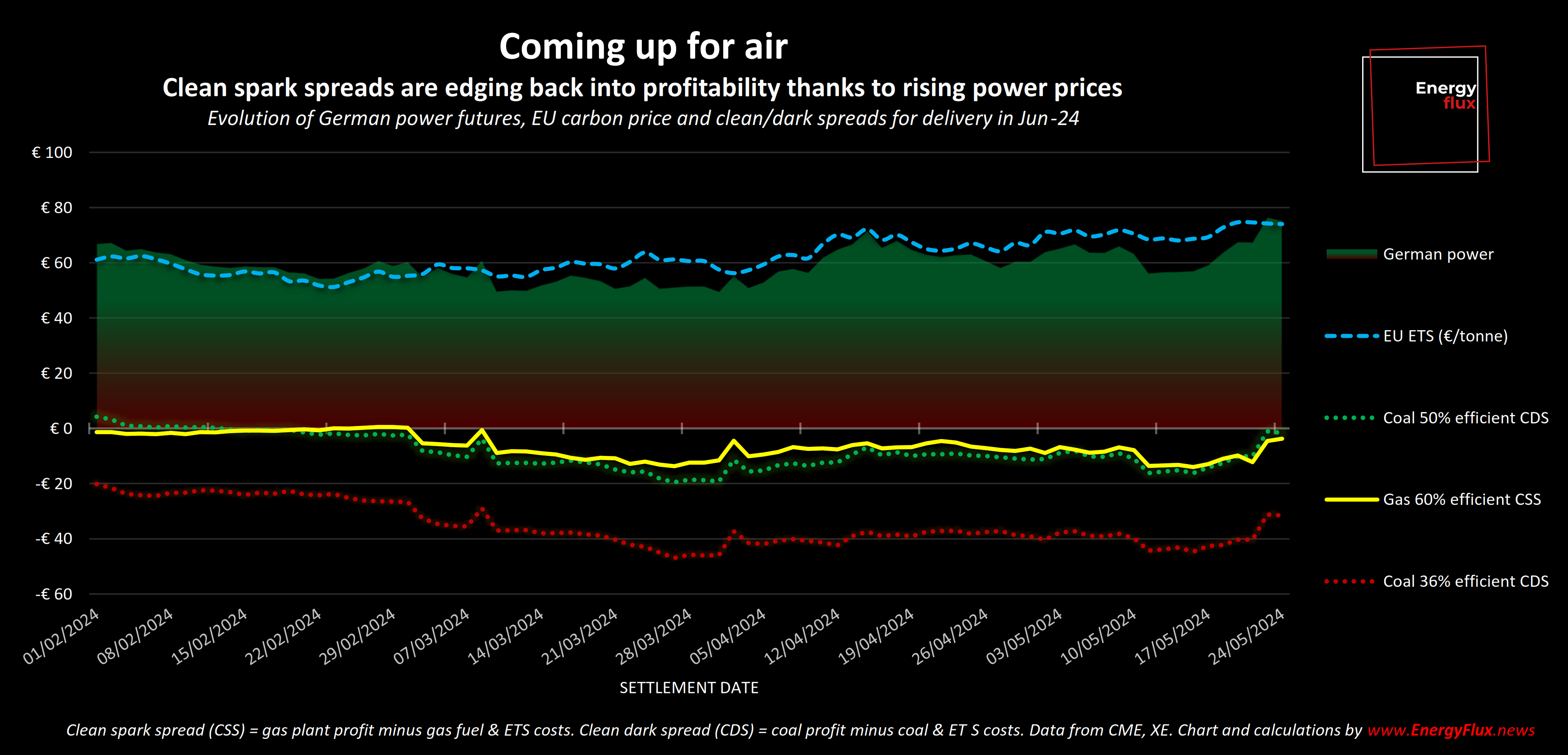

This dynamic explains why gas-fired power is becoming more profitable even as gas fuel costs are rising. Clean spark spreads – the profitability of gas-fired power after paying for carbon – are nosing back into positive territory for June/July 2024, even though all the speculative bullishness is making gas and carbon more expensive.

