The storage-speculation nexus

DEEP DIVE: Europe is holding vast amounts of natural gas in storage for longer periods. Is this fuelling energy price volatility?

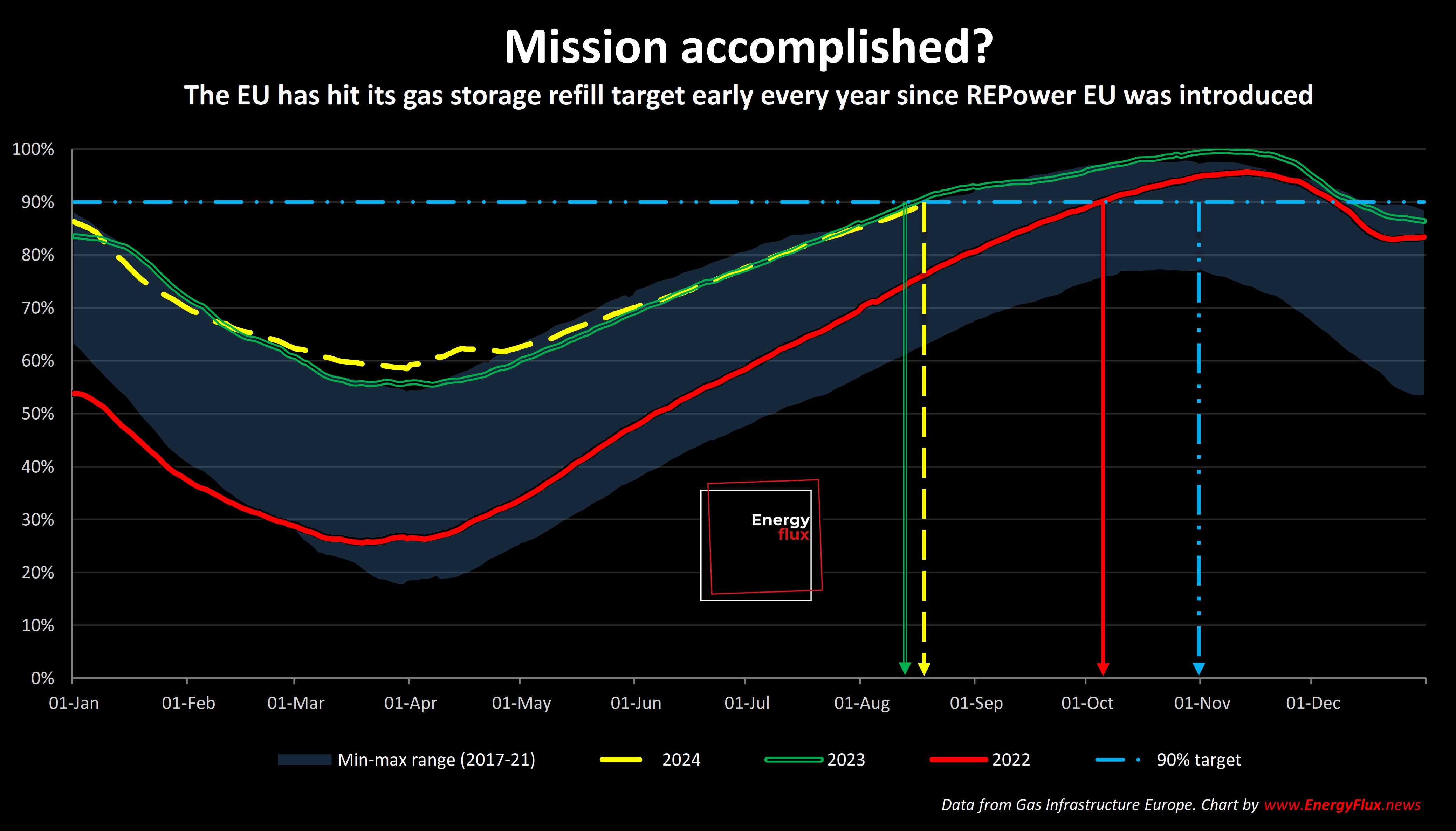

The European Union has once again achieved its gas restocking target early. At an aggregate level, EU underground gas storage facilities reached 90% full this week, more than two months ahead of the 1 November deadline.

The 90% refilling target is a central part of the REPowerEU plan introduced following the energy shock of 2022. EU Commissioners credit this intervention as playing a central role in easing prices and protecting consumers in the aftermath of Russia’s full invasion of Ukraine.

“The high level of gas storage in Europe means that markets are increasingly stable, prices are back around pre-war levels, and Europe can start refilling with confidence for next winter’s heating season,” energy commissioner Kadri Simson said in April.

It might seem logical that forcing storage operators to hold record amounts of gas in underground storage would quell prices. But what if, counterintuitively, the opposite was true?

New research suggests that the flagship mechanism of REPowerEU is in fact contributing to inflation of wholesale EU gas prices.

The emergency policy intervention is flattening seasonal price spreads and creating perverse incentives for storage system operators, according to some experts and analysts.

They say the 90% refilling obligation also encourages the kind of predatory speculation that has become evident on EU gas trading hubs, as documented by Energy Flux in recent weeks.

Could it be that the REPowerEU plan is producing unintended consequences now that market conditions are more benign?

This deep dive offers a critical examination, with reference to new statistical analysis of refilling and pricing data, as well as perspectives from expert commentators.

It concludes by outlining an alternative policy of centralised management. Proponents claim this would be more cost-effective and less conducive to speculative manipulation of European gas markets — but the risk of unintended consequences is high.

This is the first in a three-part series investigating the relationship between gas storage regulations and the behaviour of speculative capital.

- Part one (this post) identifies the possible link between storage targets and speculation (August 2024)

- Part two uses regression analysis to prove the storage-speculation hypothesis (December 2024)

- Part three uses the same technique to dissect the Q1 TTF selloff and assess seasonal price risk for 2025-26 (May 2025)

Article stats: 3,000 words, 14-min reading time, 8 charts and graphs.

✍️ FREE TO READ: This article is available for free – just sign up using your email address (choose the 'Free' subscription tier), then refresh this page to keep reading...

Member discussion: The storage-speculation nexus

Read what members are saying. Subscribe to join the conversation.