Wrong at both ends

CHART DECK: The TTF curve is failing to price in both near-term bullish risks and more distant bearish realities

The modus operandi of the European natural gas market is to price in unmaterialised bullish risks while discounting fundamentally bearish realities.

This trend remains intact, although the extent of the upwards price skew is notably more muted than at this time last year — meaning bullish risk is under-priced on the prompt, while bearish risk is under-priced further out on the curve.

Were you forwarded this email? Don’t miss out, sign up for free here:

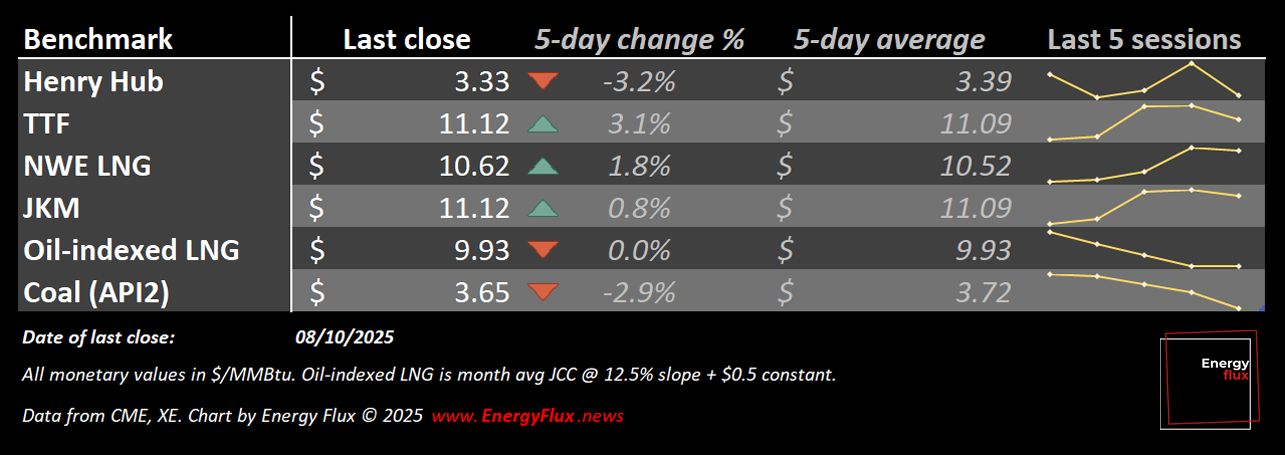

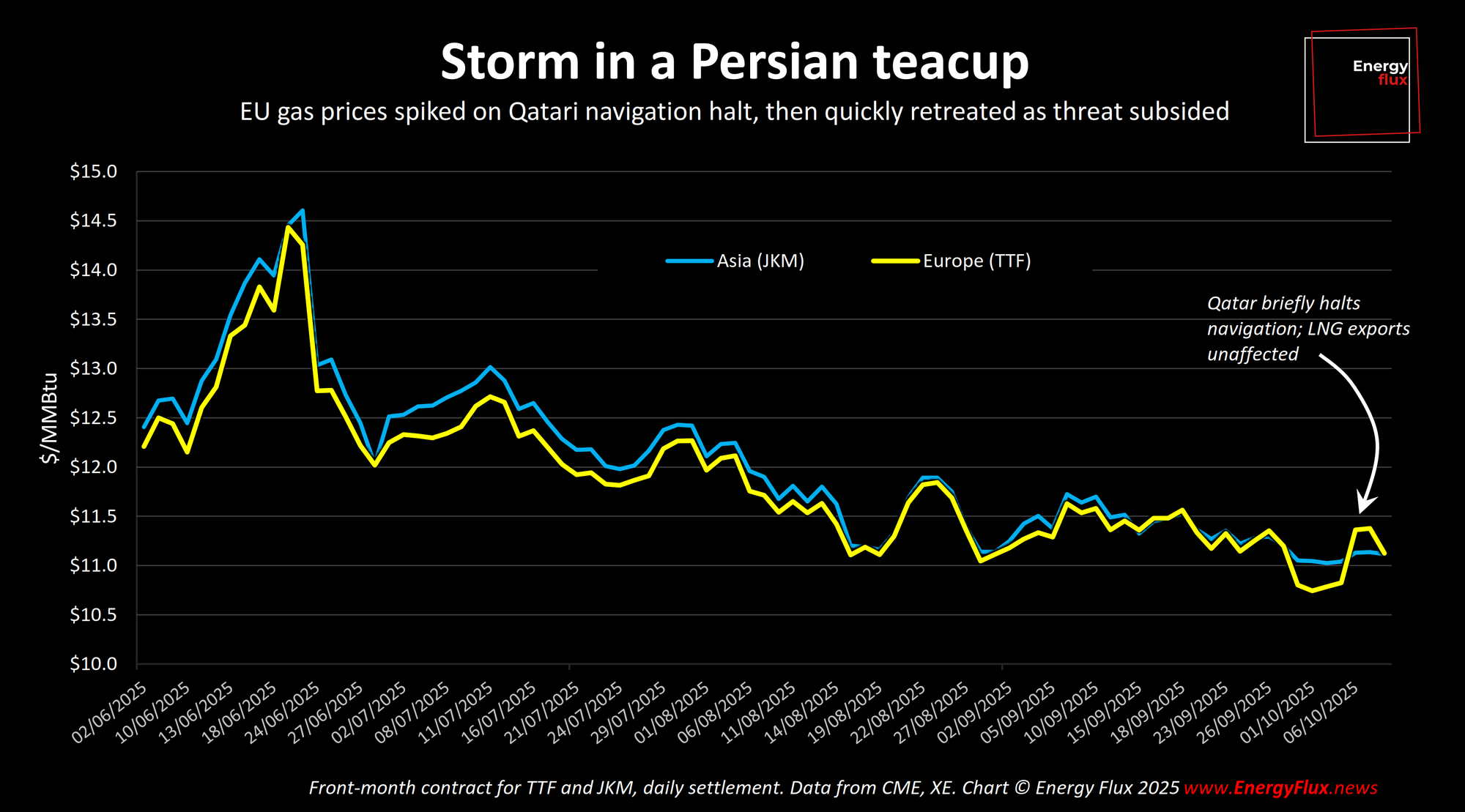

Prices on benchmark TTF were jolted out of their autumn somnolence on Saturday, when Qatar halted navigation in its territorial waters due to unexplained GPS problems.