Europe exports fear

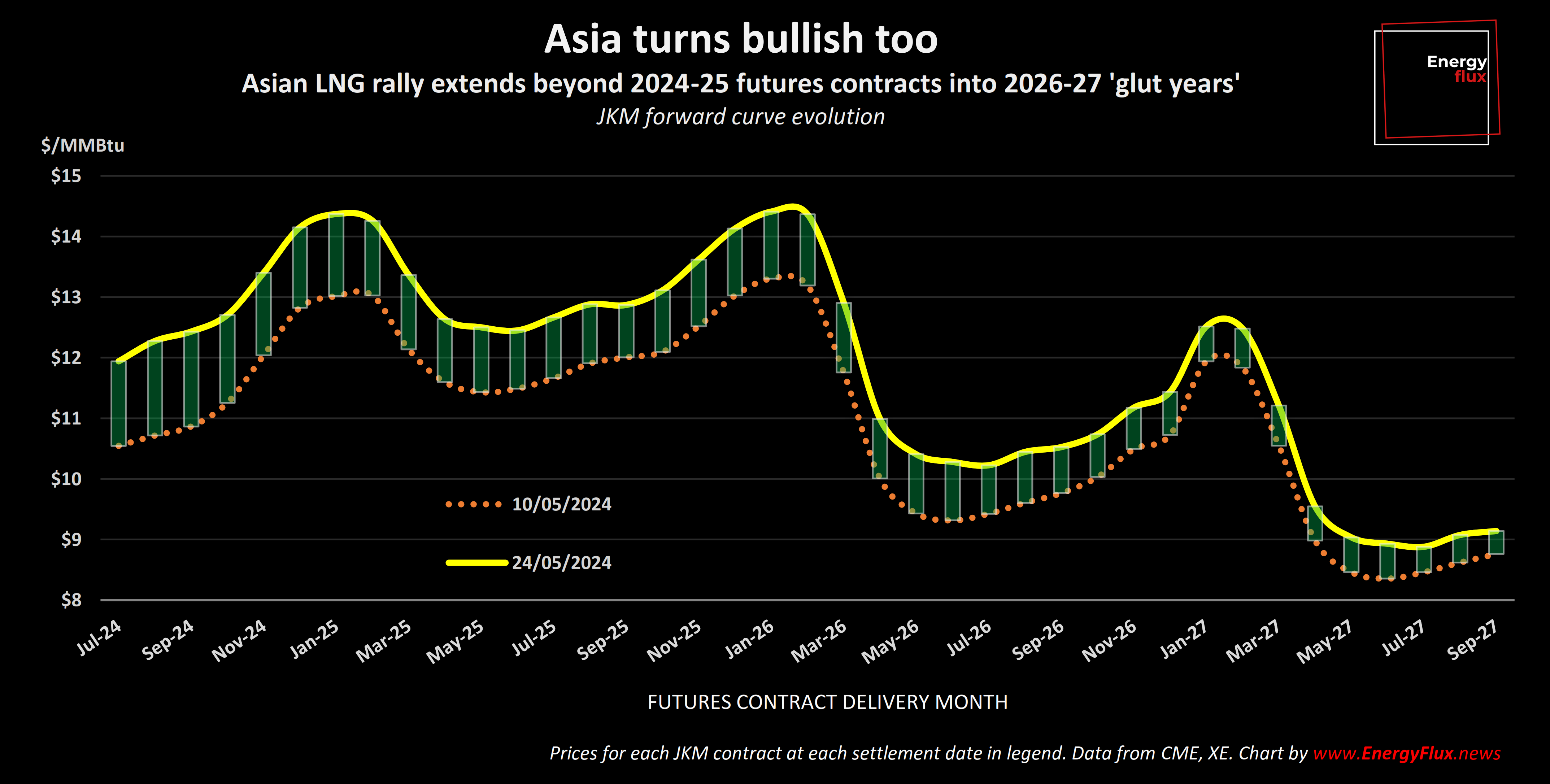

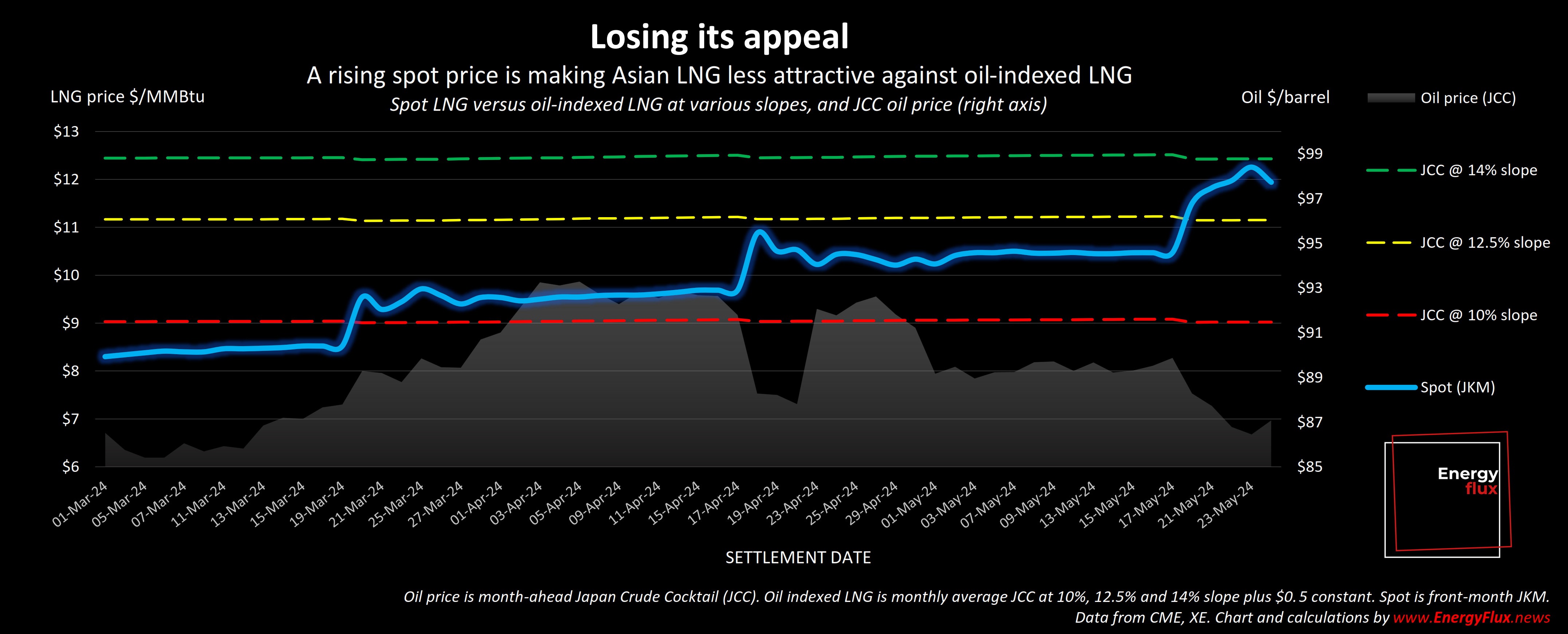

TTF’s gyrations travel east in a flash. JKM, the Asian LNG spot price, has soared to a five-month high on the back of Europe’s latest gas bubble.

Again, there’s not a whole lot to base this on other than ‘Europe is bidding up the price’.

