Venezuela’s Gas: The World’s Most Expensive Bonfire

As the world fixates on oil, Venezuela burns $1.4bn of gas — while sitting on an untouched methane empire that could redraw regional power

Since the United States captured Venezuela’s sitting president Nicolas Maduro and vowed to “run” the country at gunpoint, the energy world has been captivated by the Venezuelan oil patch: where will the barrels go, will Western oil companies reinvest, how does this dramatic intervention redraw global energy geopolitics?

As tanker-loads of ink are spilled pondering these questions, the equally urgent issue of Venezuela’s natural gas has (perhaps understandably) flown largely under the radar.

But consider this: Venezuela is sitting on more natural gas than Saudi Arabia, and routinely flares off enough of the stuff to meet the entire annual demand of neighbouring Colombia — itself a rising importer of liquefied natural gas (LNG).

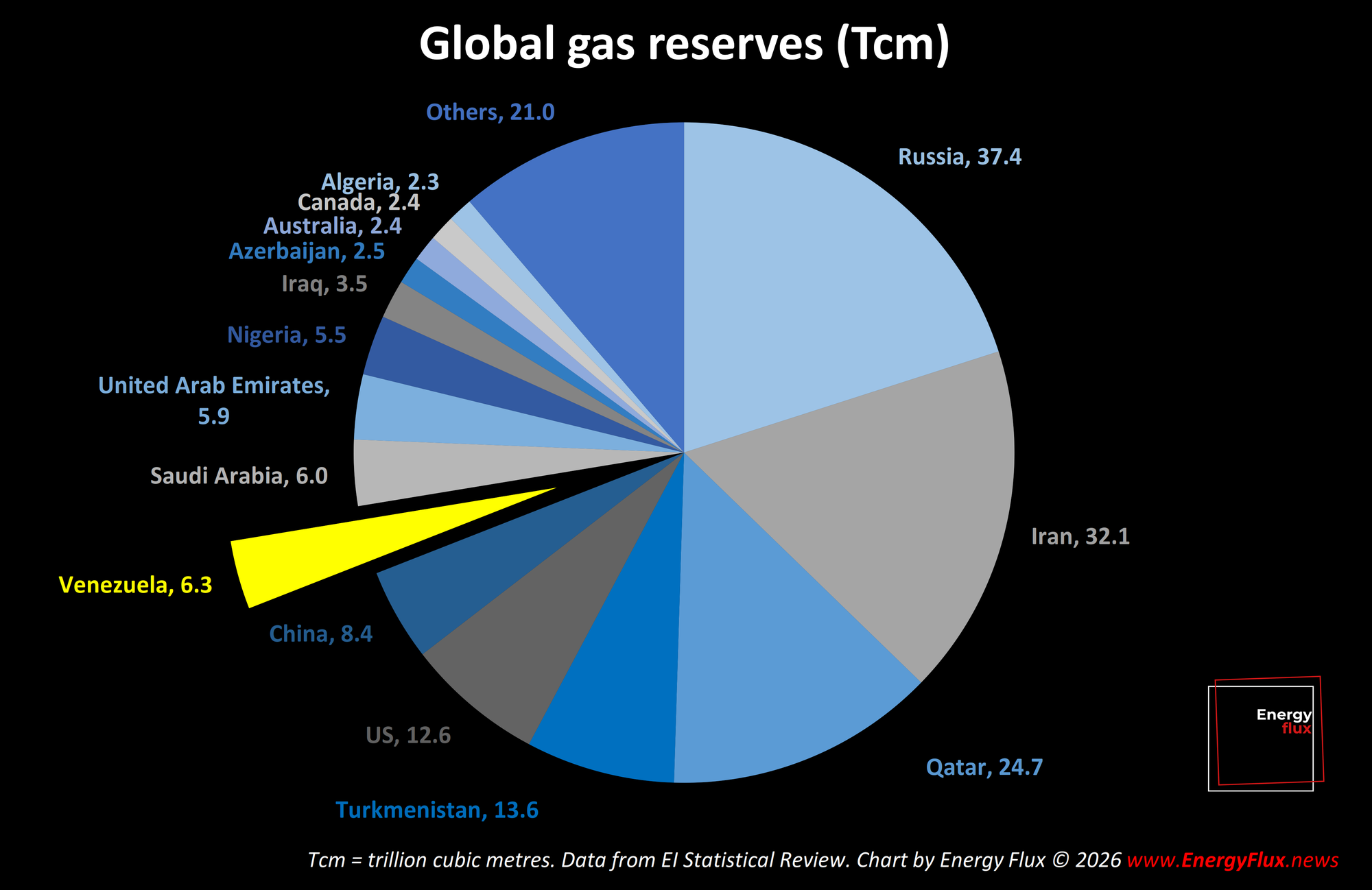

Venezuela has an estimated 6.3 trillion cubic metres (Tcm) of proved reserves, putting it in the world’s top ten gas countries with 3.3% of the global total.

