Short squeeze!

Hedge funds punish complacency in EU gas market. This is a sign of the times.

Are you receiving Flux Briefing, the daily blast of gas, LNG and geopolitical news? If not, you are missing out!

Head on over to Flux Exchange to sign up (click the alarm 🔔 icon in the Flux Briefing category and choose ‘watching first post’)

Breaking news: it gets cold in winter. Last week, the European gas market whipped violently higher for a confluence of reasons that are greater than the sum of their parts. Temperatures dropped, heating demand picked up, and EU gas stocks fell a little faster than usual.

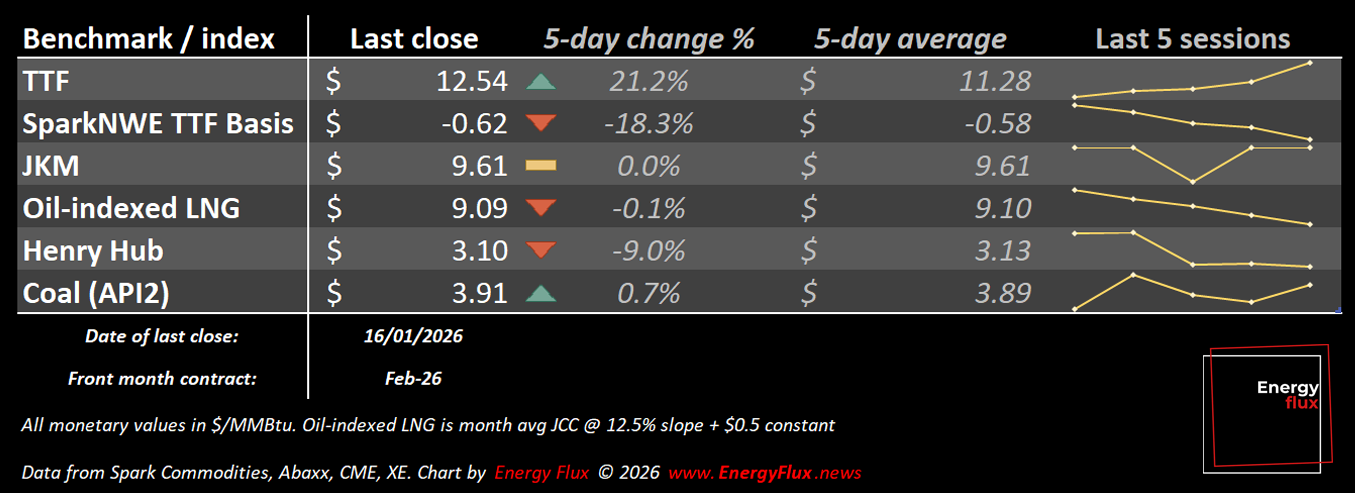

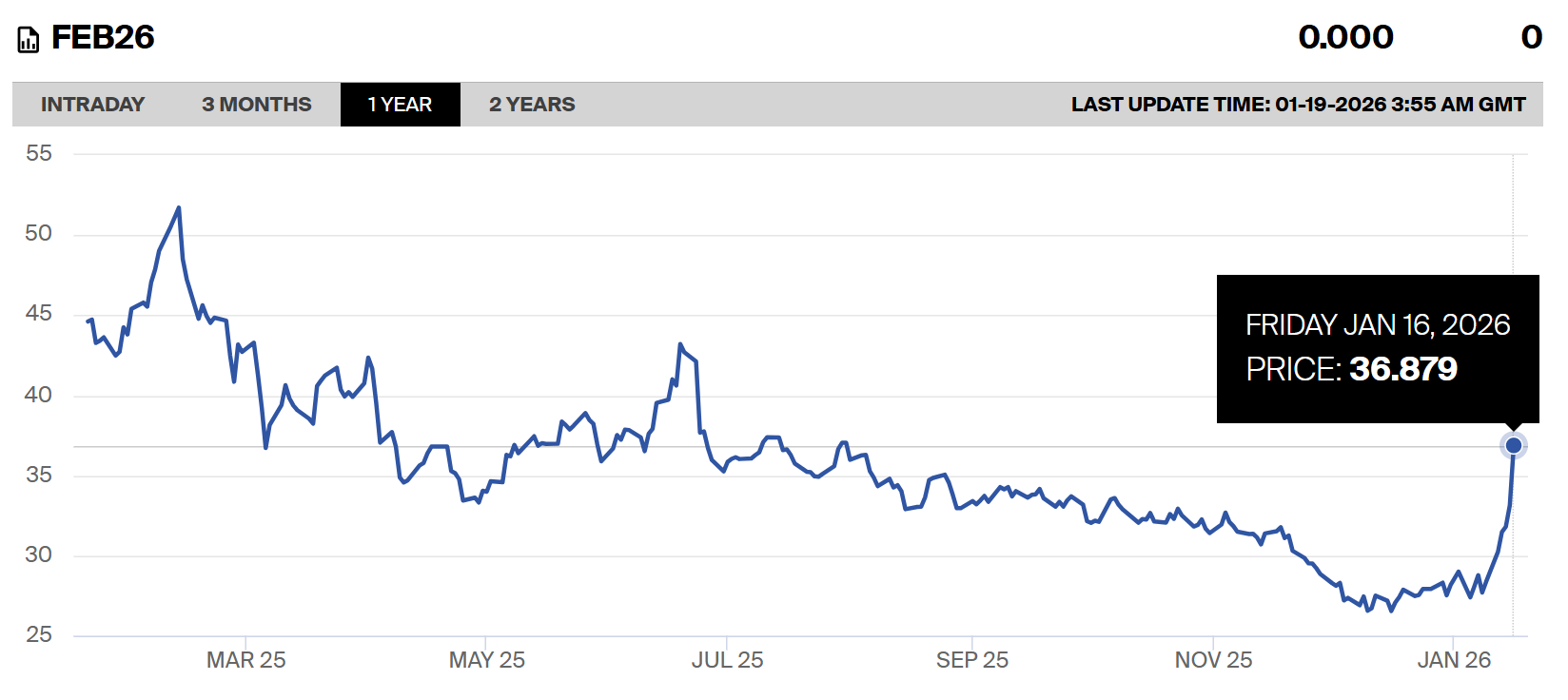

Add on the usual helping of geopolitical angst, and that was enough to lift prices by more than 20% in just five trading sessions. Front-month TTF, Europe’s gas benchmark, settled on Friday close to €37/MWh (around $13/MMBtu) – levels last seen in July 2025.

What began as a rational upward adjustment quickly morphed into forced short-covering, producing a sharp gap higher. The casualties were primarily algo-driven traders that had carried structural short exposure into the heart of winter.

The sudden jolt of life in what had become an eerily moribund winter market provoked the usual binary reactions: either “panic, the European energy crisis is back” or “relax, this is a meaningless weather blip.”

Neither interpretation is particularly helpful.

Yes, the move felt abrupt after weeks of sideways trading. But it was not entirely unforeseeable either. A small number of reputable outlets (ahem) had been flagging precisely this vulnerability: a crowded short, and a complacent market leaning a bit too hard on a bearish narrative.