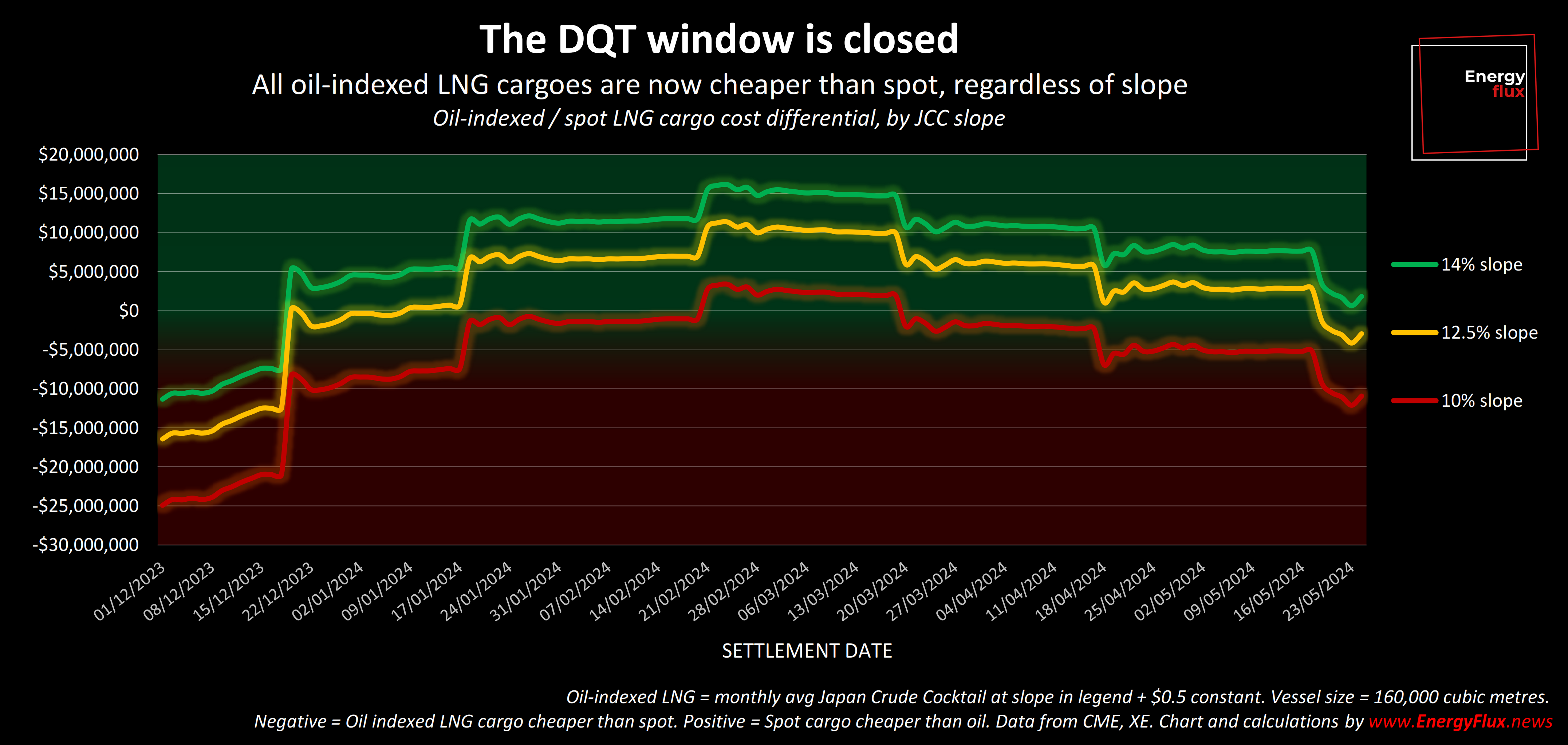

The knee-jerk response means that spot LNG is once again definitively more expensive than LNG sold under long-term oil-indexed contracts. The window of opportunity for Asian buyers to dial down their oil-linked volumes to buy cheaper spot turned out to be very short indeed.

This turn of events can only push Asian buyers away from spot procurement back towards more oil-indexed LNG. There had been some market chat about buyers renegotiating term contracts that were agreed in 2022-23 but had not yet been finalised into sales and purchase agreements (SPAs).