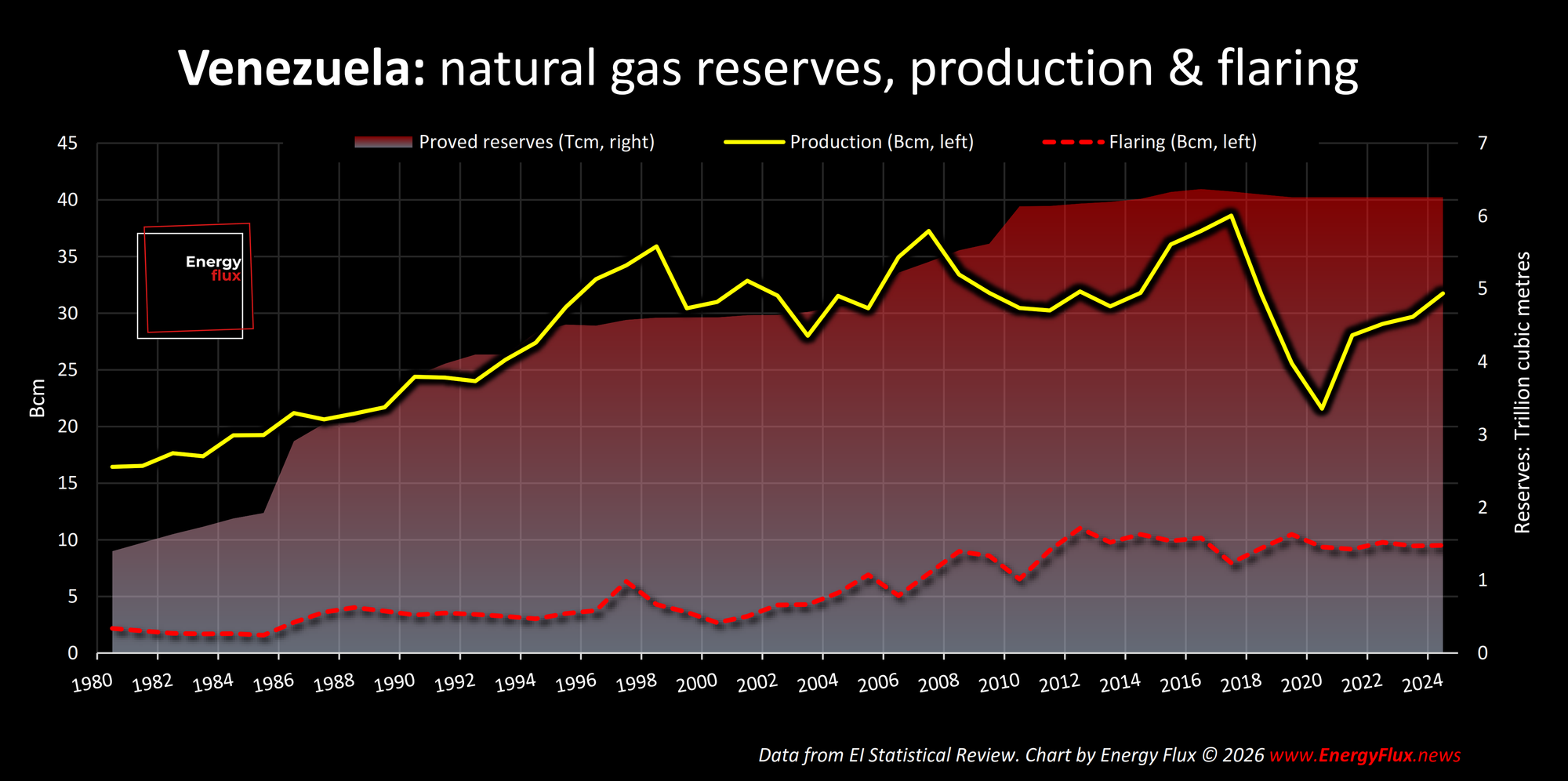

Gas production significantly lags reserves. Venezuela produced just 3 billion cubic feet of gas per day (Bcf/d) in 2024, or 0.8% global share, according to EI Statistical Review data.

That’s less than regional neighbours Argentina and Mexico (4.3 and 3.5 Bcf/d, respectively), and far below the likes of Canada, Australia, Azerbaijan and Algeria, all of which are sitting on far fewer molecules.

Capturing and monetising all of the gas wasted by Venezuela’s decrepit oil industry would boost nationwide gas production by as much as 50%. But the country’s oil patch, once a global paragon of technological advancement and Western collaboration, is in an appalling state of disrepair.

The environmental legacy of Chavismo

Aside from spawning a humanitarian crisis unlike anything seen outside of a warzone, decades of neglect and deliberate sabotage of oil infrastructure during the disastrous kleptocracies of Hugo Chavez and Nicolas Maduro have bequeathed an abysmal track record on gas flaring.