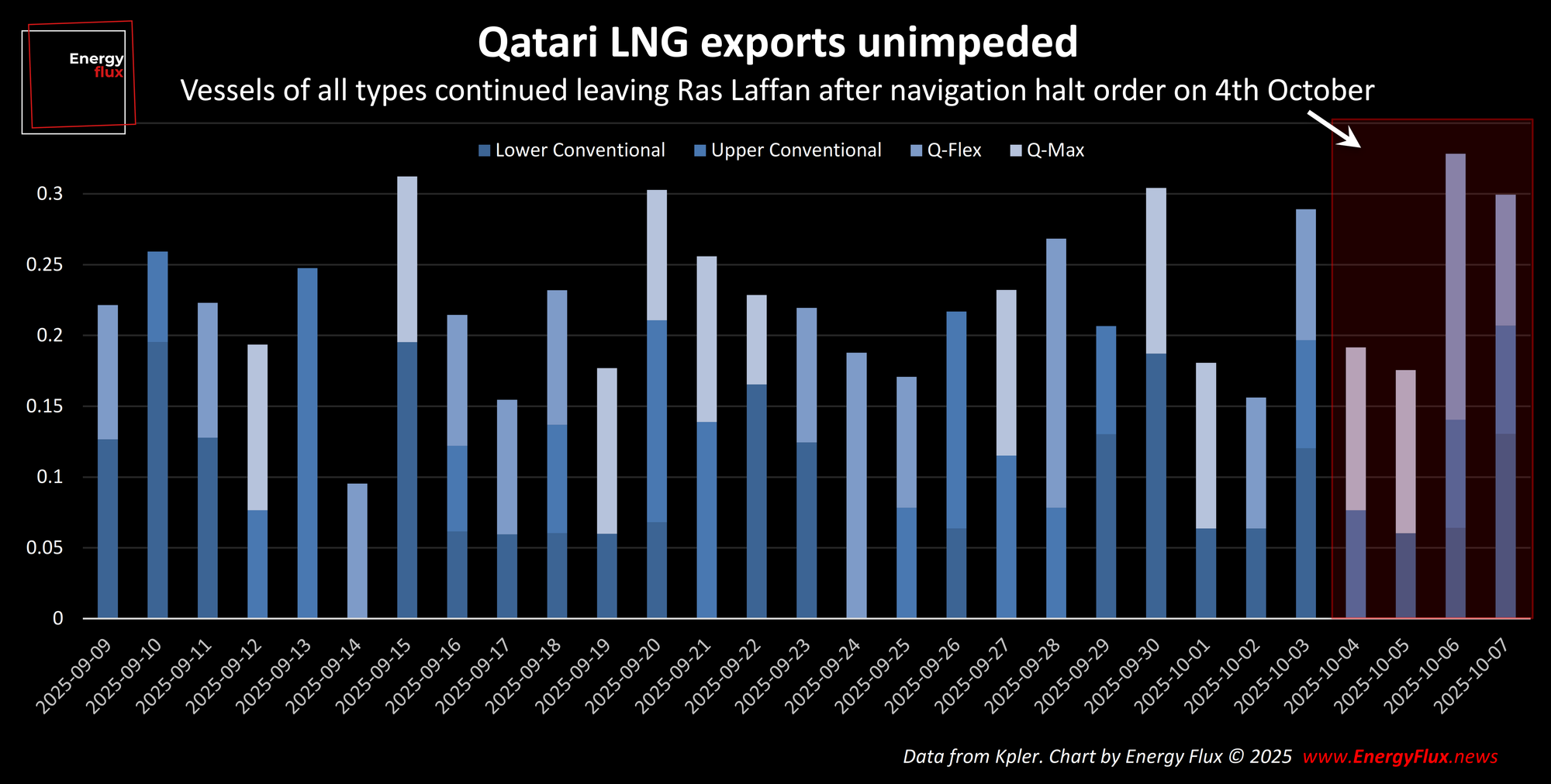

November-dated TTF leapt 5% on Monday on fears of disruptions to Qatari LNG exports, but quickly shed those gains through Wednesday as loaded vessels continued departing Ras Laffan.

The Qatari Ministry of Transport blamed a “technical fault in the GPS” for endangering safe passage in its portion of the Persian Gulf, without elaborating. The navigation halt was partially lifted on Monday. Had this happened in October 2024, the price impact would have been parabolic.

GPS faults are reportedly becoming more commonplace in Qatar. They are believed to be associated with the electronic warfare tactic known as ‘spoofing’, which can intentionally mislead navigation and guidance systems. Spoofing tends to rise in the Gulf during periods of heightened regional tension.

Muted geopol vol

Middle East tensions could subside after the White House on Wednesday negotiated a tentative ceasefire in Israel’s genocidal assault on Gaza. The protracted conflict dramatically increased the regional risk premium with the carefully choreographed direct exchange of missile strikes between Iran, Israel and the US earlier this year.

Prisoner/hostage swap details are sketchy and implementation risk remains high, meaning energy markets will be reluctant to fully discount Middle East geopolitical risks for the foreseeable future.

The Ukraine conflict is another perennial source of volatility. Russia’s intense bombardment of Ukraine’s energy infrastructure expanded notably last week, striking gas installations in the supposedly safe western region of the country. Specifically, a gas storage facility in Lviv was set ablaze on Sunday.

As reported in this morning’s Flux Briefing,

The impact of these strikes extends to Europe, as Russian military strikes targeting Ukraine’s gas infrastructure are expected to cause significant reverberations across the European energy market, highlighting ongoing risks to regional energy security. These heavy bombardments of Ukraine’s gas facilities ahead of winter are likely to force Ukraine to increase imports from Western neighbors, potentially impacting European gas prices, though global LNG abundance is anticipated to mitigate significant price spikes. – Flux Briefing, 09/10/2025

