Volatility is exploding. Fundamentals are not

Self-reinforcing volatility loop sustains sudden winter gas price rally, but for how long?

“With a record number of investment funds bidding down the TTF price, it wouldn’t take much more than a cold weather snap to trigger a chaotic bout of short covering.” – Energy Flux, 12 December 2025

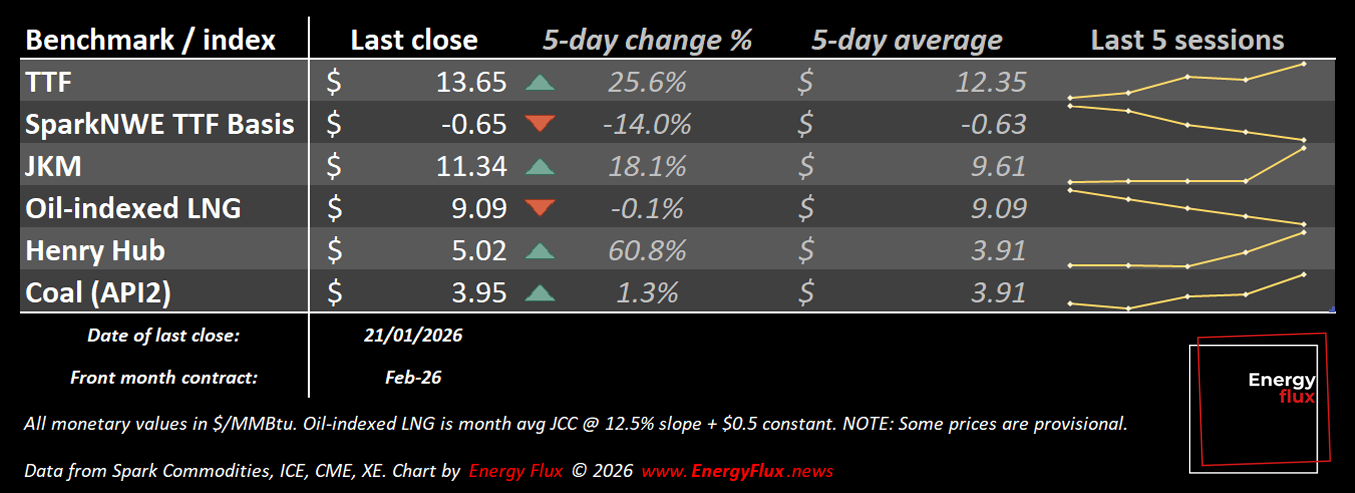

Global gas markets are in the grip of a sudden bout of renewed volatility. What started with a short squeeze in Europe has evolved into a weather-driven parabolic surge in the US, where an extreme winter storm threatens to plunge temperatures across the Lower 48 states and disrupt production during peak heating demand.

The risk of ‘freeze-off’ curtailing shale gas production is being priced into Dutch TTF, Europe’s benchmark gas hub, as markets weigh a possible tightening in Atlantic LNG balances if feed gas flows to US Gulf Coast liquefaction plants are constrained.

What we are witnessing is a self-reinforcing volatility loop with cascading second order effects: US weather risk drives scarcity fears in Europe, forcing more short covering on TTF which in turn exacerbates resurgent bullish momentum – allowing Henry Hub to rise further without compressing transatlantic LNG margins.

All of this is driving a sharp upward correction in the Asian spot LNG market, where cargoes are trading at prices that bring oil-indexed contracts back into the money at practically any slope to Brent.