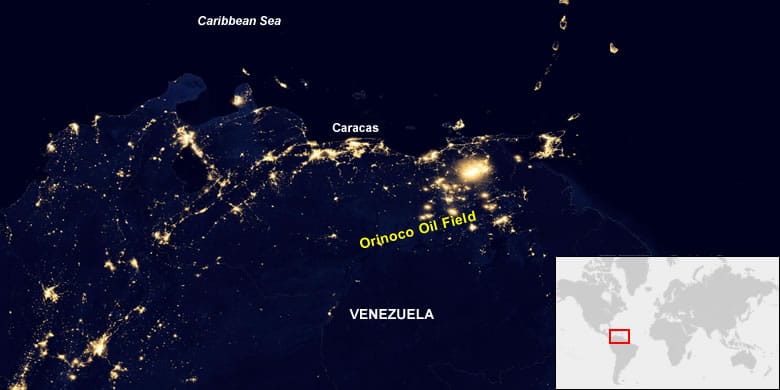

Abandoned wells leak millions of cubic feet of gas into the air every day, and operational reservoirs from Maracaibo in the west to the heavy oil fields of the Orinoco Belt in the east routinely vent and flare hundreds of millions more.

The scale of infrastructure dilapidation and environmental damage in some places has been compared to a post-apocalyptic scene from a Hollywood blockbuster. Gas transmission and distribution pipes are so leaky, “you can literally see gas bubbles surfacing on Lake Maracaibo,” one industry veteran told Energy Flux.

Oil from successive spills accumulates into rainwater drainage systems around Maracaibo, flooding the streets during storms. This has exacerbated collapse of water infrastructure, leading to frequent rationing. The situation is so bad that parched residents of Venezuela’s once-thriving oil capital are literally drilling wildcat wells to hunt for water.

Take Venezuela’s oil, own the gas flares

But this is not just another environmental catastrophe to be shrugged off while great powers squabble over the larger prize of oil. Gas flaring is a direct impediment to Washington’s imperial ambitions to control Venezuela’s world-beating heavy crude reserves.

The Trump administration is coercing Big Oil executives to invest $100 billion into the Venezuelan quagmire. ExxonMobil CEO Darren Woods was chastised for stating the obvious: Venezuela is currently “uninvestable”. Even if conditions change and investor dollars pour in, Western oil firms would need to fix the flares or put their share of this gargantuan environmental and reputational liability on their own books. Shareholders might have something to say about that.

The better option is to turn this daily disaster into the nation-building wealth creation opportunity that it clearly represents. To do that, they will need to navigate a labyrinth of sabotaged compressors, paralysing sanctions, and a state oil company seemingly hell-bent on burning its own future to prop up a dying oil empire.

For international investors and energy strategists, the critical question is no longer if Venezuela’s gas can be saved, but who will grasp the flaring nettle when the rebuild finally starts — and what they will confront along the way.

The answers uncovered in this Deep Dive are not found in press releases, newsfeeds or policy papers. They are drawn from exclusive interviews and background briefings with a dozen engineers, executives, and technical analysts on the front lines, all conducted in the hectic days since the decapitation of the Maduro regime.

Their expert testimonies reveal:

- The 25 Tcf gas cap: How a single, deliberate geological manoeuvre could unlock a hidden resource as big as the combined reserves of Argentina and Brazil, and why state oil company PDVSA refuses to flip the switch.

- The sanctions half-truth: Why the US embargo glosses over a decade of failure to build domestic and export markets to monetise Venezuela’s flaring crisis.

- The Caribbean chessboard: How Trinidad’s desperate gas shortage could force Washington’s hand, turning environmental catastrophe into a geopolitical weapon via a European ‘green fuel’ lifeline.

- The crude truth: Why Washington’s ideologues and technocrats will keep gas in the political shadows, even if it means setting fire to $1.4 billion a year — and how that myopia could backfire.

💥 Article stats: 4,200 words, 17-min reading time, 10 charts, maps and graphs

The following investigation offers the most comprehensive and accessible assessment of the post-Maduro Venezuelan gas sector available today. This consultancy-grade research exposes the ruthless and short-sighted calculus that treats a world-class resource as a disposable by-product, and the reasons why the status quo is no longer sustainable.

For energy professionals navigating the volatile intersection of global markets, Western hemisphere geopolitics, and Europe’s energy transition, understanding the likely fate of Venezuela’s gas is essential to deciphering the factors that will shape markets for decades to come.

This is the story behind the flares. To continue reading, and to unlock full access to exclusive reporting, data visuals, and expert analysis, subscribe to Energy Flux — the home of fiercely independent energy journalism.

Member discussion: Venezuela’s Gas: The World’s Most Expensive Bonfire

Read what members are saying. Subscribe to join the conversation.