With both sides becoming more entrenched and energy installations increasingly in the crosshairs, further attempts to strike critical gas infrastructure such as the TurkStream pipeline cannot be ruled out.

For TTF to be trading below €33/MWh — a discount of 14% compared to this time last year — the immediate risk this side of Christmas appears to be an upwards correction.

This is supported in the latest run of the Energy Flux TTF Risk Model, which is now strongly signalling that bullish risk is being under-priced, even while the TTF Sentiment Tracker languishes in bearish territory.

Get instant access to the full Chart Deck with a free trial of Energy Flux:

But looking further ahead, myriad bearish risks stalk the market, not all of which are priced into the futures curve.

Chief among these is the rarely-discussed Chinese LNG trucking market, which accounts for the lion’s share of China’s LNG procurement. And there are signs that this crucial demand segment could be losing steam.

In parallel, Pakistan is struggling to deal with an oversupply of contracted LNG amid a boom in rooftop solar and battery storage — a bearish story that could be replicated across supposed LNG demand growth markets.

This week’s Chart Deck breaks down the divergence and explains the paradox of inverted risk pricing along the TTF forward curve.

In this issue 👇

- Why investment fund short buying exposes the market to a sudden winter spike

- How to reconcile the TTF Risk Model bullish signal with bearish TTF Sentiment Tracker

- Don’t be fooled by the backwardated TTF curve slope

- The myriad factors undermining the LNG demand growth story

- How China became self-sufficient in LNG for heavy-duty trucking

- Why the solar PV boom is giving Pakistan an LNG headache

- And more!

Level up your gas market insight. Subscribe to Energy Flux for instant access, and support fiercely independent market analysis

Member discussion: Wrong at both ends

Read what members are saying. Subscribe to join the conversation.