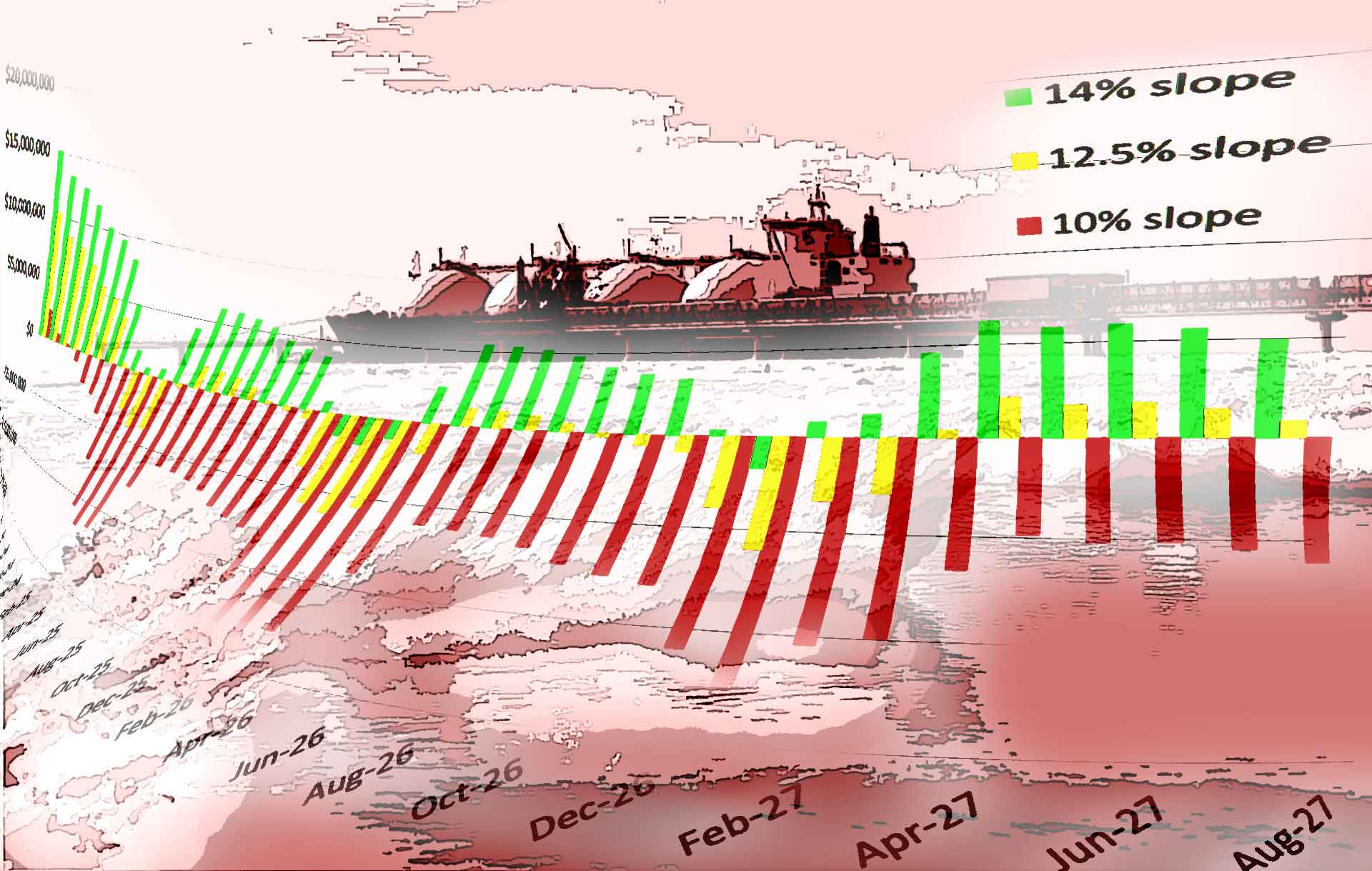

That seems less likely now, particularly since Shell signed a notable deal with Indian steelmaker AMNS at an 11.5% slope to crude — the lowest Brent slope since the outbreak of hostilities in Ukraine in 2022.