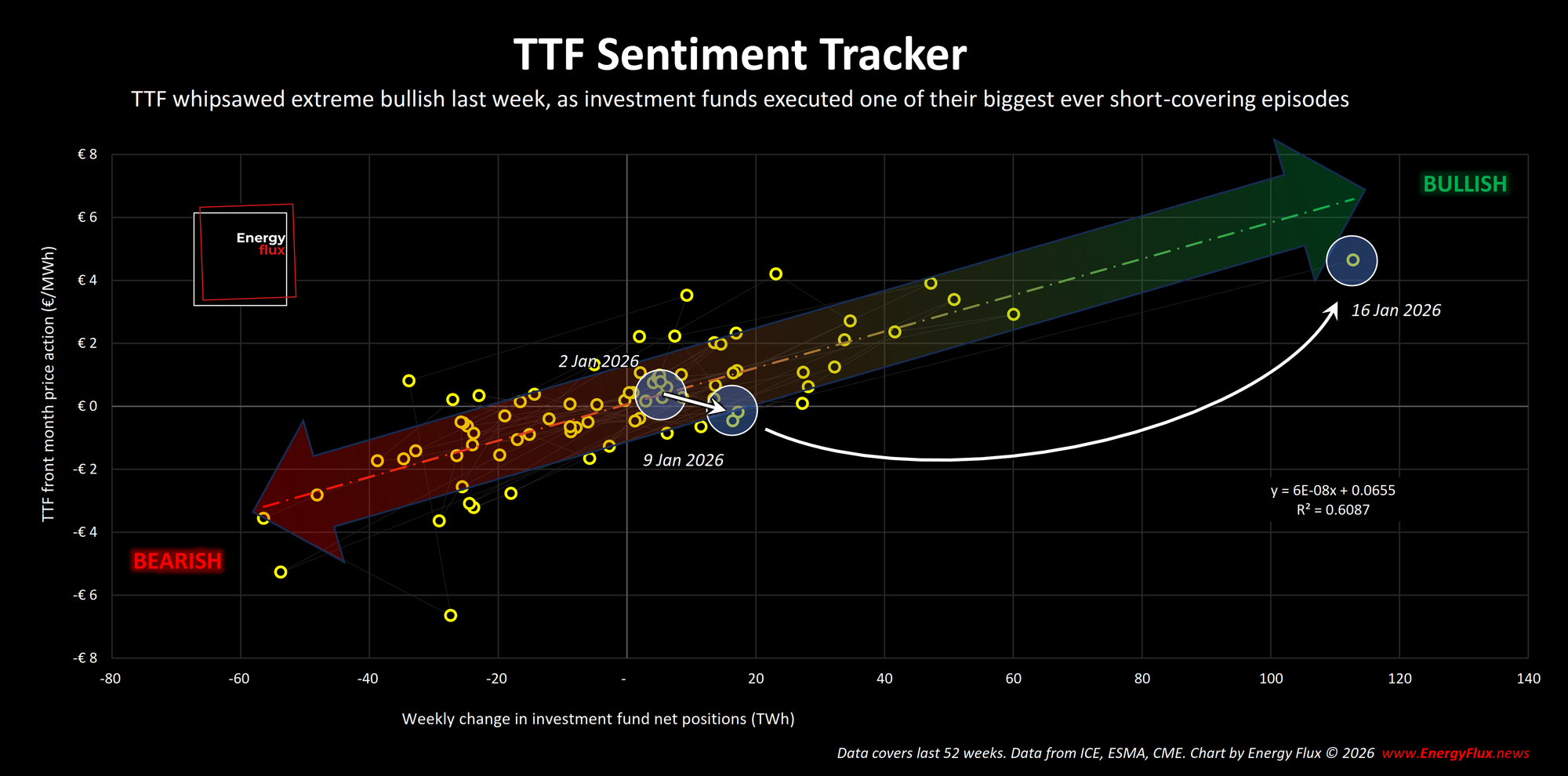

The genesis of the global gas price outbreak was the ever-febrile European market, which last week witnessed a dramatic repositioning of investment funds in TTF futures.

The latest ICE Endex Commitment of Traders data confirms that funds flipped from net short to net long by adding a near-record 113 TWh of net length in one crazy week, fuelling the +20% TTF rally.

The TTF Sentiment Tracker captured the spectacular pivot, with an off-the-chart lurch back into bullish territory.

That was the third biggest repositioning event ever, and the largest since Russia’s full invasion of Ukraine. The extreme move turned a risk-strewn sideways winter market into a chaotic long-buying frenzy driven by hedge funds, CTAs, and algos – all of which was entirely foreseeable.

As advised in Monday’s newsletter, this shift “should be read as a lagged positioning response to price, not as evidence of a durable change in market regime”. I stand by those words: the noise of the market at times like this is almost deafening, but double-digit moves in prompt prices are exactly that: mostly noise.

If you’re looking for signal, you’re in the right place. This week’s subscriber-only Chart Deck examines CoT, exchange, gas storage and LNG flow data in forensic detail to make sense of the volatility and unpack the competing forces that will determine price outturn on the major gas and LNG trading hubs.

Highlights:

- Henry Hub surges above $5/MMBtu, as polar vortex weather warnings drive +60% price swing (slide 51).

- This exacerbates renewed bullish momentum in Europe, where TTF hits almost €40/MWh despite milder forecasts (slide 10).

- Asian spot LNG finally reacts, as JKM leaps >$11/MMBtu. This leaves TTF at a $2 premium to JKM (slide 13), with winter risk strongly concentrated in the front of the strip (slide 12).

- The TTF Risk Model foresaw the initial short squeeze and is now signalling moderately bullish on two competing factors (slides 30-34).

- Investment funds dashed to close out-of-the-money shorts and scramble for length in epic repositioning move (slides 19-21).

- Commercial operators pivot hard into sell mode to hedge future sales at profitable prices (slide 25).

- EU gas storage operators accelerate gas destocking (slides 39-41), perhaps motivated by the same incentive: to cash in on the TTF spike.

💥DOWNLOAD: 70+ slides in .ppsx and .pdf format

Volatility is loud. Signal is scarce. Get instant access to this week’s 70-slide Chart Deck and see what the positioning, flows and curves actually say — not what the market is shouting.

Member discussion: Volatility is exploding. Fundamentals are not

Read what members are saying. Subscribe to join the conversation.