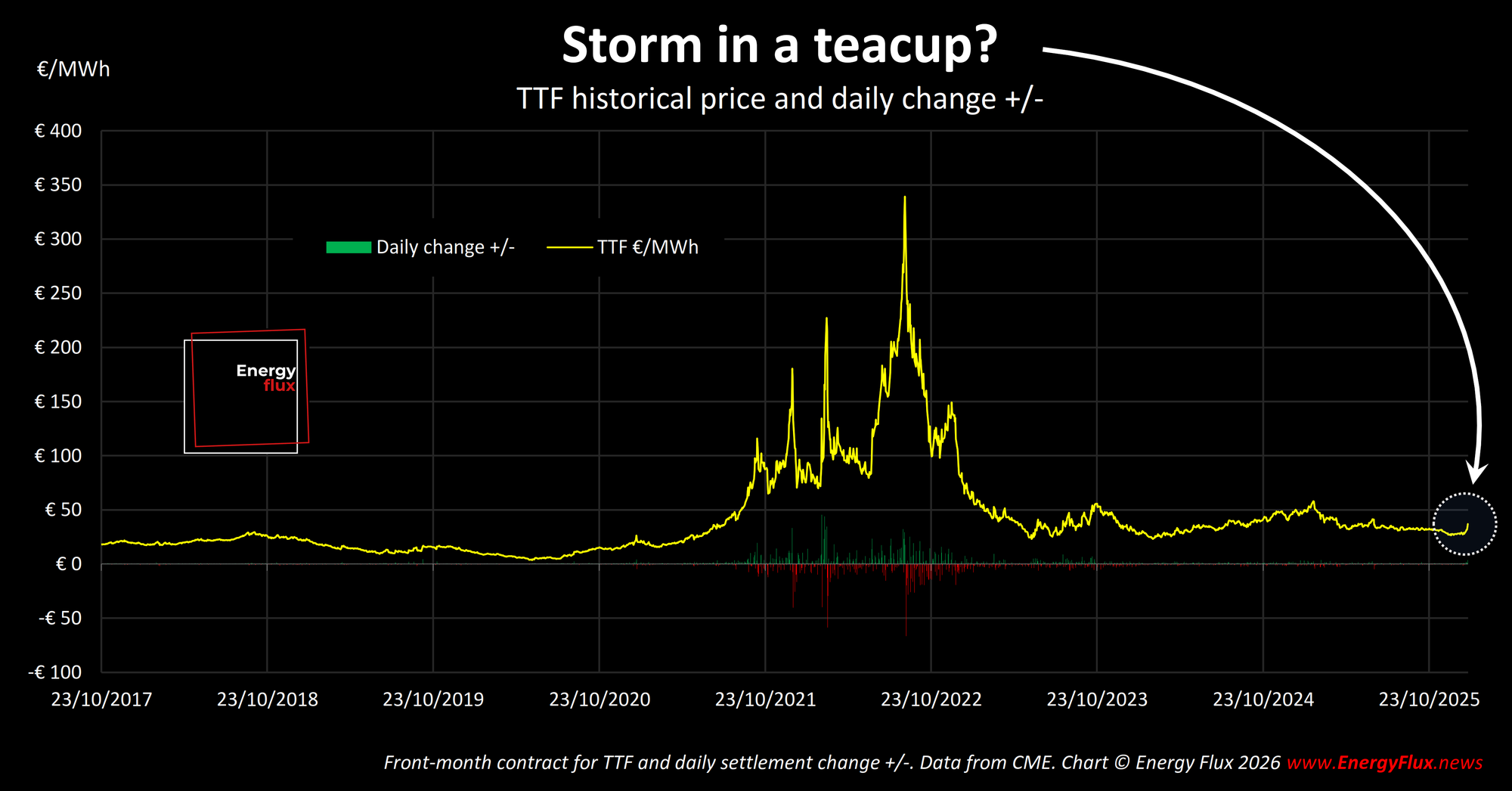

And no, a rally back to €37/MWh is not a statistical outlier. Several commentators were quick to share long-run charts showing that, in historical terms, this barely registers.

But if your yardstick is the stratospheric absurdity of 2022, then almost nothing will ever look interesting again. If you lived through the energy crisis and your only conclusion from a +20% move is “wake me when it hits €300,” you might as well stop watching gas markets altogether.

So how should we think about it?

Last week’s price shock was not an anomaly. It was a sign of the times.

Outlier price risk is quietly expanding as structurally permabullish investment funds attempt to extract value from a market whose fundamentals are increasingly bearish. The big picture has not changed (abundant LNG, plenty of spare European import capacity); but neither have the latent risks created by positioning, leverage, and narrative inertia.

This is a short analytical note for Premium and Chart Deck subscribers. It contains five charts that explain why the recent price action largely confirms what we already knew about the EU gas market, and why that critical nuance still matters more than histrionics or dismissive counter-reactions.

👑 Elevate your market insight with Energy Flux. Upgrade for instant access to this and hundreds other unique articles like it — timely, unflinching analysis that stays ahead of the curve.

Member discussion: Short squeeze!

Read what members are saying. Subscribe to join the conversation.