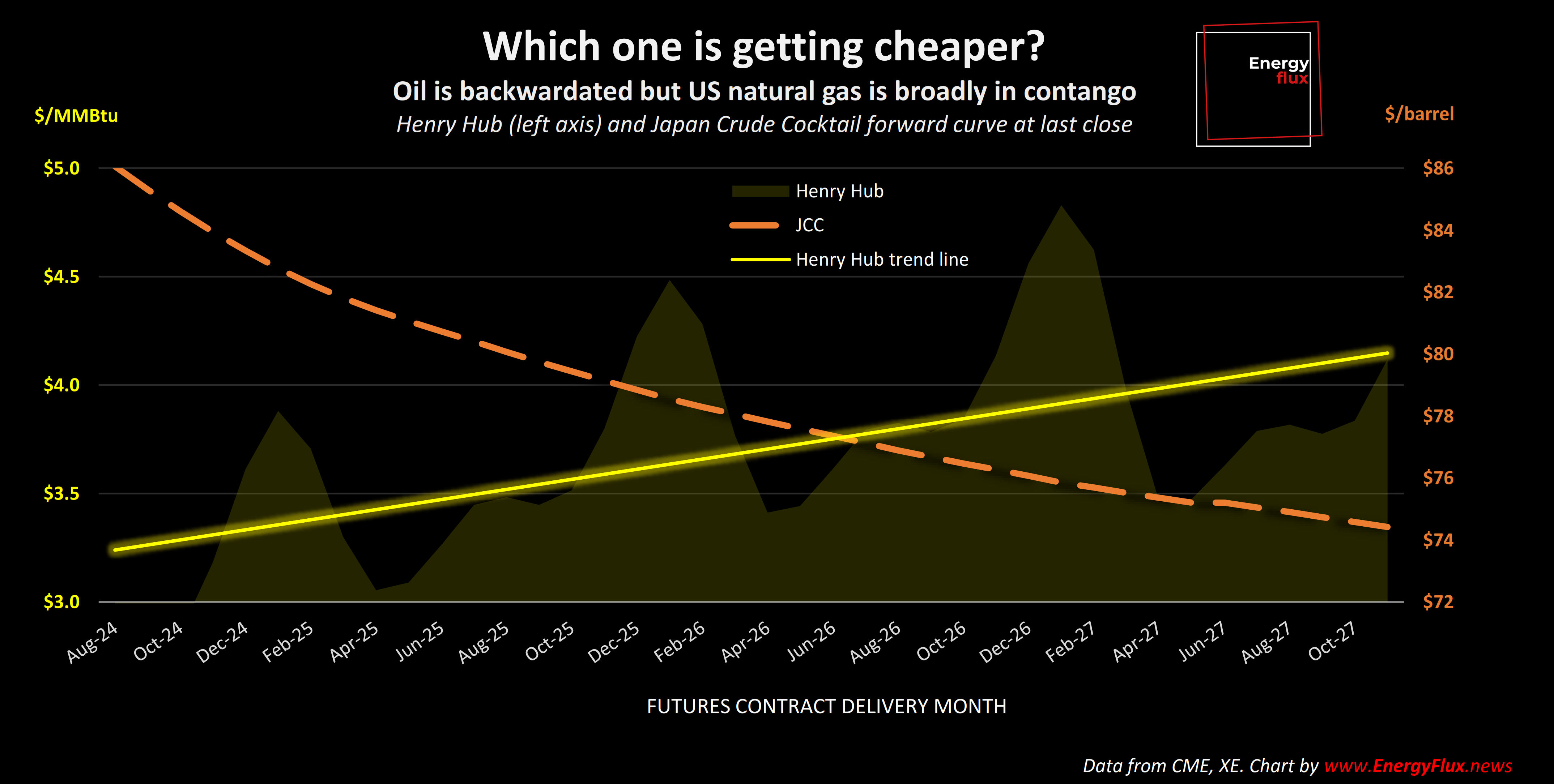

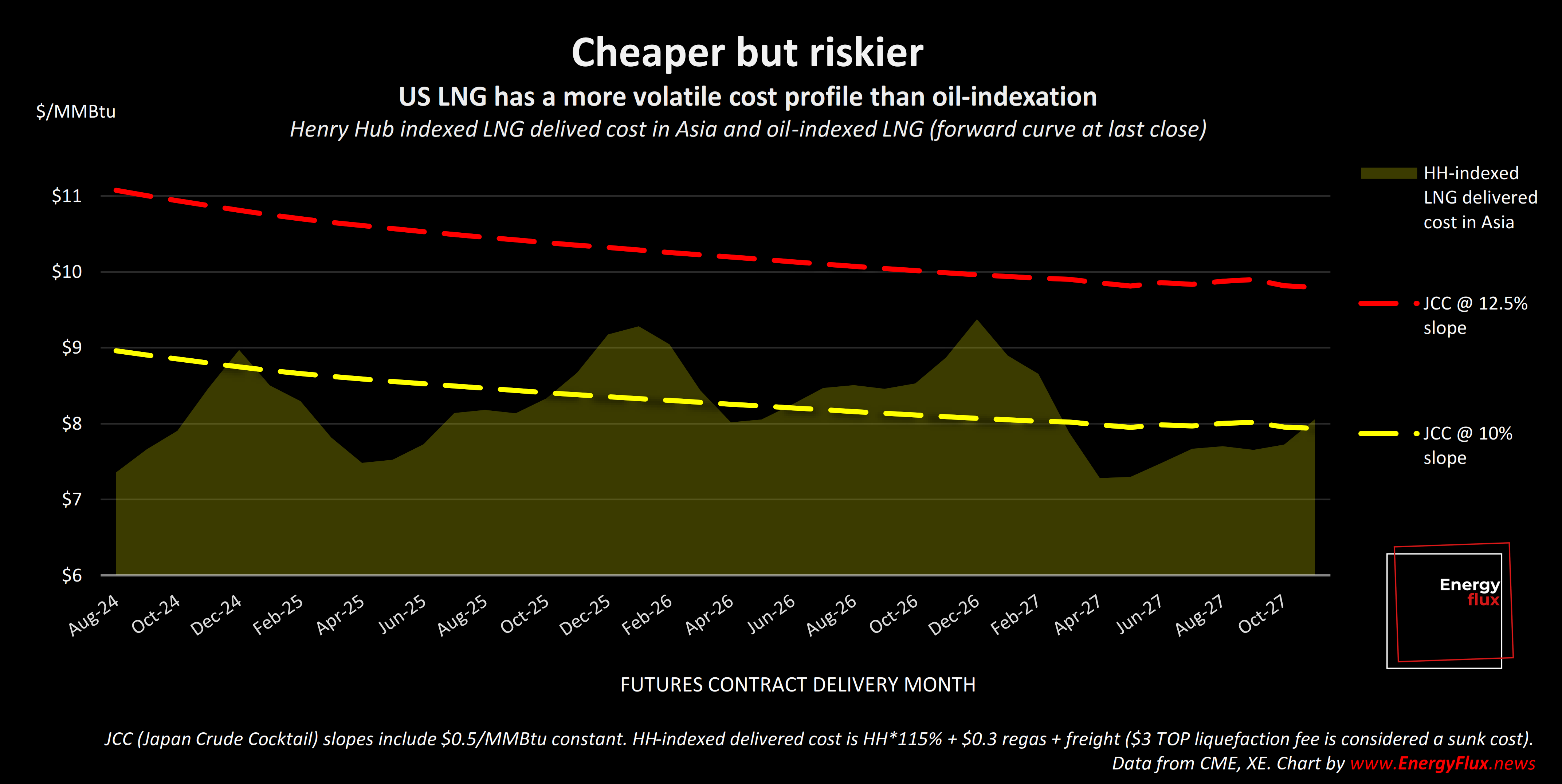

So, too, does the possibility of Asian buyers diversifying their price exposure by buying LNG under long-term delivered prices indexed to Henry Hub. A recent report indicated there is appetite in China and elsewhere to explore contracts with a Henry Hub slope of between 119% and 121% plus a $4.50/MMBtu constant to cover liquefaction and freight costs.

With everything that’s going on in the American energy space, a long-term commitment to buy LNG indexed to HH is strewn with risk for no apparent gain. It is the worst of both worlds: all the volatility of spot procurement, with all the inflexibility of a long-term contract.

Yes, HH-linked LNG is cheaper than even a 10% Brent slope today, but that won’t last long. Regardless of how quickly the US LNG buildout occurs, Henry Hub is on a bumpy ride north. Hitching your economic fortunes to that wagon is only going to end in tears.

To conclude: there are powerful forces working away behind the scenes to inflate gas and LNG prices. Over-reactions ripple across global markets, and outcomes are hard to anticipate. The bullish narrative could lock in structural risks by creating a febrile backdrop to long-term dealmaking.

I’ll be digging deeper into what’s driving gas volatility in the coming weeks. Stay tuned for more.

Seb Kennedy | Energy Flux | 27 May 2024

🧠 Energised Minds

— Critical thinking on crucial energy issues —

“How the hydrogen hype fizzled out” — the FT’s Lex column becomes the latest mainstream outlet to dissect the dawning reality among investors that many of the vaunted use cases for hydrogen are evaporating before their eyes.

“Face it, Putin: China is just not that into your gas pipeline” — the Russian president has once again left Beijing empty-handed, after being give the run-around by his counterpart Xi Jinping over the Power of Siberia 2 pipeline to China, writes David Fickling in Bloomberg.

“Could US data centres and AI shake up the global LNG market?” — if Henry Hub surges, oil-indexed contracts will become more attractive to buyers, according to Wood Mackenzie analysts (who have clearly been reading Energy Flux!)

More from Energy Flux:

Member discussion: Bursting the narrative bubble

Read what members are saying. Subscribe to join the conversation.